- United States

- /

- Specialty Stores

- /

- NYSE:LOW

How Investors Are Reacting To Lowe's Companies (LOW) Patent Lawsuit Over AI Retail Technology

Reviewed by Sasha Jovanovic

- Earlier this week, Alpha Modus Corp. announced it has filed a patent infringement lawsuit against Lowe's Companies Inc. and Lowe's Home Centers, LLC in the U.S. District Court for the Eastern District of Texas, alleging that Lowe's in-store computer-vision and retail-media systems infringe on six patents related to AI-driven inventory, analytics, and customer engagement technologies.

- This legal action draws attention to the fast-evolving intersection between retail technology, artificial intelligence, and intellectual property as retailers expand their digital capabilities in physical stores.

- To help understand the potential risks, we'll explore how this legal dispute may affect Lowe's future retail technology initiatives and overall investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Lowe's Companies Investment Narrative Recap

To be a shareholder in Lowe's Companies, you need to believe in its ability to integrate large acquisitions like FBM and ADG while expanding its Pro contractor business, investing in digital tools, and managing risks associated with execution, debt financing, and economic headwinds in the home improvement sector. The patent infringement lawsuit filed by Alpha Modus Corp. brings attention to Lowe's digital initiatives, but at this stage, it does not appear to materially impact the most important short-term catalyst, successful FBM integration, or the main risk around debt and execution.

One recent and closely related announcement is Lowe’s $2 billion unsecured revolving credit agreement and $2 billion term loan. This financial step is directly tied to funding the FBM acquisition, which remains pivotal for accessing the Pro contractor market and driving growth, while potentially intensifying exposure should legal or operational challenges arise. As Lowe’s invests more heavily in technology within its stores, new legal challenges may test both its risk management and its future flexibility in digital transformation.

Yet, with growing digital ambitions, investors should also weigh the potential legal and operational risks that...

Read the full narrative on Lowe's Companies (it's free!)

Lowe's Companies is projected to reach $94.0 billion in revenue and $8.4 billion in earnings by 2028. This outlook assumes an annual revenue growth rate of 4.0% and an earnings increase of $1.6 billion from the current $6.8 billion.

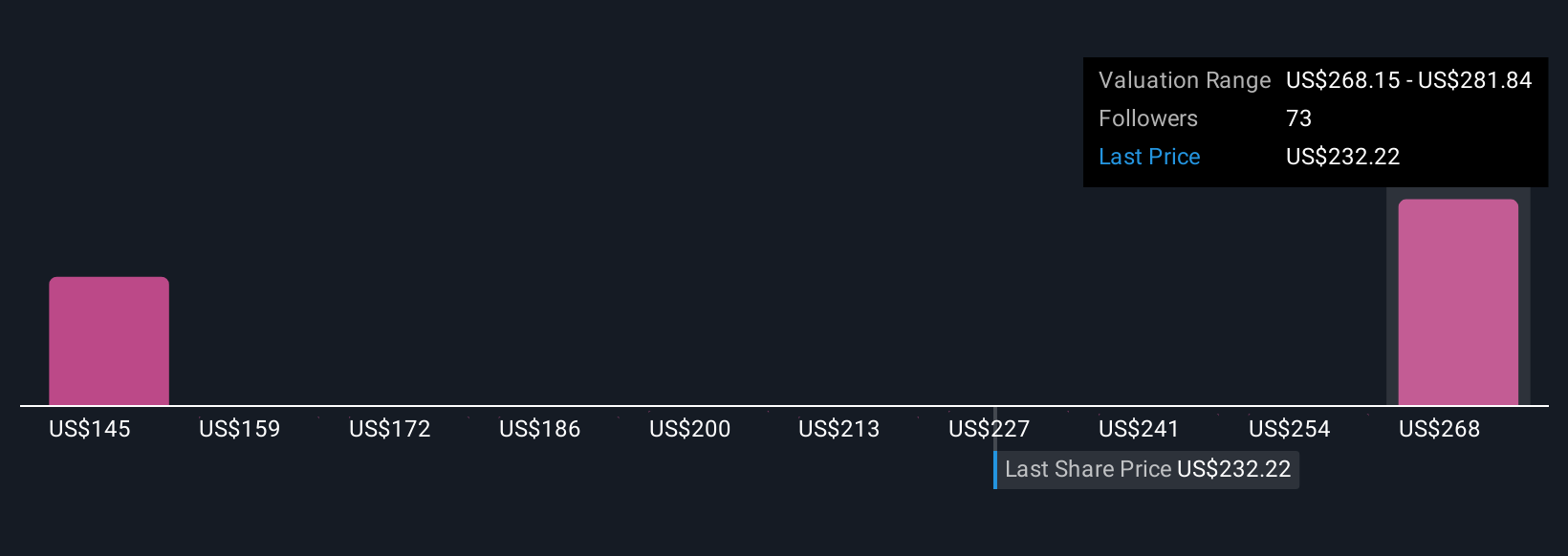

Uncover how Lowe's Companies' forecasts yield a $281.84 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided eight fair value estimates for Lowe's that span from US$144.99 to US$281.84 per share. While everyone is interpreting the company's prospects differently, the unresolved risk of technology-related legal disputes could have wider impacts on Lowe’s strategy, making it critical to review these varied perspectives.

Explore 8 other fair value estimates on Lowe's Companies - why the stock might be worth as much as 16% more than the current price!

Build Your Own Lowe's Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lowe's Companies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lowe's Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lowe's Companies' overall financial health at a glance.

No Opportunity In Lowe's Companies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOW

Lowe's Companies

Operates as a home improvement retailer in the United States.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives