- United States

- /

- Specialty Stores

- /

- NYSE:MUSA

Murphy USA (MUSA): Evaluating Valuation After Earnings Beat, $2B Buyback, and Dividend Hike

Reviewed by Simply Wall St

Murphy USA reported third-quarter earnings that surpassed forecasts, supported by higher merchandise sales. In addition to these results, the company authorized a $2 billion share repurchase and increased its quarterly dividend by 19%.

See our latest analysis for Murphy USA.

Murphy USA's positive quarter comes after a transitional stretch for the stock. While the one-month share price return of 7.7% hints at building momentum and recent buy-and-back initiatives signal management’s optimism, the total shareholder return over the past year is still down 28%. However, looking longer term, investors holding for five years have seen total returns surge 216%, underscoring the potential for patient shareholders.

If you're weighing what else could be next in fast-changing markets, this is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares rebounding after a tough year and management increasing their commitment to buybacks and dividends, investors are left to wonder if Murphy USA has further room to run, or if the market is already reflecting future gains.

Most Popular Narrative: 8.9% Undervalued

Murphy USA's most watched valuation view places fair value at $423, compared with the last close of $386. Bulls will note that this valuation gap is grounded in strong expansion and margin catalysts expected to play out over the next few years.

Accelerated implementation of digital loyalty programs and private label initiatives is increasing customer retention, boosting inside merchandise sales (especially beyond cigarettes and lottery) and enhancing net margins by shifting sales mix towards higher-margin, non-fuel categories. Operational efficiencies and cost discipline, including lower store OpEx and SG&A achieved through technology and supply chain improvements, are structurally reducing expenses and driving higher net earnings. This allows the company to maintain profitability even in softer demand environments.

Want to discover the full recipe behind the narrative’s bold valuation? Find out which surprising financial levers could put Murphy USA on a new growth trajectory and why some assumptions might spark debate. Dive in to see which future performance benchmarks this narrative is built around.

Result: Fair Value of $423 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in fuel demand or execution setbacks on new store openings could challenge Murphy USA’s outlook and put the strength of this narrative to the test.

Find out about the key risks to this Murphy USA narrative.

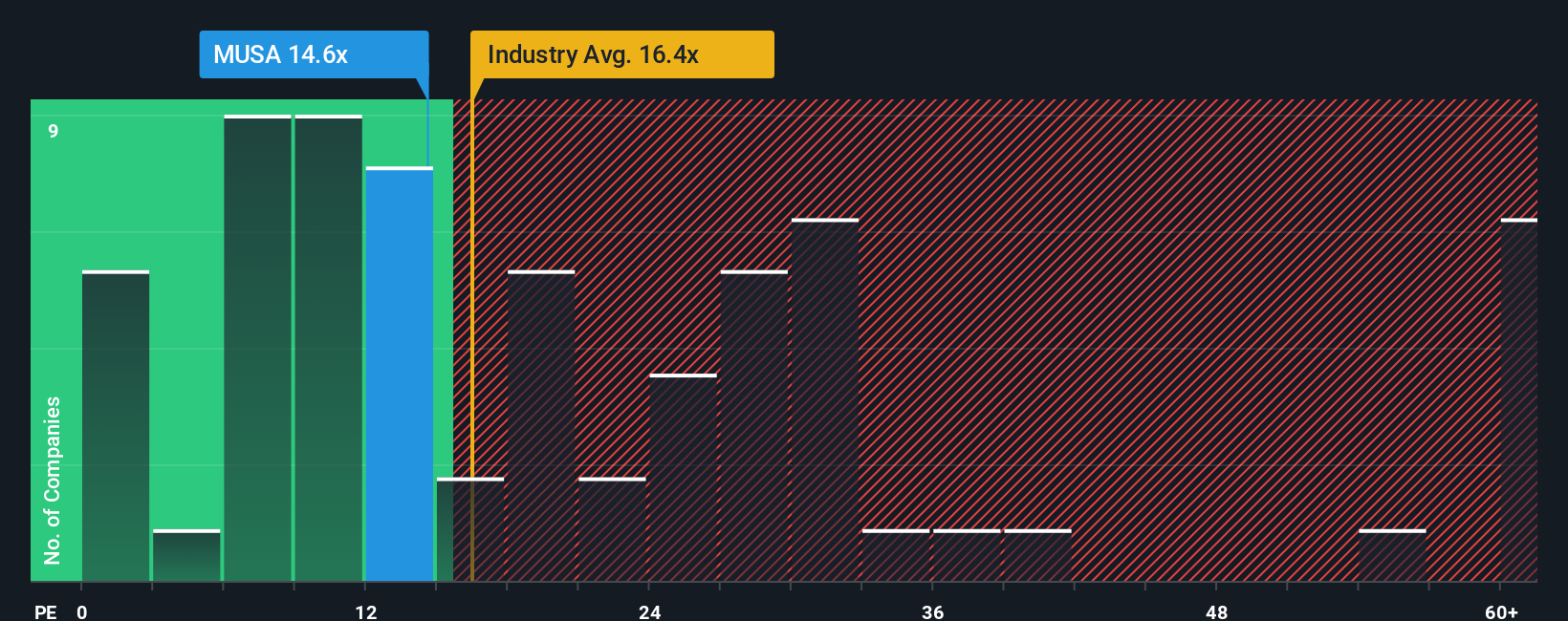

Another View: Multiples Tell a Different Story

Looking through the lens of price-to-earnings, Murphy USA trades at 15.3x. This is below the broader US market’s 18.7x but above the US Specialty Retail industry average of 10.6x and its own fair ratio of 14.7x. The stock is priced higher than its closest peers, which increases the expectations for future performance. Which approach should weigh heavier in your decision?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Murphy USA for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 922 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Murphy USA Narrative

If you think a different story emerges from the data, or if you'd rather see the numbers for yourself, you can build your own perspective in just a few minutes. Do it your way.

A great starting point for your Murphy USA research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take your portfolio to the next level with these curated selections. They could spark your next move. Don’t miss some of the market’s most talked-about opportunities right now.

- Spot opportunities for recurring income by scanning these 14 dividend stocks with yields > 3% with yields over 3% and robust payout histories.

- Focus on promising disruptors by reviewing these 922 undervalued stocks based on cash flows to find stocks trading well below their intrinsic value based on future cash flows.

- Stay informed on medical breakthroughs by exploring these 30 healthcare AI stocks to see which innovators are addressing the next generation of healthcare challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MUSA

Murphy USA

Together with subsidiaries, engages in marketing of retail motor fuel products and convenience merchandise.

Limited growth with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026