How Investors May Respond To Jumia Technologies (JMIA) Q3 Revenue Growth and Efficiency Gains Amid Wider Losses

Reviewed by Sasha Jovanovic

- Jumia Technologies AG reported third-quarter 2025 earnings, with sales rising to US$45.63 million from US$36.43 million a year earlier, but the net loss widened to US$17.94 million from US$16.9 million for the same period.

- While revenue expanded at a strong pace, the company also showed improved operational efficiency as seen in a 17% better adjusted EBITDA loss and a substantial narrowing of losses for the nine-month period.

- We'll explore how Jumia's significant revenue growth and improved efficiency in Q3 2025 shape the company's investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Jumia Technologies Investment Narrative Recap

To be a Jumia Technologies shareholder, you need conviction in African e-commerce growth outpacing ongoing challenges around scale, competition, and digital infrastructure. The strong Q3 revenue jump and better operational efficiency support the current growth thesis, but the slightly wider net loss does little to resolve short-term uncertainty over Jumia’s path to profitability, which remains the company’s most immediate catalyst and largest risk.

Among recent announcements, Jumia’s ongoing expansion of logistics hubs, like those in Ghana, Egypt, and Ivory Coast earlier this year, closely relates to its strategy of unlocking new customer pools and lowering operational costs, both crucial to sustaining elevated order growth and smoothing the path toward eventual profitability as highlighted by the latest quarter.

However, beneath the headline revenue growth, investors should be mindful of the persistent challenge in translating efficiency gains into lasting profitability, particularly given...

Read the full narrative on Jumia Technologies (it's free!)

Jumia Technologies' narrative projects $236.6 million revenue and $20.6 million earnings by 2028. This requires 13.0% yearly revenue growth and a $90.3 million earnings increase from the current -$69.7 million.

Uncover how Jumia Technologies' forecasts yield a $6.99 fair value, a 31% downside to its current price.

Exploring Other Perspectives

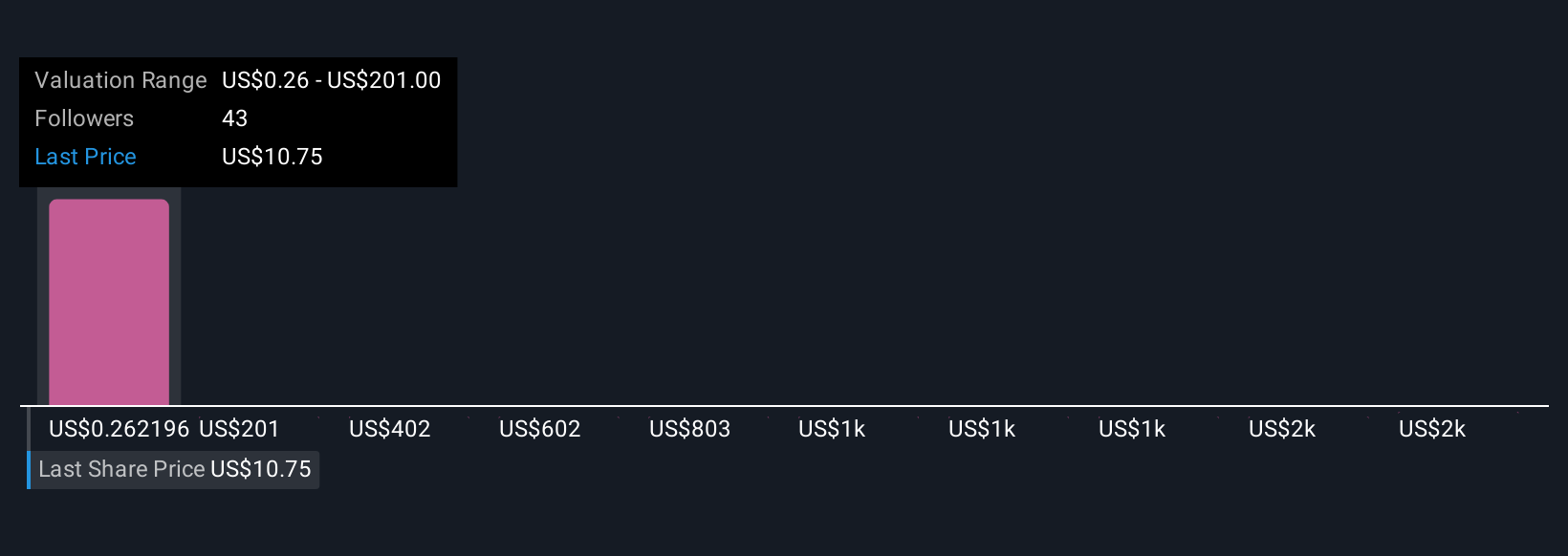

Seven Simply Wall St Community members estimate Jumia’s fair value anywhere from US$0.22 up to US$46.28 per share. With such varied views but ongoing uncertainty about Jumia’s profitability path, your own outlook can shape very different conclusions.

Explore 7 other fair value estimates on Jumia Technologies - why the stock might be worth over 4x more than the current price!

Build Your Own Jumia Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jumia Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Jumia Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jumia Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JMIA

Jumia Technologies

Operates an e-commerce platform in West Africa, North Africa, East and South Africa, Europe, the United Arab Emirates, and internationally.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives