- United States

- /

- Specialty Stores

- /

- NYSE:WRBY

3 Growth Stocks Insiders Are Betting On

Reviewed by Simply Wall St

As the U.S. market navigates a period of mixed performance, with technology shares rebounding while the Dow Jones Industrial Average faces declines, investors are keenly observing insider activity as a potential indicator of confidence in growth stocks. In this environment, companies with high insider ownership can be particularly appealing, reflecting strong internal belief in their future prospects despite broader market volatility.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 51.6% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| FTC Solar (FTCI) | 23.1% | 59.4% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Cloudflare (NET) | 10.4% | 45.3% |

| Bitdeer Technologies Group (BTDR) | 37.3% | 85.8% |

| Atour Lifestyle Holdings (ATAT) | 18.1% | 24.2% |

| Astera Labs (ALAB) | 11.9% | 27.1% |

| AppLovin (APP) | 27.6% | 26.6% |

Let's dive into some prime choices out of the screener.

Oddity Tech (ODD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Oddity Tech Ltd. is a consumer tech company focused on developing digital-first brands in the beauty and wellness sectors, with a market cap of approximately $2.31 billion.

Operations: The company generates revenue primarily from its Personal Products segment, which accounted for $751.85 million.

Insider Ownership: 21.1%

Earnings Growth Forecast: 16.8% p.a.

Oddity Tech demonstrates robust growth potential with earnings projected to increase by 16.84% annually, outpacing the US market's average. Despite a lack of significant insider trading activity over the past three months, the stock is trading at 50.1% below its estimated fair value according to analysts. Revenue growth is expected at 15.9% per year, surpassing market expectations, and Return on Equity is forecasted to reach a strong 31.2%.

- Navigate through the intricacies of Oddity Tech with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Oddity Tech's share price might be on the cheaper side.

Westrock Coffee (WEST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Westrock Coffee Company, LLC operates as an integrated provider of coffee, tea, flavors, extracts, and ingredients solutions both in the United States and internationally with a market cap of approximately $379.55 million.

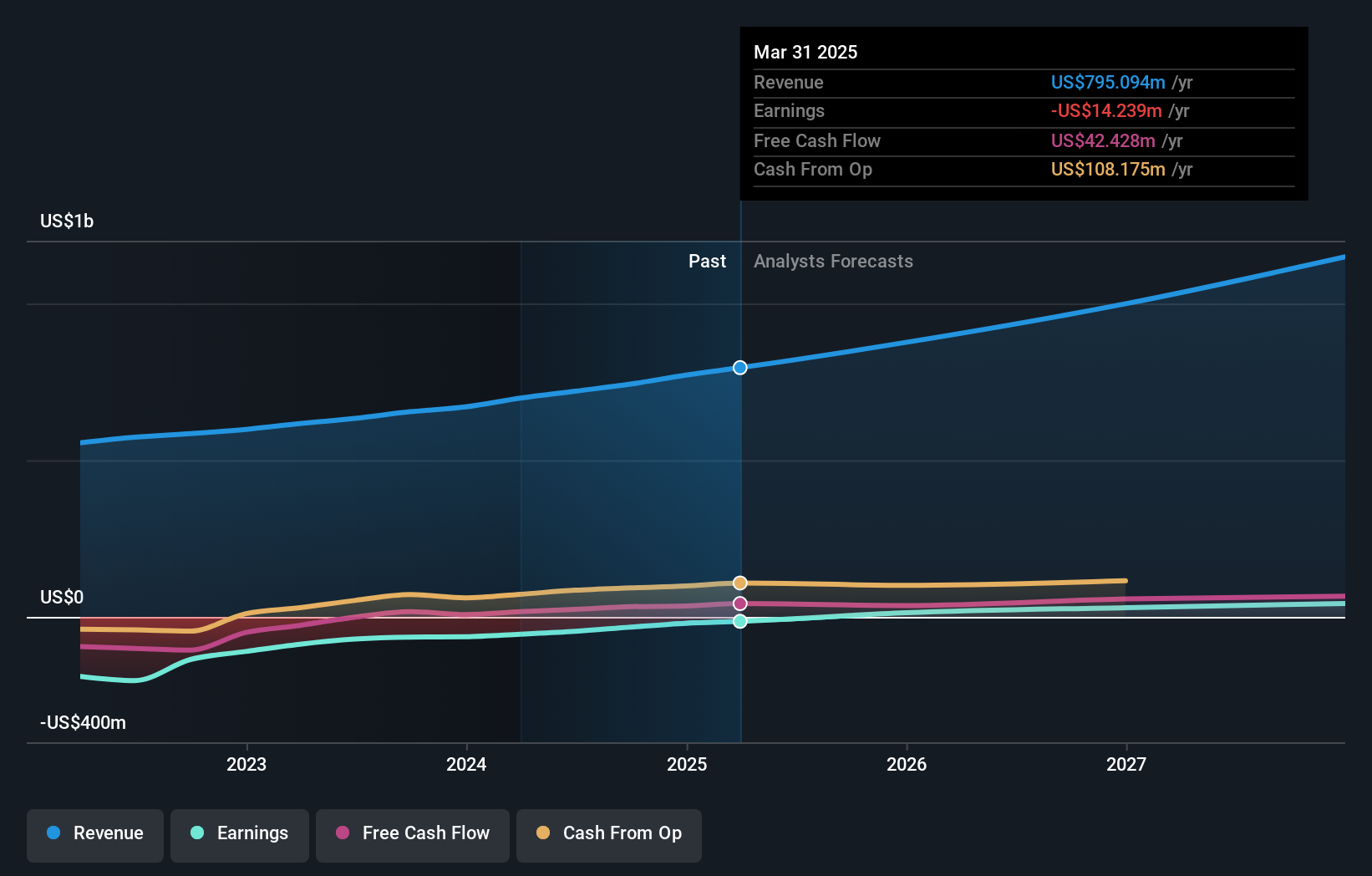

Operations: The company's revenue is primarily derived from its Beverage Solutions segment, which accounts for $810 million, and its Sustainable Sourcing & Traceability segment, contributing $280.67 million.

Insider Ownership: 14.4%

Earnings Growth Forecast: 128.4% p.a.

Westrock Coffee is poised for significant growth, with earnings expected to rise 128.37% annually and revenue projected to grow at 12.9% per year, outpacing the broader US market. Insider confidence is high, evidenced by substantial insider buying in recent months without notable selling. Despite reporting a net loss of US$19.1 million in Q3 2025, the company has adjusted its credit agreement and secured US$30 million through a private placement of convertible notes due 2031.

- Dive into the specifics of Westrock Coffee here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Westrock Coffee is priced lower than what may be justified by its financials.

Warby Parker (WRBY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Warby Parker Inc. operates in the United States and Canada, offering eyewear products with a market cap of approximately $2.14 billion.

Operations: The company's revenue primarily comes from its Holistic Vision Care segment, which generated $850.58 million.

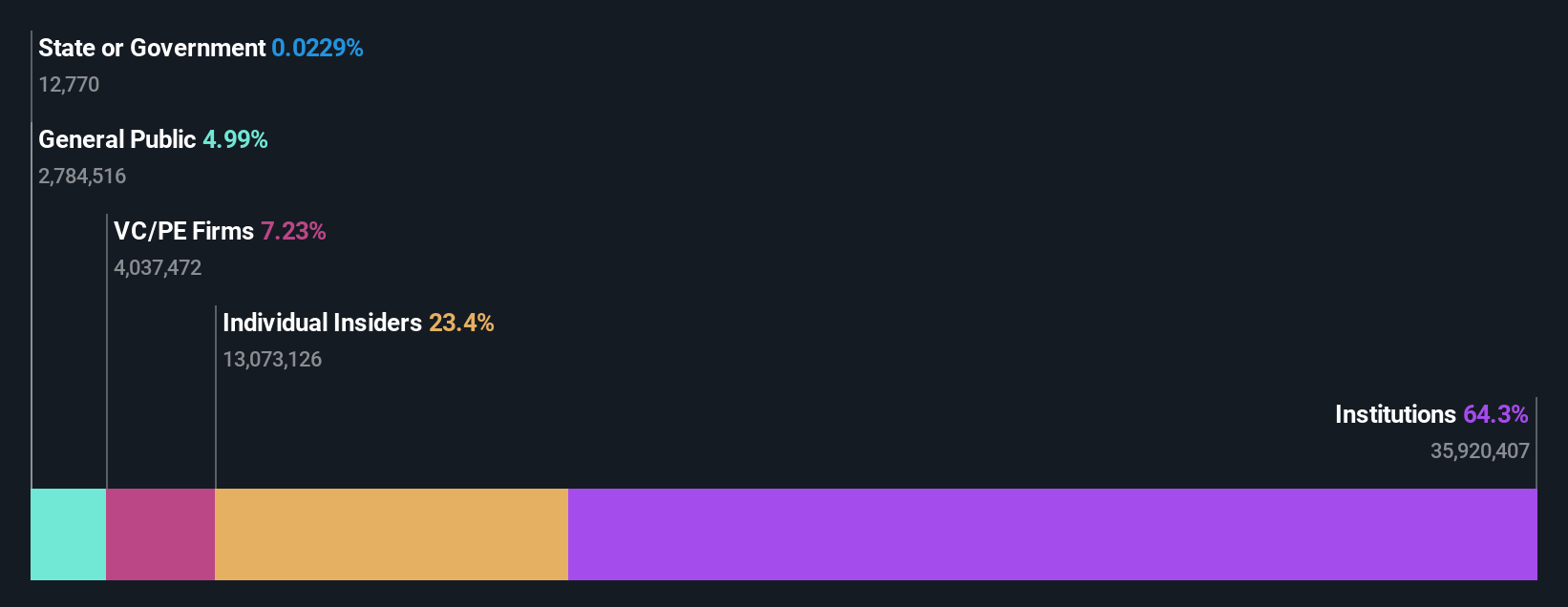

Insider Ownership: 16.4%

Earnings Growth Forecast: 98.3% p.a.

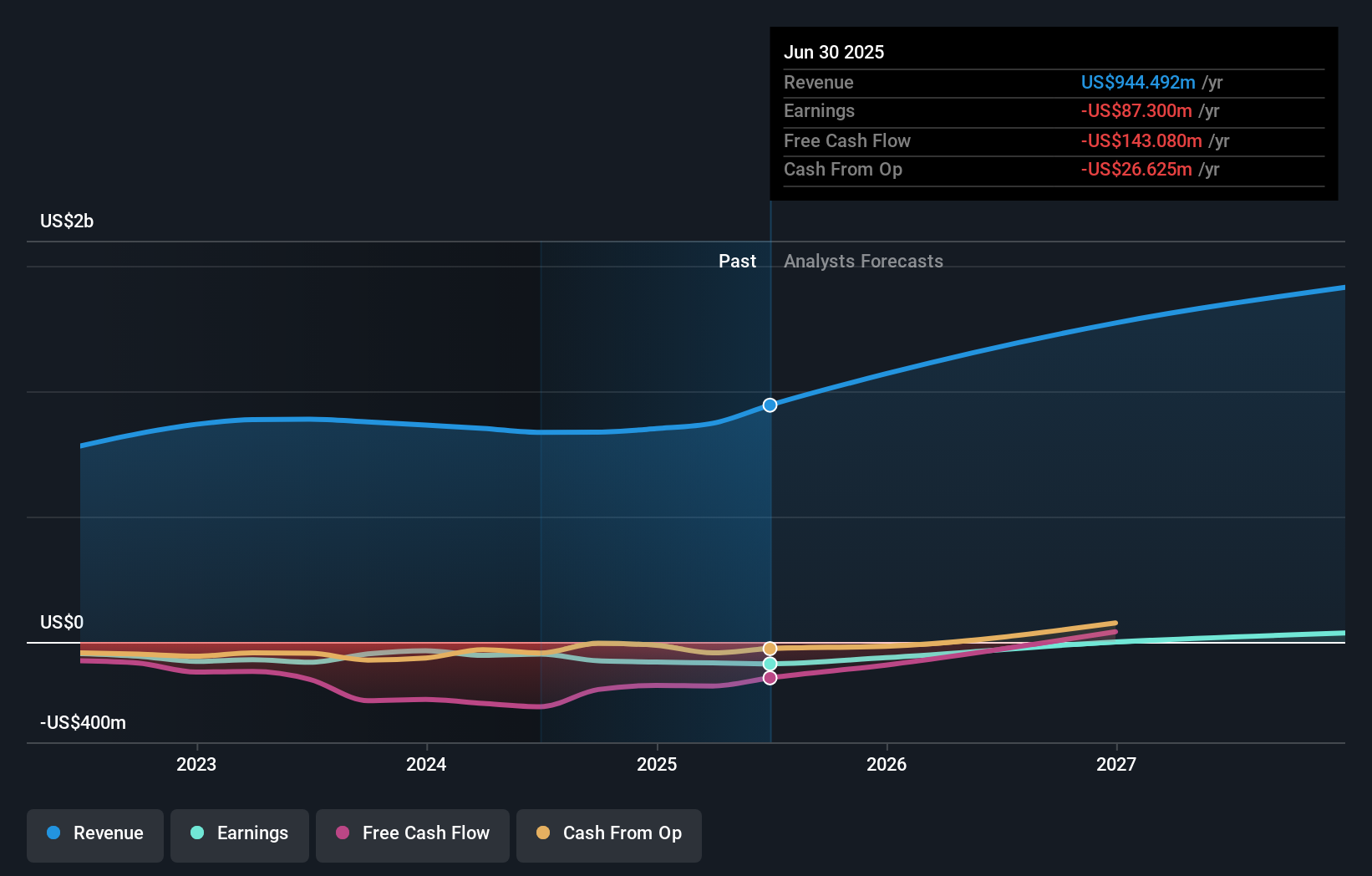

Warby Parker demonstrates strong growth potential, with earnings forecasted to rise 98.3% annually, surpassing the US market's average. Revenue is expected to grow at 12.4% per year, indicating a solid upward trajectory. Recent financials reveal a transition to profitability, reporting Q3 net income of US$5.87 million compared to a loss last year. The company anticipates annual revenue of up to US$874 million for 2025, reflecting approximately 13% growth amidst stable insider ownership without substantial recent insider buying or selling activities.

- Unlock comprehensive insights into our analysis of Warby Parker stock in this growth report.

- Our valuation report unveils the possibility Warby Parker's shares may be trading at a premium.

Next Steps

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 186 companies by clicking here.

- Ready For A Different Approach? Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Warby Parker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRBY

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives