- United States

- /

- Specialty Stores

- /

- NYSE:HD

Instacart’s Canada Expansion With Home Depot Might Change The Case For Investing In Home Depot (HD)

Reviewed by Sasha Jovanovic

- Instacart announced a partnership in early December 2025 with The Home Depot Canada to provide same-day delivery in as fast as an hour from over 175 stores nationwide, including heavy items up to 60 pounds, with in-store pricing via the Instacart app.

- This collaboration makes The Home Depot Canada the first home improvement retailer with nationwide coverage on Instacart in the country, expanding its reach just as customers prepared for holiday gatherings, seasonal projects, and year-end renovations.

- Now we’ll examine how this expanded Canadian same-day delivery access via Instacart could influence Home Depot’s longer-term investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Home Depot Investment Narrative Recap

To own Home Depot, you need to believe that its scale, Pro-focused strategy, and omnichannel capabilities can offset softer big-ticket remodeling, margin pressure, and heavy capex needs. The Instacart partnership extends convenience and digital reach in Canada, but it does not materially change the key near term catalyst, which is a recovery in demand for larger projects, or the biggest risk, which is earnings pressure from slower sales and elevated operating costs.

Among recent announcements, the updated full year 2025 guidance is most relevant, because it frames how much near term earnings softness management is currently willing to absorb while it invests in supply chain, digital tools, and Pro ecosystem expansion. Against that backdrop, the Instacart tie up looks more like a complementary convenience upgrade than a swing factor for margins or sales, especially compared with the capital intensity of store upgrades, distribution centers, and pending acquisitions.

But investors also need to be aware that rising inventories and slower turns could still pressure margins if...

Read the full narrative on Home Depot (it's free!)

Home Depot’s narrative projects $182.4 billion in revenue and $17.4 billion in earnings by 2028.

Uncover how Home Depot's forecasts yield a $403.36 fair value, a 14% upside to its current price.

Exploring Other Perspectives

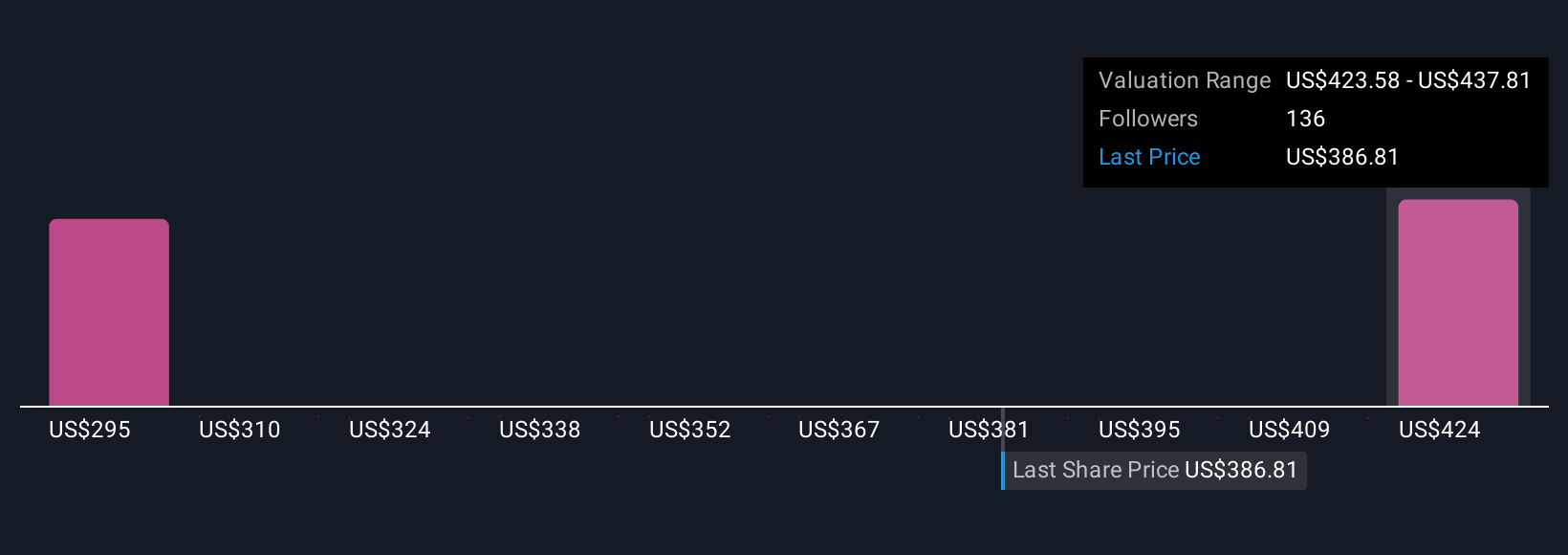

Four members of the Simply Wall St Community value Home Depot between US$300.99 and US$403.36, underlining how far individual views can stretch. Set those opinions against current concerns about flat to declining EPS and margin pressure, and it becomes even more important to weigh several perspectives before deciding how Home Depot fits into your portfolio.

Explore 4 other fair value estimates on Home Depot - why the stock might be worth 15% less than the current price!

Build Your Own Home Depot Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Home Depot research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Home Depot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Home Depot's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HD

Home Depot

Operates as a home improvement retailer in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026