- United States

- /

- Specialty Stores

- /

- NYSE:SIG

Signet Jewelers (SIG): Reassessing Valuation After Strong Q3 Results and Upgraded Full-Year Outlook

Reviewed by Simply Wall St

Signet Jewelers (NYSE:SIG) just delivered a stronger third quarter, lifted its full year outlook, and paired that with an ongoing buyback and steady dividend. This combination naturally sharpens investor attention.

See our latest analysis for Signet Jewelers.

Those stronger numbers and the raised outlook help explain why the latest 1 day share price return jumped 5.29 percent, even though the 30 day share price return of minus 12.88 percent signals fading near term momentum. At the same time, a 5 year total shareholder return of 271.27 percent still underlines how powerful the longer term story has been.

If Signet’s mix of improving earnings and long term wealth creation has your attention, it could be a good moment to explore fast growing stocks with high insider ownership.

Yet with the stock still trading below analyst targets and our intrinsic value estimate, investors face a familiar dilemma: is Signet genuinely undervalued after its latest beat, or is the market already pricing in the next leg of growth?

Most Popular Narrative Narrative: 22.8% Undervalued

With Signet Jewelers last closing at $87.39 against a most popular narrative fair value of about $113, the spread sets up a surprisingly bullish case.

Analysts are assuming Signet Jewelers's revenue will decrease by 1.0% annually over the next 3 years.

Analysts assume that profit margins will increase from 1.9% today to 8.8% in 3 years time.

Want to see how shrinking sales can still fuel a much higher valuation? The real twist sits in the profit curve and the future earnings multiple. Curious which assumptions turn modest top line expectations into a materially higher fair value? The full narrative lays out the numbers driving that call.

Result: Fair Value of $113.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on Signet successfully navigating rising tariff pressures and demonstrating that demand reflects more than just higher pricing and mix.

Find out about the key risks to this Signet Jewelers narrative.

Another Angle on Valuation

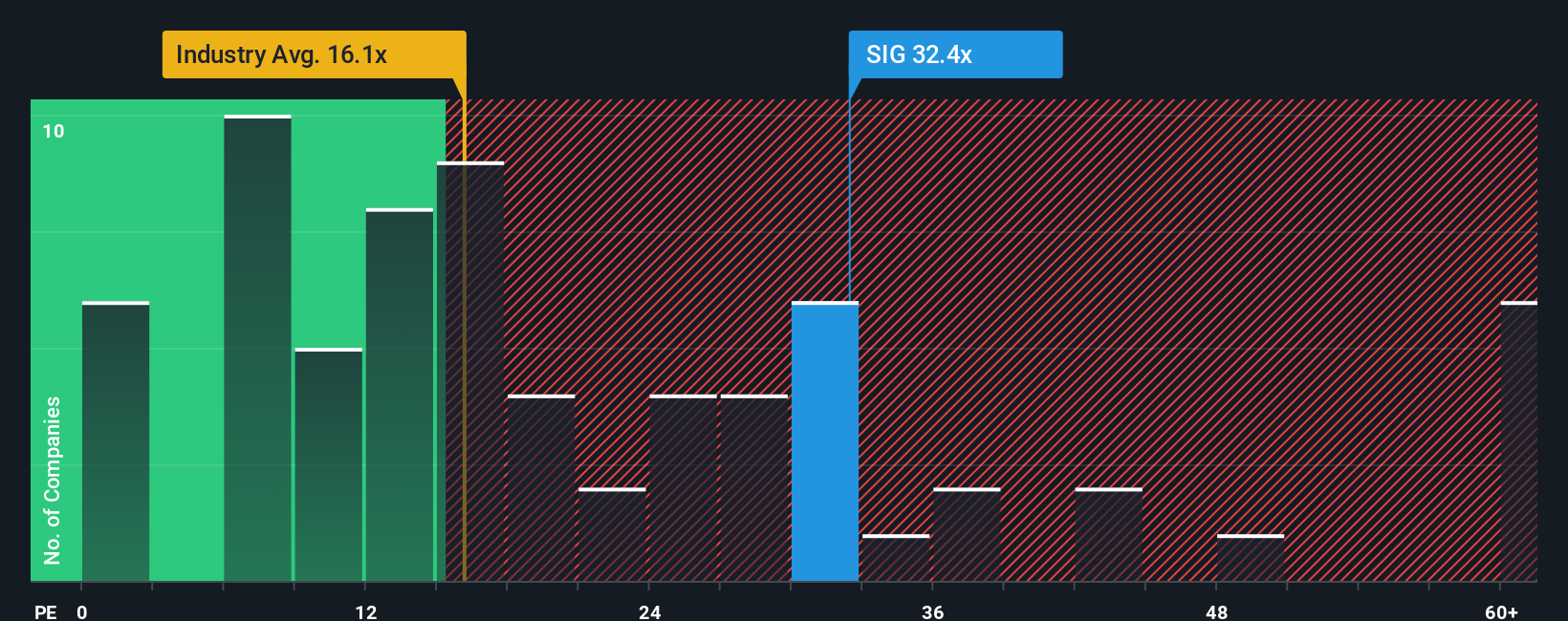

There is a catch to the bullish fair value story. On earnings, Signet trades on a P E ratio of 24.5 times, richer than both the US Specialty Retail average of 20 times and peer average of 14.7 times, while our fair ratio sits higher at 29.5 times.

In practice, that means the market already bakes in solid execution, with less room for error even if there is theoretical upside to a higher fair ratio. If growth, margins, or sentiment wobble, this premium could compress before it ever moves closer to that level.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Signet Jewelers Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in minutes, Do it your way.

A great starting point for your Signet Jewelers research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one opportunity when you can quickly scan powerful themes; your future self may benefit from acting while these ideas remain under the radar.

- Consider capturing high-upside potential early by reviewing these 3581 penny stocks with strong financials that already back their stories with improving fundamentals and strengthening balance sheets.

- Explore structural trends in automation and analytics by reviewing these 27 AI penny stocks that are positioned to serve enterprise and consumer demand for intelligent software.

- Evaluate income prospects by focusing on these 15 dividend stocks with yields > 3% that pair regular cash payouts with business models designed for durability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SIG

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026