- United States

- /

- Specialty Stores

- /

- NYSE:SIG

How Investors Are Reacting To Signet Jewelers (SIG) Raising Guidance After Strong Q3 Earnings

Reviewed by Sasha Jovanovic

- On December 2, 2025, Signet Jewelers reported third-quarter earnings that exceeded expectations, with total sales of US$1.39 billion, net income of US$20 million, and updated full-year fiscal 2026 guidance raising both total sales and same-store sales outlooks.

- The company also affirmed a quarterly dividend and continued share repurchases, highlighting a focus on shareholder returns while confidence in ongoing business momentum led to upwardly revised projections for revenue and earnings.

- We’ll examine how Signet’s raised sales guidance and strong quarterly results could shape the company’s longer-term investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Signet Jewelers Investment Narrative Recap

To become a long-term shareholder in Signet Jewelers, you need to believe the company can sustain sales gains by driving demand among younger consumers and expanding its share in both bridal and fashion categories, despite ongoing shifts in preferences and market challenges. The recent third-quarter results and raised sales guidance underline management's confidence, but the most important short-term catalyst, further traction in lab-grown diamonds and product innovation, remains, while a key risk continues to be reliance on price increases over real unit growth. These results, while positive, do not appear to materially change the near-term risk from flat or declining jewelry unit volumes.

Among the recent announcements, Signet's upsized full-year sales and same-store sales guidance stands out as particularly relevant. This move shows management sees potential for continued (if moderate) sales growth, even as unit trends remain pressured and tariff headwinds could further impact profitability. All of this feeds directly into debates over what will drive the next phase of performance for the stock.

However, investors should be aware that even with solid headline numbers, persistent weakness in actual jewelry unit sales could…

Read the full narrative on Signet Jewelers (it's free!)

Signet Jewelers' narrative projects $7.0 billion revenue and $612.3 million earnings by 2028. This requires a 1.0% annual revenue decline and a $481.9 million increase in earnings from $130.4 million today.

Uncover how Signet Jewelers' forecasts yield a $113.14 fair value, a 18% upside to its current price.

Exploring Other Perspectives

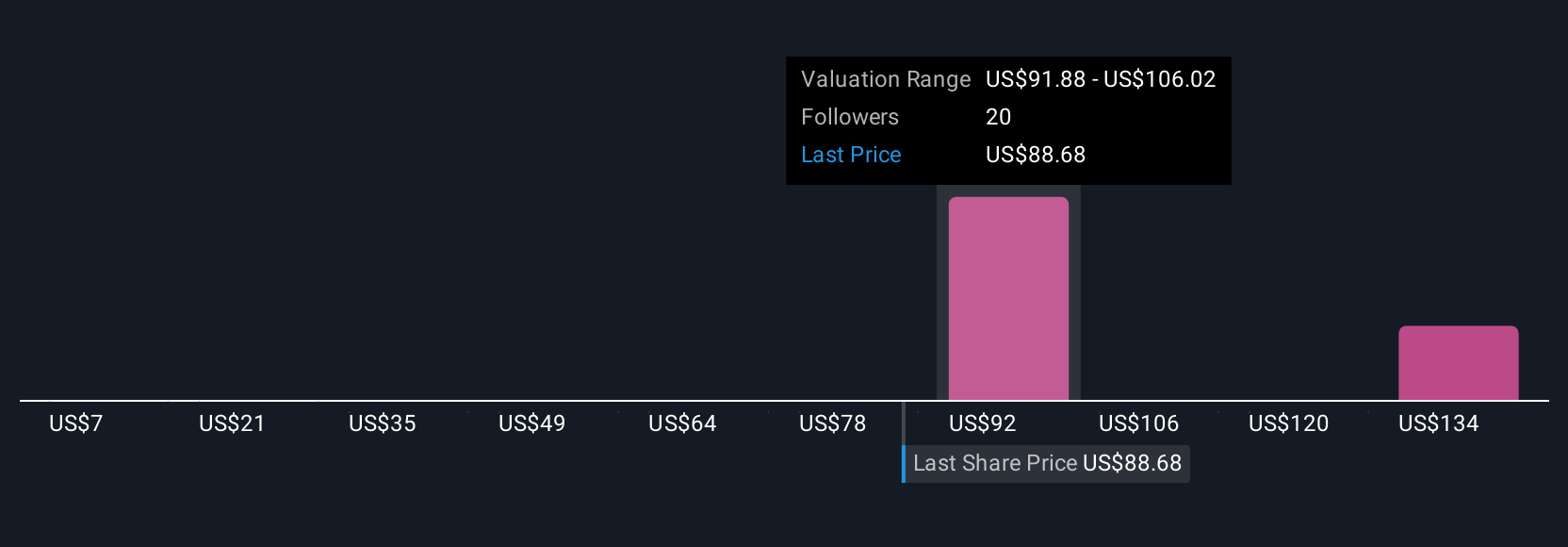

Six unique fair value estimates from the Simply Wall St Community range from as low as US$7 to as high as US$169, reflecting extremely broad outlooks. While many expect margin growth from lab-grown diamonds, opinions differ, explore the risks to real demand growth and compare views.

Explore 6 other fair value estimates on Signet Jewelers - why the stock might be worth less than half the current price!

Build Your Own Signet Jewelers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Signet Jewelers research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Signet Jewelers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Signet Jewelers' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SIG

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026