- United States

- /

- Specialty Stores

- /

- NYSE:TJX

TJX (TJX) Valuation Check After Quarterly Sales Growth and New Store & E‑Commerce Expansion Plans

Reviewed by Simply Wall St

TJX Companies (TJX) just posted another quarter of sales growth while laying out multi billion dollar plans to upgrade stores, distribution, and e commerce. This combination helps explain the stock’s steady climb.

See our latest analysis for TJX Companies.

That growth story seems to be resonating with investors, with the share price now around $153.28 after a roughly 26.5% year to date share price return and a powerful three year total shareholder return of about 105 percent, helped by steady buybacks and upbeat initiatives such as the Maxxinista Express campaign.

If TJX’s momentum has you rethinking your retail exposure, this is also a good moment to explore fast growing stocks with high insider ownership for other potentially compelling ideas on your radar.

But after such a strong run and only a modest gap to Wall Street’s price target, is TJX still a mispriced compounder hiding in plain sight, or has the market already baked in the next leg of off price growth?

Most Popular Narrative: 3.7% Undervalued

With the narrative fair value sitting modestly above TJX’s last close, the story leans toward upside while assuming its off price engine keeps compounding.

The Fair Value Estimate has increased from $151.84 to $159.16 per share, reflecting a moderate reassessment upward.

The Revenue Growth Projection is up, increasing from 5.51% to 5.71%, while the Net Profit Margin Estimate saw a modest uptick from 9.25% to 9.34%, and the forecast for the future Price to Earnings (P/E) Ratio increased from 33.1x to 35.3x.

Want to see what supports richer profitability, higher sales, and an even steeper earnings multiple all at once, without any tech like growth? The full narrative unpacks the assumptions behind that upgraded fair value, step by step.

Result: Fair Value of $159.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat narrative could falter if e commerce siphons more traffic from stores or if brands tighten inventory, which could squeeze TJX’s merchandise pipeline and margins.

Find out about the key risks to this TJX Companies narrative.

Another View: Richer Multiples, Different Message

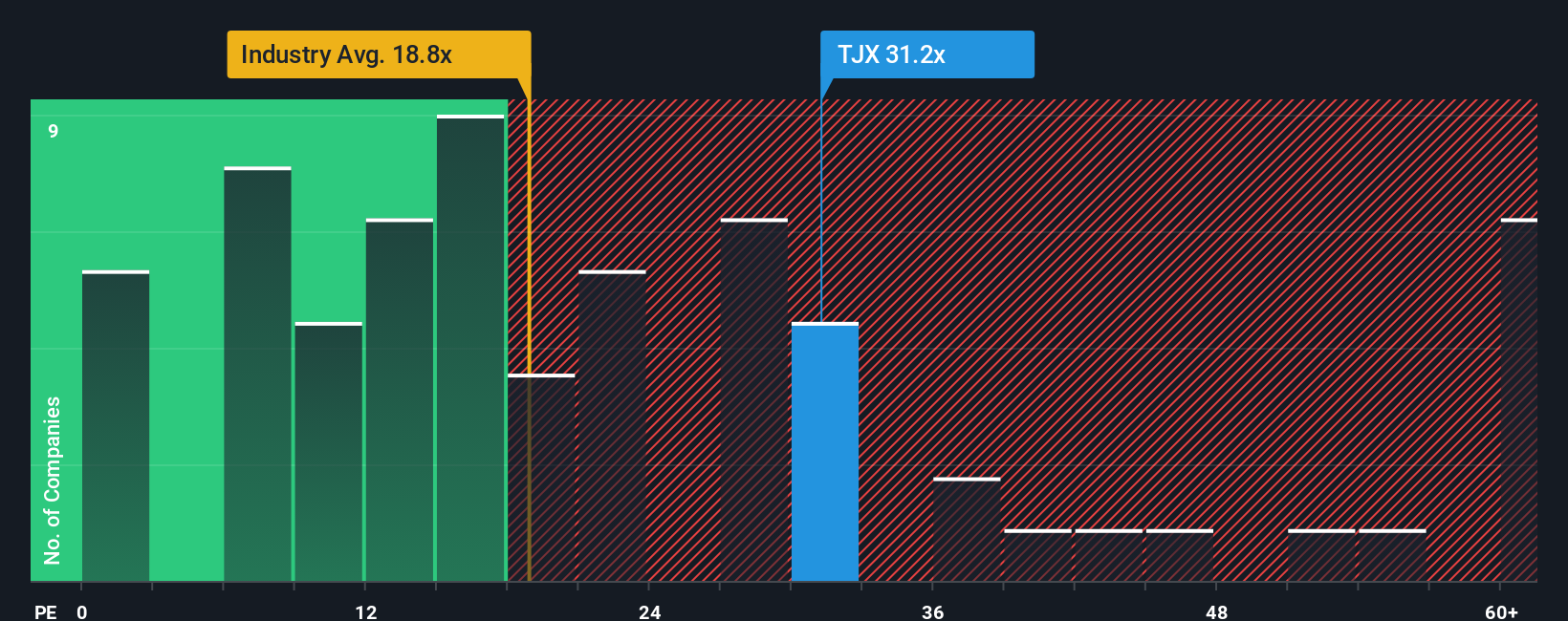

Step back from narrative fair value and TJX looks pricey on earnings. Its price to earnings ratio of 33.3x sits well above the US Specialty Retail average of 18.8x and a fair ratio of 22x. This suggests investors are paying up for quality, but it also raises the question of how much cushion is really left if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TJX Companies Narrative

If the story here does not quite fit your view, dig into the numbers yourself and build a fresh narrative in minutes, Do it your way.

A great starting point for your TJX Companies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunities by using targeted screens that surface high potential names you are far more likely to miss otherwise.

- Capitalize on mispriced potential by reviewing these 906 undervalued stocks based on cash flows that combine strong cash flows with compelling entry points.

- Tap into structural growth by scanning these 30 healthcare AI stocks shaping the future of diagnostics, treatment, and medical decision support.

- Boost your income strategy by focusing on these 15 dividend stocks with yields > 3% that can strengthen returns with reliable cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TJX Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TJX

TJX Companies

Operates as an off-price apparel and home fashions retailer worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026