- United States

- /

- Specialty Stores

- /

- NYSE:GME

GameStop (GME) Valuation Check After Renewed Burry–Gill Buyback Buzz and Rising Retail Enthusiasm

Reviewed by Simply Wall St

The latest spark around GameStop (GME) is not a new filing or headline deal. Instead, it is a resurfaced 2019 email exchange between Michael Burry and Keith Gill that revived the buyback debate.

See our latest analysis for GameStop.

Those resurfaced emails, plus quirky promotions like Trade Anything Day and speculation about how GameStop might use its cash pile, have helped spark a short term sentiment shift, even though the share price return year to date is still firmly negative and the multi year total shareholder return remains strikingly positive.

If you are weighing what comes after the latest meme fueled move, it might be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership

With the stock still down sharply this year but sitting on substantial cash and a loyal retail base, is GameStop quietly undervalued, or is the market already pricing in every bit of future turnaround and crypto fueled upside?

Most Popular Narrative Narrative: 80.8% Undervalued

Compared with GameStop’s last close at $23, the narrative’s fair value of $120 implies a dramatically higher long term potential path for the stock.

GameStop’s Q1 2025 financials, combined with an amazing shareholder community, just showed its takes-money-to-buy-whiskey strategy at work, demonstrating its status as a compelling investment as the retail investors have been saying for years while fighting a corrupt legacy media, bots, social media manipulation and hedge funds. Gamestop delivered a stellar adjusted EPS of $0.17, beating estimates by 325%, and achieved a $44.8 million net profit, reversing last year’s $32 million loss.

According to prime_is_back, this bold valuation leans on a striking profit turnaround, hefty cash reserves, and a premium future earnings multiple more often reserved for fast growing tech names. Want to see how those moving parts supposedly add up to that triple digit fair value, and which profitability and growth assumptions do the heavy lifting in this story?

Result: Fair Value of $120 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustaining margins while shrinking the store base and executing any crypto or digital pivot could disappoint and challenge the bold undervaluation thesis.

Find out about the key risks to this GameStop narrative.

Another View: Traditional Valuation Sends Mixed Signals

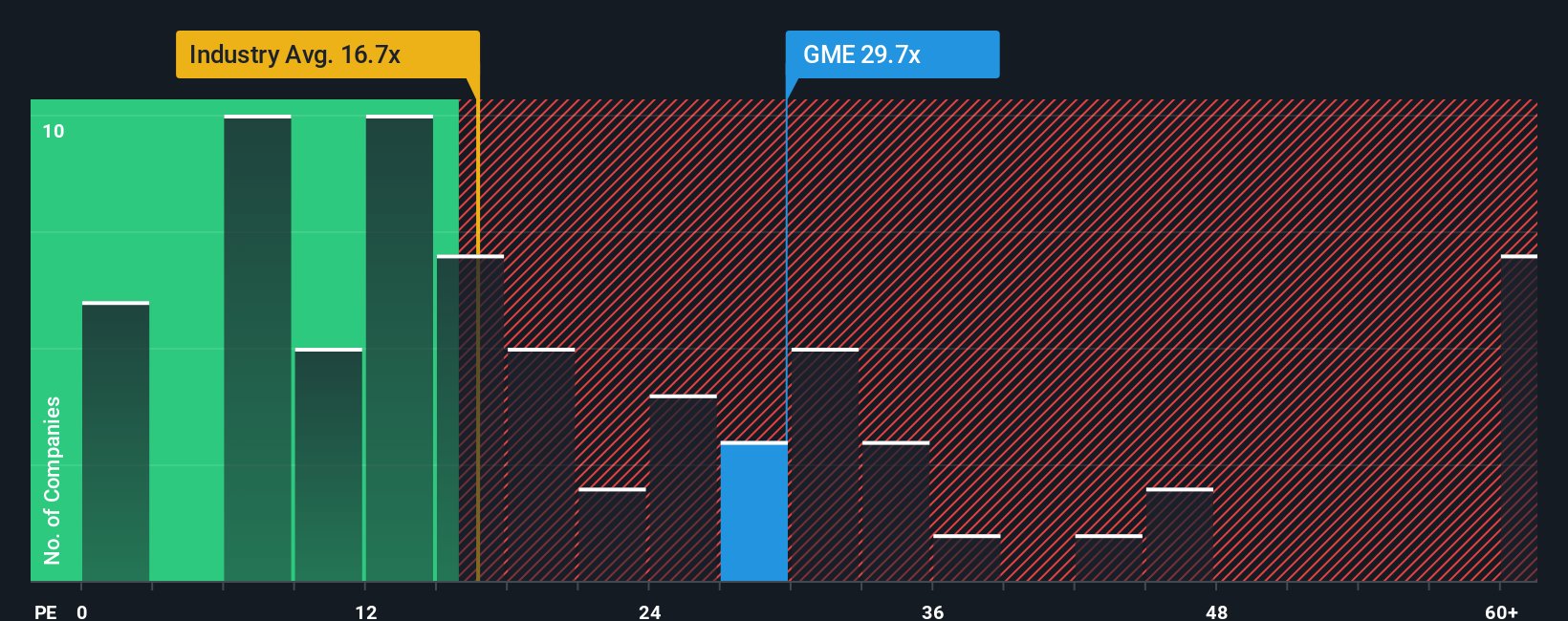

Step away from the narrative, and the picture looks more cautious. On a simple price to earnings basis, GameStop trades at 28.4 times, well above both peer averages around 19 times. That richer tag suggests less margin for error if growth cools or sentiment fades.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GameStop Narrative

If this perspective does not quite match your own or you would rather dig into the numbers yourself, you can build a fresh narrative in just a few minutes, Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding GameStop.

Looking for more investment ideas?

GameStop might be front of mind today, but you could miss your next big winner if you ignore fresh opportunities hiding in other corners of the market.

- Explore high-upside potential early by scanning these 3574 penny stocks with strong financials that already show strong financial underpinnings instead of just hype.

- Participate in the AI trend by targeting these 26 AI penny stocks that may benefit from rising demand for intelligent software and automation.

- Seek more consistent income streams by reviewing these 15 dividend stocks with yields > 3% that can help support your portfolio’s cash flow when markets are unpredictable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GME

GameStop

A specialty retailer, provides games and entertainment products through its stores and e-commerce platforms in the United States, Canada, Australia, and Europe.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026