- United States

- /

- Specialty Stores

- /

- NYSE:RH

RH (RH) Valuation: Is the Market Pricing In Earnings Uncertainty Ahead of Results?

Reviewed by Simply Wall St

RH (RH) shares slipped 2% even as the broader market moved higher, with investors keeping a close eye on the company’s upcoming earnings report. The market appears focused on forecasts of an earnings per share decline, while also considering hopes for revenue growth.

See our latest analysis for RH.

RH’s share price has slumped significantly over the past year, dropping more than 60% year-to-date, as investors weigh the potential for weaker profitability against hints of revenue growth. Recent price action reflects a cautious mood, with the long-term total shareholder return also deeply negative. This suggests momentum has faded even as the company looks to turn the page with upcoming results.

If you’re assessing where momentum or value may appear next, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership

With shares now trading at a sizable discount to analyst price targets, the question is whether the recent declines present a buying opportunity or if the market is already factoring in all of RH’s future growth prospects.

Most Popular Narrative: 39.9% Undervalued

RH’s most widely followed valuation narrative sees significant upside from current levels, with the fair value estimate standing well above the last closing price. This upbeat scenario focuses on the financial impact of platform expansion, new product lines, and asset monetization as levers for future growth.

RH's platform expansion, including the opening of 7 Design Galleries and 2 Outdoor Galleries in 2025, is expected to create new opportunities for revenue growth and brand exposure across multiple markets, potentially boosting overall sales revenue.

Want to know what’s powering this bullish outlook? The secret sits within a bold projection for higher profit margins and an aggressive ramp-up in future earnings, all grounded in ambitious expansion plans. Curious which financial leaps these analysts believe RH can deliver next? Get the inside scoop behind the numbers that could transform the company’s valuation.

Result: Fair Value of $262.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a severe housing market downturn or ongoing tariff pressures could quickly weigh on demand and squeeze RH’s margins. This could delay any recovery hopes.

Find out about the key risks to this RH narrative.

Another View: Multiples Tell a Different Story

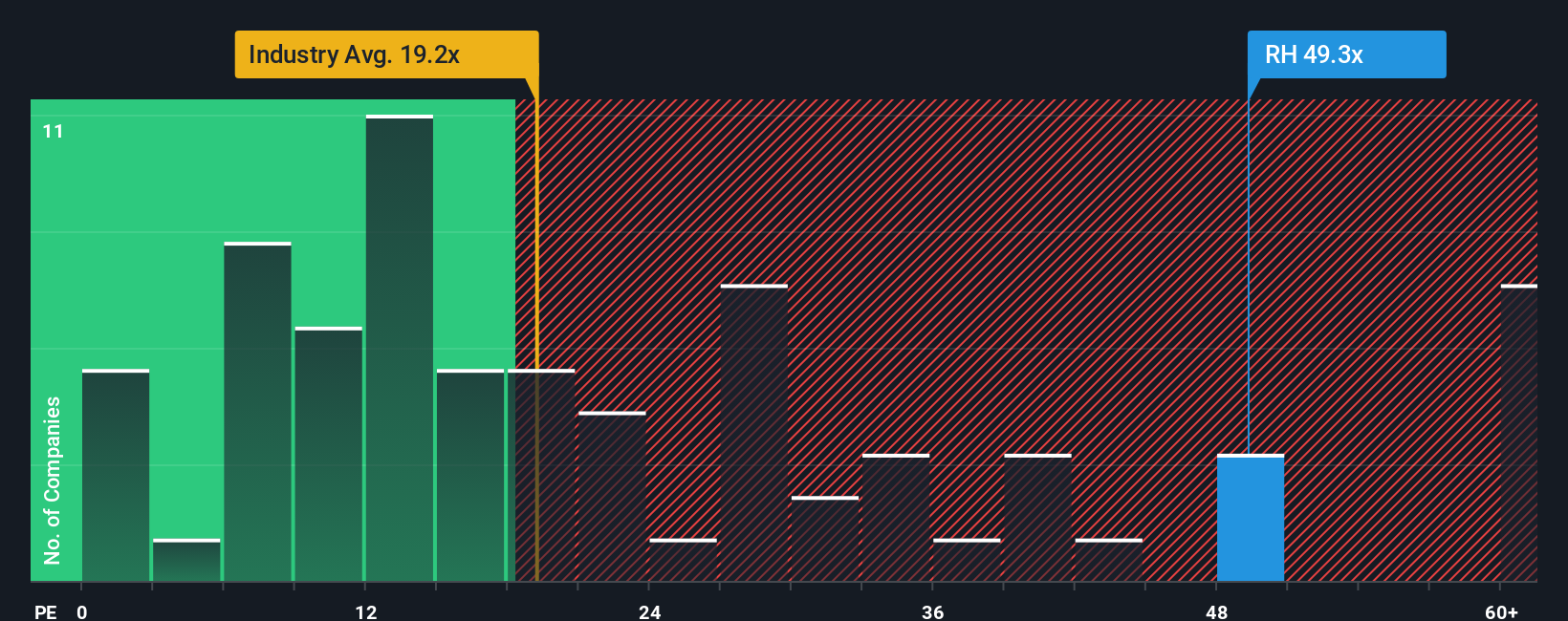

Looking at RH through the lens of earnings multiples, the outlook appears less optimistic. The company's price-to-earnings ratio is 27.7x, which is significantly higher than both the industry average of 18x and the peer average of 18.1x. This indicates the market is paying a substantial premium for RH compared to its competitors, raising questions about how much future growth is already reflected in the stock price. This premium could signal higher risk, or it could reflect market optimism.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RH Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build your own narrative in just a few minutes and in your own way. Do it your way

A great starting point for your RH research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your investment horizons and tap into fresh opportunities with screener-powered insights from Simply Wall Street. Thousands of investors are already uncovering new growth stories. Don’t let these gems pass you by.

- Unleash the potential of undervalued companies with strong cash flows by starting with these 914 undervalued stocks based on cash flows today.

- Boost your search for income-generating possibilities by checking out these 15 dividend stocks with yields > 3% that exceed 3% yields.

- Jump into the future of innovation and find these 25 AI penny stocks at the forefront of artificial intelligence trends and advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RH

RH

Operates as a retailer and lifestyle brand in the home furnishings market in the United States, Canada, the United Kingdom, Germany, Belgium, and Spain.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026