- United States

- /

- Specialty Stores

- /

- NYSE:SIG

Will Analysts' Lab-Grown Diamond Endorsements Shift Signet Jewelers' (SIG) Investment Narrative?

Reviewed by Sasha Jovanovic

- In the past week, Stephens initiated coverage on Signet Jewelers with an Overweight rating, highlighting a strengthened business position and early progress under new leadership. Their report marks a reversal in sentiment, noting that lab-grown diamonds, once considered a challenge, are now seen as a key advantage for Signet's business model.

- The endorsement also underscored Signet’s ability to generate consistent and meaningful free cash flow despite macroeconomic uncertainties, indicating growing confidence in its operational resilience.

- We'll examine how the shift in analyst sentiment on lab-grown diamonds may strengthen Signet Jewelers' overall investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Signet Jewelers Investment Narrative Recap

To be a Signet Jewelers shareholder, you need confidence in the company’s ability to translate its strengthened business model and ongoing turnaround strategy into sustainable revenue and earnings growth, particularly as it leans into the lab-grown diamond trend. While the Stephens analyst coverage offers a vote of confidence and reframes lab-grown diamonds as an advantage, this development does not materially change the short-term catalyst of driving real unit growth, nor does it eliminate the risk of demand stagnation or margin pressures from tariffs and input costs.

One of the recent announcements most connected to this shift in sentiment is Signet’s ongoing expansion of its lab-grown diamond assortment, now making up 14% of product mix and targeting accessible price points. This progress aligns with the analyst’s view that lab-grown products could help widen Signet’s customer base and lift average unit retail, but real topline acceleration will still rely on boosting underlying demand in both fashion and bridal segments.

However, against this cautious optimism, investors should be aware that if jewelry unit sales remain flat or pricing power fades...

Read the full narrative on Signet Jewelers (it's free!)

Signet Jewelers' narrative projects $7.0 billion revenue and $612.3 million earnings by 2028. This requires a 1.0% annual revenue decline and a $481.9 million earnings increase from $130.4 million currently.

Uncover how Signet Jewelers' forecasts yield a $113.14 fair value, a 10% upside to its current price.

Exploring Other Perspectives

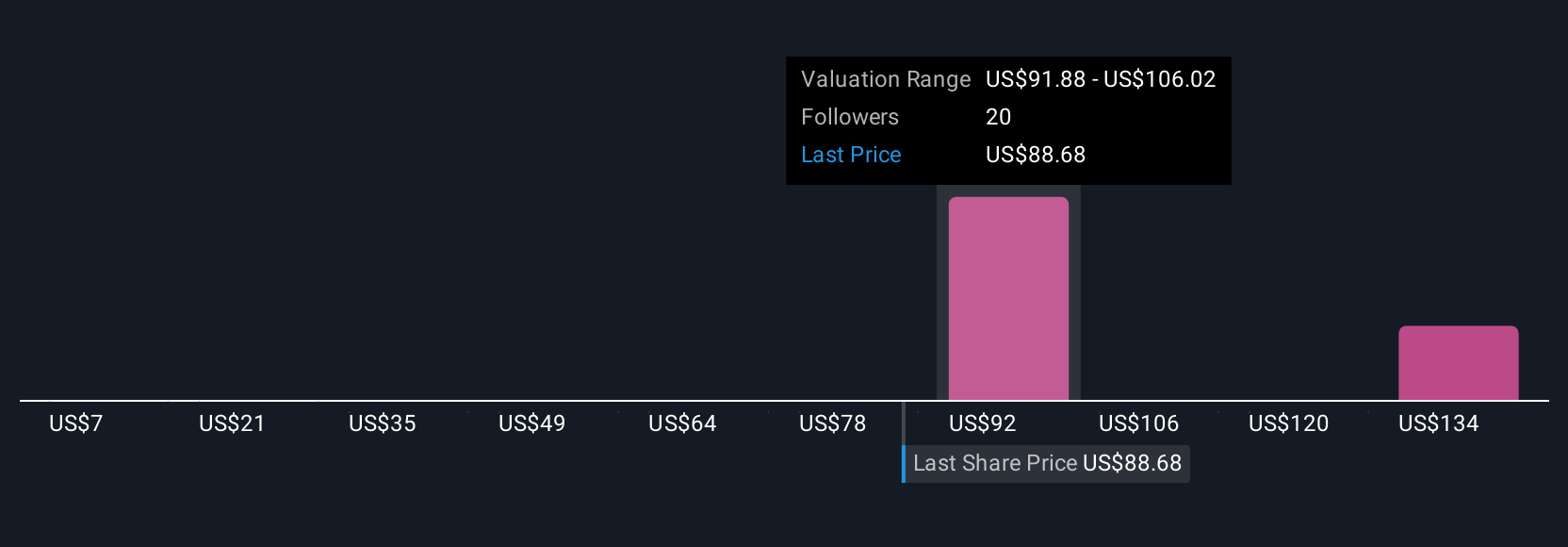

Six different Simply Wall St Community members estimate Signet’s fair value from as low as US$7 to as high as US$175.19 per share. While community opinions vary widely, recent analyst coverage shines a spotlight on the risks of flat unit sales and pricing headwinds that could challenge future growth.

Explore 6 other fair value estimates on Signet Jewelers - why the stock might be worth as much as 70% more than the current price!

Build Your Own Signet Jewelers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Signet Jewelers research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Signet Jewelers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Signet Jewelers' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SIG

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives