How Etsy’s OpenAI-Powered ChatGPT Shopping Integration At Etsy (ETSY) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Etsy recently announced a partnership with OpenAI that lets U.S. ChatGPT users directly discover and purchase Etsy products, supported by the company’s ongoing AI investments in personalization, search ranking, and seller tools.

- This move positions Etsy to tap into emerging AI-assisted shopping behavior and potentially deepen shopper engagement with its handmade and creator-led inventory during the holiday season and beyond.

- Next, we’ll explore how Etsy’s OpenAI-powered shopping integration could influence its AI-centered investment narrative and future marketplace engagement.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Etsy Investment Narrative Recap

To own Etsy, you likely need to believe its differentiated, handmade marketplace can re-accelerate buyer engagement and stabilize gross merchandise sales, even as competition and marketing costs weigh on margins. The OpenAI partnership could support the near term catalyst of improving GMS by broadening product discovery, but the biggest immediate risk remains that active buyers and GMS per buyer continue to drift lower despite these initiatives.

The OpenAI integration fits squarely with Etsy’s AI focused push across personalization, search ranking and seller tools, which management frames as core to lifting conversion and deepening loyalty. If these investments do not translate into sustained improvements in buyer activity and more efficient marketing, the pressure from rising acquisition costs and lower profitability may persist.

But investors should also be aware that if buyer activity keeps sliding while Etsy leans harder into paid marketing...

Read the full narrative on Etsy (it's free!)

Etsy's narrative projects $3.2 billion revenue and $377.3 million earnings by 2028.

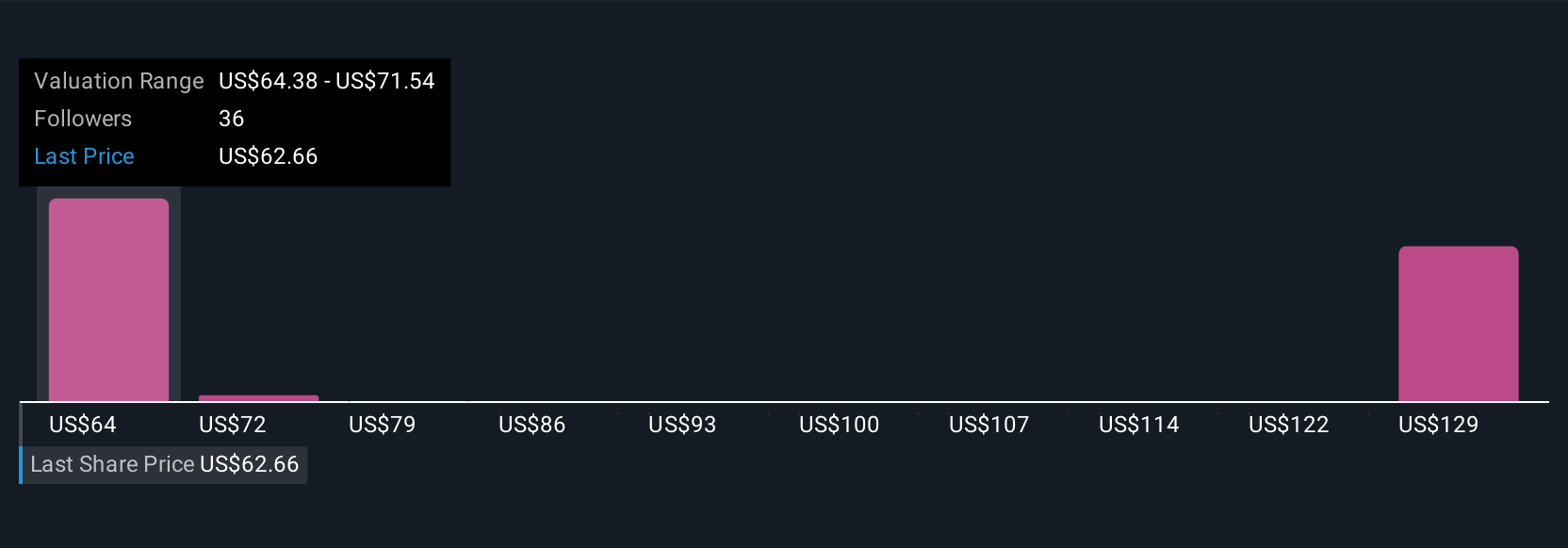

Uncover how Etsy's forecasts yield a $68.59 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community fair value estimates for Etsy span roughly US$67 to US$110 per share, underlining how far apart individual views can be. When you set this range against concerns about declining GMS and buyer engagement, it becomes even more important to weigh several independent perspectives on what might drive Etsy’s future performance.

Explore 5 other fair value estimates on Etsy - why the stock might be worth over 2x more than the current price!

Build Your Own Etsy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Etsy research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Etsy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Etsy's overall financial health at a glance.

No Opportunity In Etsy?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Etsy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETSY

Etsy

Operates two-sided online marketplaces that connect buyers and sellers worldwide.

Moderate risk and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026