- United States

- /

- Specialty Stores

- /

- NYSE:LOW

Lowe’s (LOW): Assessing Valuation Potential After Recent Steady Gains

Reviewed by Simply Wall St

Lowe's Companies (LOW) stock has seen modest movement this month, up around 3%, as investors assess its steady business performance. Some are curious whether recent trading offers a reasonable entry point for long-term gains.

See our latest analysis for Lowe's Companies.

Despite some choppy trading earlier this year, Lowe's share price has quietly recovered, gaining 3.5% over the past month. Recent price momentum suggests investors are growing more optimistic after a challenging spell. However, the 1-year total shareholder return is still negative. Over the last three and five years, long-term total returns remain robust. This positions the stock as a steady compounder for patient holders.

If you’re curious what else is trending, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With Lowe's stock still trading below average analyst price targets and boasting steady long-term returns, investors have to ask: is there real value still left on the table, or is the market already reflecting future growth?

Most Popular Narrative: 9.6% Undervalued

Lowe's current stock price remains below the latest fair value estimate cited in the most-followed narrative. This suggests room for upside if projections are realized. The narrative is based on concrete future growth assumptions and major business shifts, setting the foundation for a strong catalyst that follows.

The acquisition of Foundation Building Materials (FBM) sharply accelerates Lowe's access to the large Pro contractor market, especially in key underserved regions (California, Northeast, Midwest). This unlocks new revenue streams, greater ticket sizes, and a larger share of the $250 billion Pro market, which is expected to drive above-market sales growth and improve diversification of revenue over the coming years.

What if one bold integration plan could radically reshape market share? There are surprising assumptions about sustained margin boosts, accelerating revenues, and a future profit multiple that raises eyebrows even among optimists. The full story breaks down exactly what must go right and what that could mean for investors betting on a comeback.

Result: Fair Value of $272.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if integration challenges or prolonged home improvement market weakness lead to higher costs and limited long-term growth.

Find out about the key risks to this Lowe's Companies narrative.

Another View: Multiples Tell a Different Story

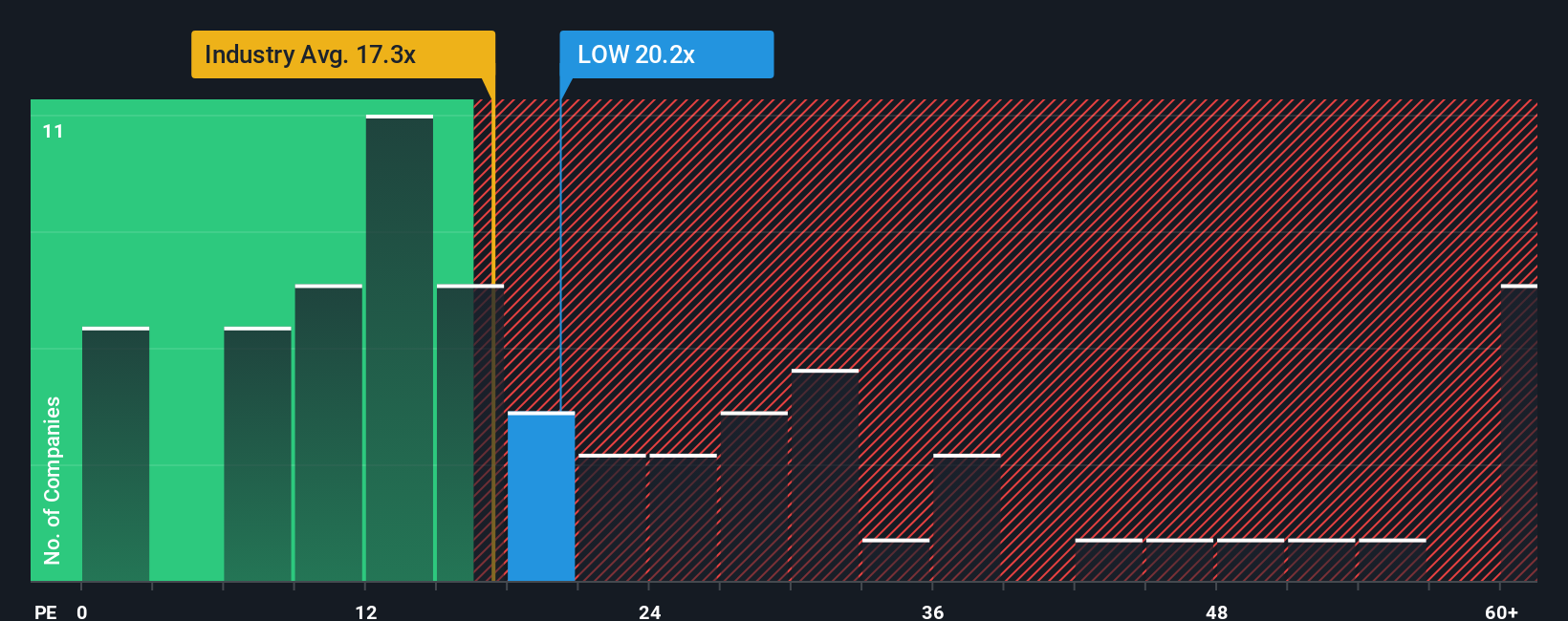

Stepping away from the fair value estimate, the price-to-earnings ratio provides another lens. Lowe’s shares trade at 20.4 times earnings, making them look pricier than the US Specialty Retail industry’s 18.1 average, yet cheaper than the peer average of 30.9. The current level sits just below the fair ratio of 21.5. This means the stock is not clearly cheap or expensive based on these benchmarks. Does this create a valuation risk, or a quiet opportunity hiding in plain sight?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lowe's Companies Narrative

If you want to dig deeper, challenge the consensus, or simply explore your own take, you can easily map out your narrative in just minutes. Do it your way

A great starting point for your Lowe's Companies research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Open up new possibilities by using the Simply Wall Street Screener to quickly spot high-potential stocks and opportunities you might otherwise miss out on.

- Target reliable income streams by tapping into these 14 dividend stocks with yields > 3% with attractive yields above 3% and a track record of consistent payouts.

- Catch the momentum of rapid innovation when you access these 25 AI penny stocks that are positioned to benefit from the rise of artificial intelligence solutions across industries.

- Secure bargains for long-term growth by exploring these 923 undervalued stocks based on cash flows currently trading below their intrinsic value based on strong cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOW

Lowe's Companies

Operates as a home improvement retailer in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026