- United States

- /

- Specialty Stores

- /

- NYSE:FND

Floor & Decor (FND): Evaluating Valuation Following New Store Openings and Expansion Strategy

Reviewed by Simply Wall St

Floor & Decor Holdings (FND) has just opened new warehouse stores in Washington, South Carolina, and Idaho, highlighting its growth strategy and expanding footprint. These new locations could generate increased interest in the stock’s direction.

See our latest analysis for Floor & Decor Holdings.

Shareholders have seen Floor & Decor’s share price slip 34.8% year-to-date, with a 1-year total shareholder return of -43.2%. While recent store openings fuel optimism about long-term growth, the short-term momentum is still fading compared to where the stock started the year.

If expansion stories like this have you curious about where else growth might surprise, now is the perfect moment to discover fast growing stocks with high insider ownership

With both recent expansion and a challenging stock chart, the key debate is whether the market has fully priced in Floor & Decor’s long-term growth or if current levels present a rare buying opportunity for investors.

Most Popular Narrative: 18.7% Undervalued

Compared to its latest close of $63.62, the most followed narrative considers Floor & Decor’s fair value to be $78.27. This suggests significant upside potential if growth drivers play out as expected. This viewpoint reflects a blend of optimism for margin expansion and caution around sector volatility.

Expanding store footprint, pro customer focus, and targeted design services position the company for ongoing sales and margin growth as market demand rebounds. Strong supply chain agility, omnichannel initiatives, and demographic tailwinds support long-term revenue growth and competitive advantages despite economic uncertainty.

Want to discover what’s behind this bold valuation call? The story hinges on fast-growing sales, rising profit margins, and an ambitious expansion strategy. Intrigued to learn which key assumptions power that double-digit upside? Dive into the full narrative and see which future milestones could trigger the next major move.

Result: Fair Value of $78.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in housing activity or ongoing tariff challenges could limit Floor & Decor’s revenue growth and put pressure on margins, even with expansion efforts.

Find out about the key risks to this Floor & Decor Holdings narrative.

Another View: What Do Multiples Tell Us?

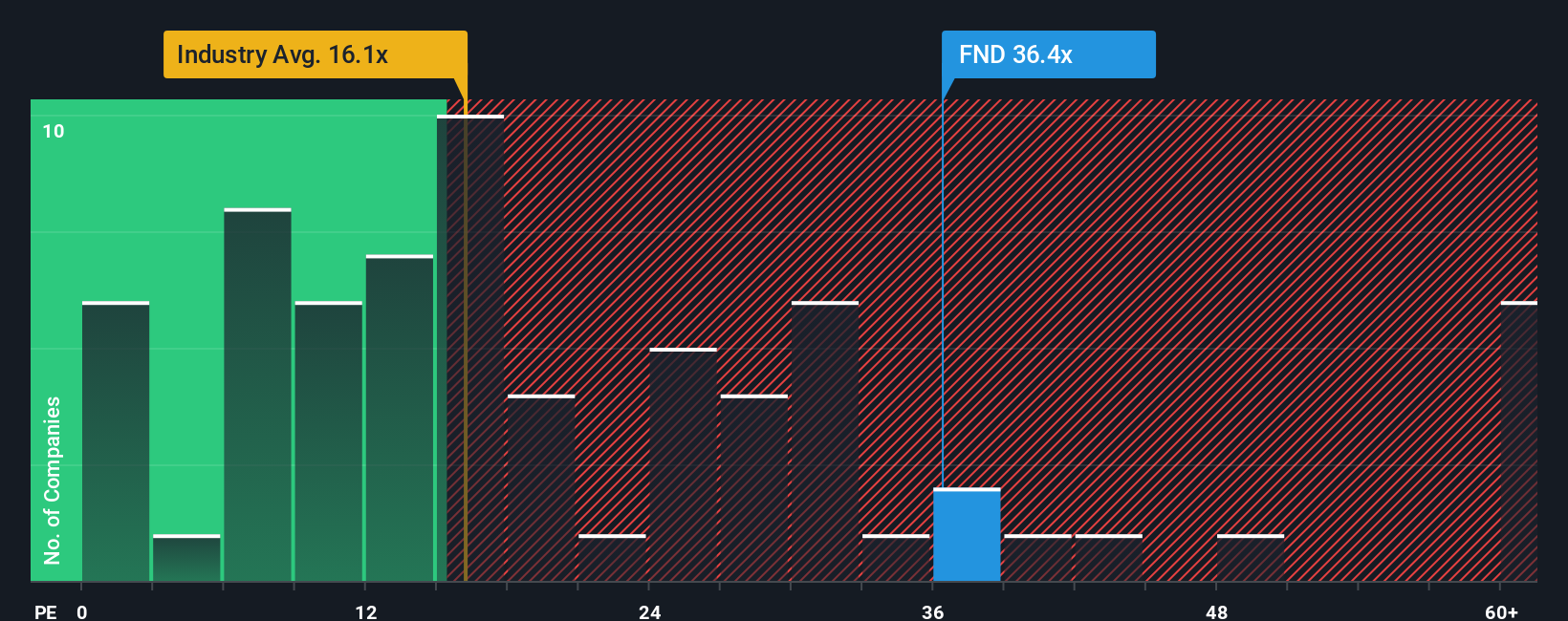

While many analysts focus on Floor & Decor’s growth forecasts, its price-to-earnings ratio stands out at 31.6x. That is more than double the US Specialty Retail industry average of 18x and well above its fair ratio of 17.5x. This pricing gap suggests investors may be taking on more valuation risk than with peers. Could current optimism be overdone, or is the potential worth the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Floor & Decor Holdings Narrative

If you see the story differently or want to dig into the details yourself, it takes just a few minutes to shape your own perspective. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Floor & Decor Holdings.

Looking for More Investment Ideas?

Serious investors know that opportunity moves fast. Don't limit yourself to just one stock. Stay ahead of the curve by tapping into these targeted picks that reflect today's top investment trends:

- Lock in consistent income by targeting companies with proven yields using these 15 dividend stocks with yields > 3%.

- Catch early technology disruptors reshaping tomorrow with these 25 AI penny stocks, before they hit everyone’s radar.

- Go after hidden gems trading for less than their true worth through these 920 undervalued stocks based on cash flows and build a smarter, stronger portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FND

Floor & Decor Holdings

Operates as a multi-channel specialty retailer of hard surface flooring and related accessories, and commercial surfaces seller in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026