- United States

- /

- Specialty Stores

- /

- NYSE:SBH

Sally Beauty Holdings (SBH): Evaluating Whether Recent Gains Reflect True Value

Reviewed by Kshitija Bhandaru

Sally Beauty Holdings (SBH) shares have seen some interesting movement recently, with the stock drifting slightly lower over the past month but delivering strong gains across the past three months. Investors watching this retailer may be weighing its latest results and future growth signs as the company navigates changing consumer habits.

See our latest analysis for Sally Beauty Holdings.

Sally Beauty Holdings has been building positive momentum, with a recent share price rally of over 53% across the last three months. This increase stands out against its somewhat quieter short-term moves. On a longer view, shareholders have enjoyed a 14% total return over the past year. This suggests the market’s confidence in the company’s progress may be gradually rebounding as business results stabilize and consumer sentiment improves.

If you’re ready to look beyond the retail space or spot the next opportunity, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading near recent highs but fundamentals improving, investors now face a crucial question: Is Sally Beauty Holdings trading at a bargain, or is the company’s promising future already reflected in its price?

Most Popular Narrative: 2.5% Overvalued

With Sally Beauty Holdings closing at $14.81, the most recent narrative consensus places its fair value at $14.45, slightly below current levels. This creates a narrow gap that anchors the debate over future prospects and price sustainability.

Store refreshes aimed at creating a modern, discovery-oriented beauty retail experience, with added focus on high-growth categories (nail, cosmetics, fragrance, skincare) and localization, are already yielding higher basket sizes and unit metrics, positioning the company for sustainable comp sales improvement and stronger revenue growth.

What is propelling these ambitious forecasts? The narrative draws on a secret blend of digital expansion, exclusive brands, and rising customer spend, plus a profit multiple that points to confidence. Want to know the surprising drivers anchoring that fair value? The answers may change your outlook on Sally Beauty’s future potential.

Result: Fair Value of $14.45 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent consumer frugality and slow digital adoption could limit Sally Beauty’s ability to drive revenue growth and maintain margin improvements in the future.

Find out about the key risks to this Sally Beauty Holdings narrative.

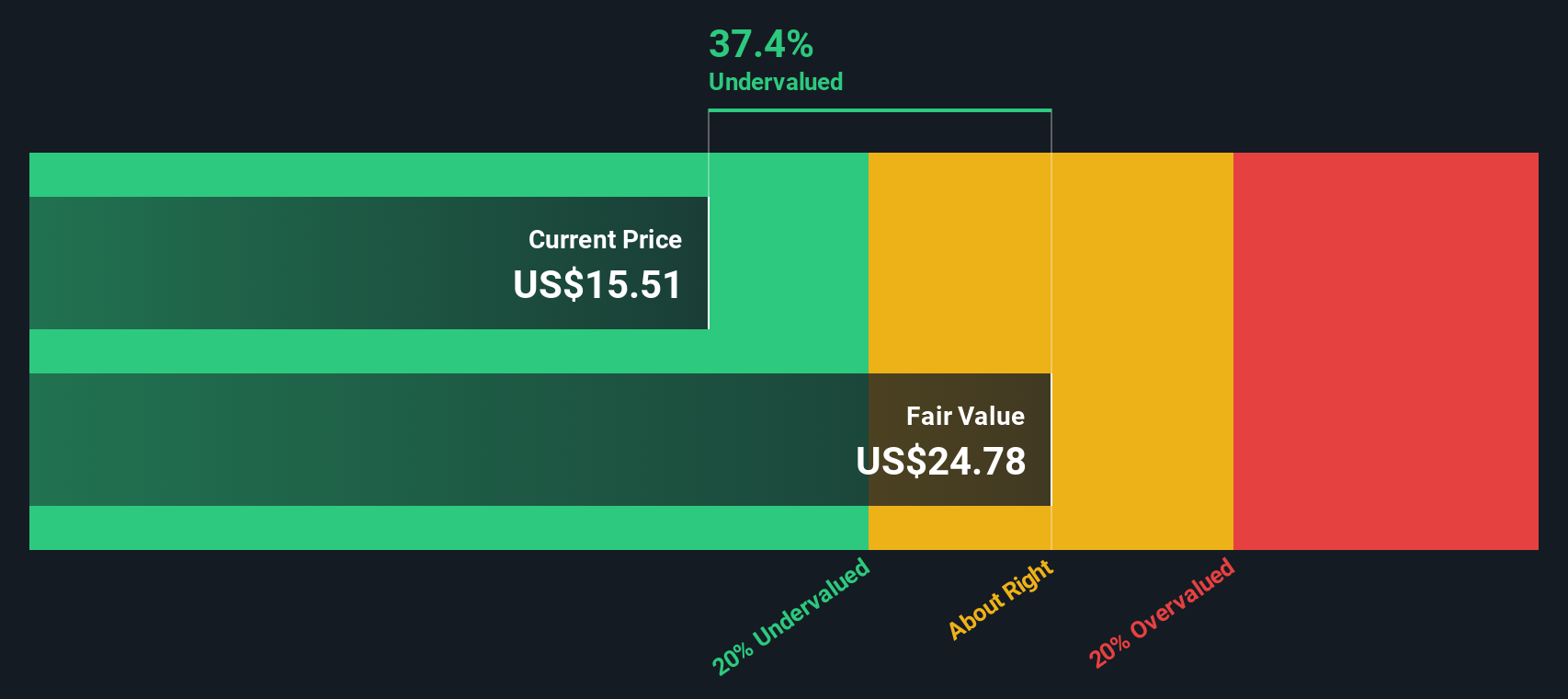

Another View: Discounted Cash Flow Model Calls SBH Undervalued

While the market’s current price slightly exceeds analyst consensus, our SWS DCF model presents a sharply different view. According to this approach, Sally Beauty Holdings is trading at around 40% below its intrinsic value. That represents a substantial undervaluation by this measure. How do you reconcile such a big gap between two widely used models?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sally Beauty Holdings Narrative

If you want a different perspective or prefer hands-on research, you can shape your own Sally Beauty Holdings outlook in just minutes. Do it your way

A great starting point for your Sally Beauty Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Investing Move?

Don’t let market opportunities pass you by. Use the Simply Wall Street Screener to find hidden gems, exciting sectors, and strong performers shaping tomorrow’s stock winners.

- Capture tomorrow’s value by targeting exceptional businesses trading below their true worth. Start with these 874 undervalued stocks based on cash flows for serious upside potential.

- Boost your portfolio’s income stream by selecting companies already rewarding shareholders. Tap into these 20 dividend stocks with yields > 3% for reliable dividend payers yielding over 3%.

- Ride the frontier of technology with companies redefining artificial intelligence. Get ahead of the curve by checking out these 24 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SBH

Sally Beauty Holdings

Operates as a specialty retailer and distributor of professional beauty supplies.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives