Why Sea (SE) Is Down 9.8% After Beating Revenue Estimates but Missing on Profitability

Reviewed by Sasha Jovanovic

- Sea Limited recently reported third-quarter 2025 revenue of US$5.99 billion to US$6.17 billion, achieving year-over-year growth between 36.5% and 44.6% and surpassing analyst expectations, with broad-based gains across digital entertainment, e-commerce, and financial services.

- Despite the strong top-line performance and a surge in paying users, Sea's profitability missed analyst estimates, highlighting a mix of robust expansion and ongoing earnings challenges.

- We’ll explore how Sea’s better-than-expected revenue growth, alongside a shortfall in profitability, influences its investment outlook and ongoing growth story.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Sea Investment Narrative Recap

To be a shareholder in Sea Limited, you generally need to believe in the continued expansion of Southeast Asia’s digital economy and the company’s ability to lead in e-commerce, digital finance, and gaming. The recent surge in third-quarter revenue, while impressive and a signal for short-term momentum, does little to address the immediate pressure on the company’s profitability, this remains the most important near-term catalyst, with rising competition and margin challenges as the biggest risks; the impact from this news event, though positive for sentiment, is not material enough to change these dynamics.

Among recent announcements, Sea’s August earnings report highlighted sustained revenue and earnings progress, including a six-month net income of US$809.02 million, yet even with prior profitability gains, this quarter’s earnings miss reinforces that scaling toward sustainable profits is still a work in progress. Investors will likely weigh the company’s rapid top-line growth against ongoing cost pressures in the coming quarters, particularly as Sea invests heavily to retain its leadership position and offset intensifying competition.

On the flip side, the ability to deliver strong revenue growth amid aggressive rivals is only part of the picture investors must keep in mind...

Read the full narrative on Sea (it's free!)

Sea's outlook anticipates $33.2 billion in revenue and $4.7 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 19.7% and a $3.5 billion increase in earnings from the current level of $1.2 billion.

Uncover how Sea's forecasts yield a $196.66 fair value, a 38% upside to its current price.

Exploring Other Perspectives

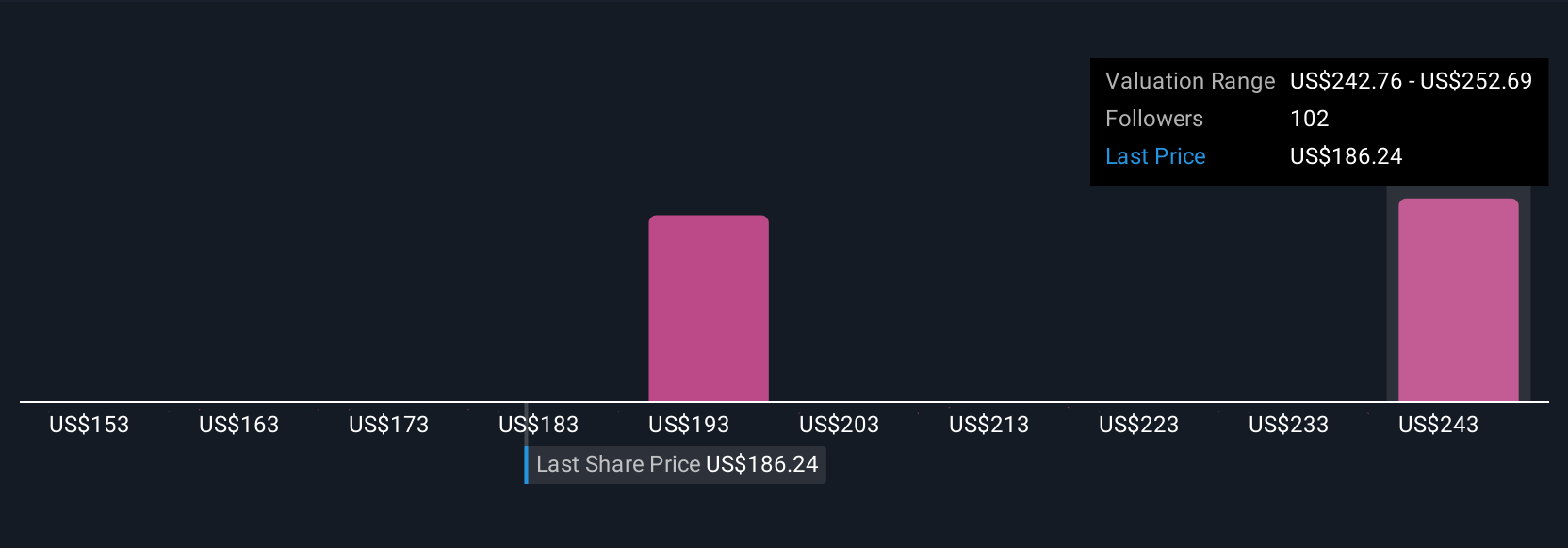

Seventeen fair value estimates from the Simply Wall St Community run from US$153.42 to US$286.16 per share. As you compare these valuations, consider how Sea’s tight margins and aggressive investment to defend e-commerce leadership can shape outcomes in a highly competitive market.

Explore 17 other fair value estimates on Sea - why the stock might be worth over 2x more than the current price!

Build Your Own Sea Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sea research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Sea research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sea's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SE

Sea

Through its subsidiaries, operates as a consumer internet company in Southeast Asia, Latin America, the rest of Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives