Has the 22% Share Price Drop Changed the Outlook for Etsy in 2025?

Reviewed by Bailey Pemberton

- If you have been wondering whether Etsy is actually a hidden bargain or just riding a wave of hype, you are in the right place.

- After a strong start to the year, Etsy’s share price took a sharp turn, dropping 22.1% in just the last week and down almost 20% over the past month, even though its one-year return is a positive 10.5%.

- The major headlines lately have revolved around shifts in consumer e-commerce spending and changes in Etsy’s fee structure. Both factors have created uncertainty for investors, and these stories are adding fuel to recent price swings while shaping the market’s view of risk and opportunity.

- When it comes to valuation, Etsy’s value score stands at 2 out of 6, suggesting that there may still be questions about whether the shares are truly undervalued. Let’s explore the various valuation approaches investors use. We will also discuss a better way to size up Etsy’s real worth.

Etsy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Etsy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their present value. This method aims to give investors a picture of what a company should be worth today, based on how much cash it is expected to generate in the future.

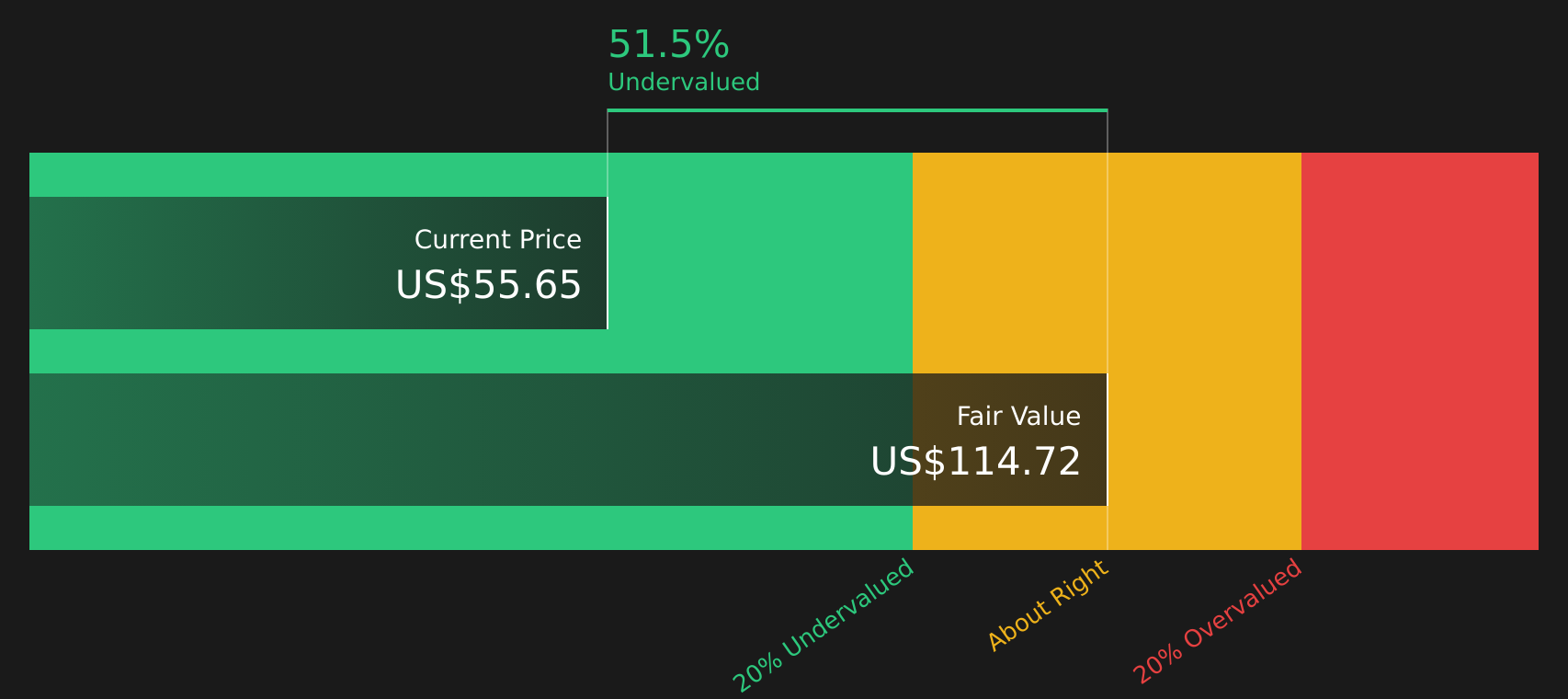

Etsy’s current Free Cash Flow stands at $645 million, and analysts expect this figure to gradually increase over the coming years. Looking to 2029, projections have Etsy’s annual Free Cash Flow rising to $789 million. The projections for the next ten years show steady growth, with estimates largely driven by input from industry analysts for the first five years. Continued growth is extrapolated beyond that point.

Based on these assumptions, the model estimates Etsy’s intrinsic or fair value at $115.06 per share. Compared to the current share price, this suggests Etsy is trading at a discount of 49.4 percent, meaning the market price is significantly lower than the company’s calculated value using this method.

For investors, this model points to Etsy as deeply undervalued given its projected cash flow growth and current valuation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Etsy is undervalued by 49.4%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Etsy Price vs Earnings

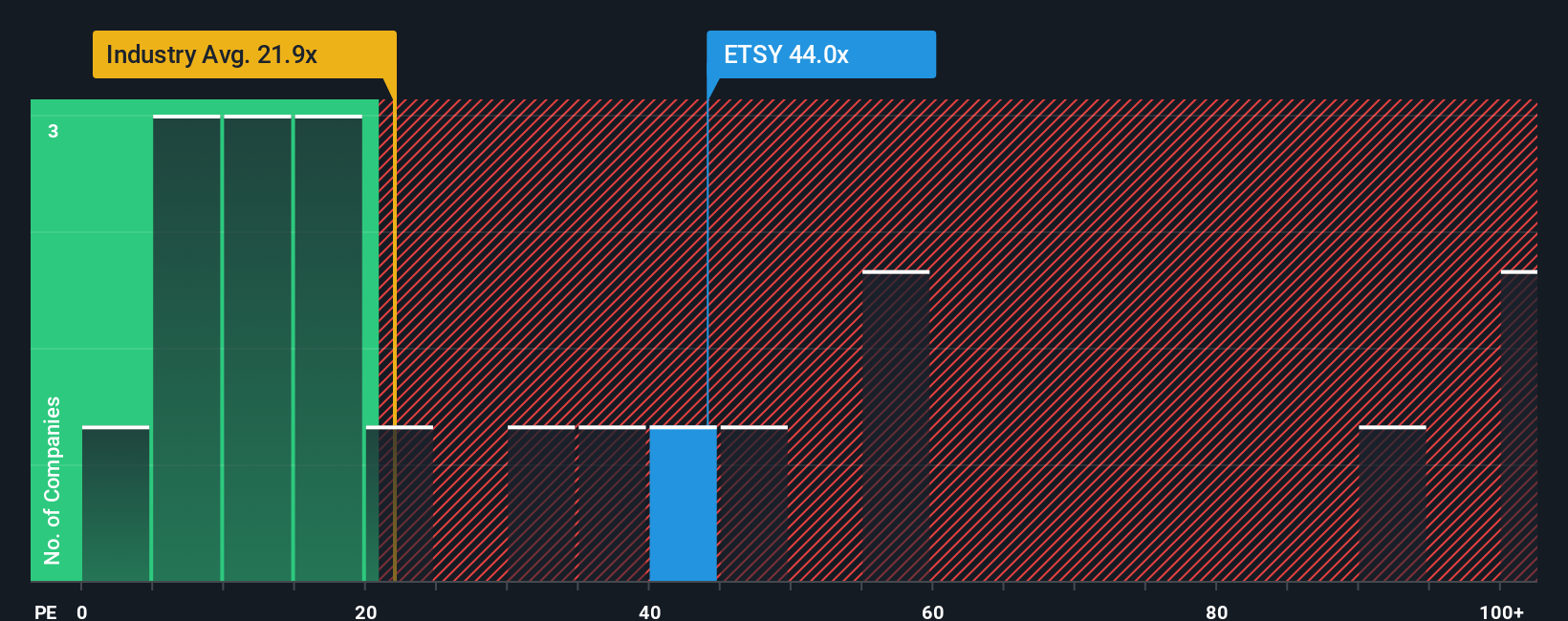

The Price-to-Earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies like Etsy because it relates a company's market value directly to its bottom-line earnings. For businesses consistently generating profits, the PE ratio offers a straightforward way for investors to gauge what they are paying for each dollar of earnings.

What counts as a “fair” PE ratio depends on factors like future growth prospects, overall market risk, and company-specific elements. Higher expected growth rates or lower risk can justify a higher PE ratio, while companies facing challenges might trade at a discount.

Currently, Etsy trades at a PE ratio of 31.6x. This is noticeably above the industry average of 19.5x for Multiline Retail and also higher than the 18.7x average among peers. However, benchmarks like industry or peer averages do not fully capture Etsy’s unique position, growth expectations, and risk profile.

This is where the Simply Wall St "Fair Ratio" comes in. Unlike standard comparisons, the Fair Ratio for Etsy is 22.6x. This reflects a comprehensive assessment that incorporates the company’s growth outlook, profit margins, market cap, industry context, and risk factors. This approach provides a more tailored view of what a reasonable PE ratio should be for Etsy rather than relying on broad averages.

Comparing Etsy’s current PE ratio of 31.6x to its Fair Ratio of 22.6x, the stock appears overvalued based on this approach, since its market price reflects a premium beyond what is justified by key fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

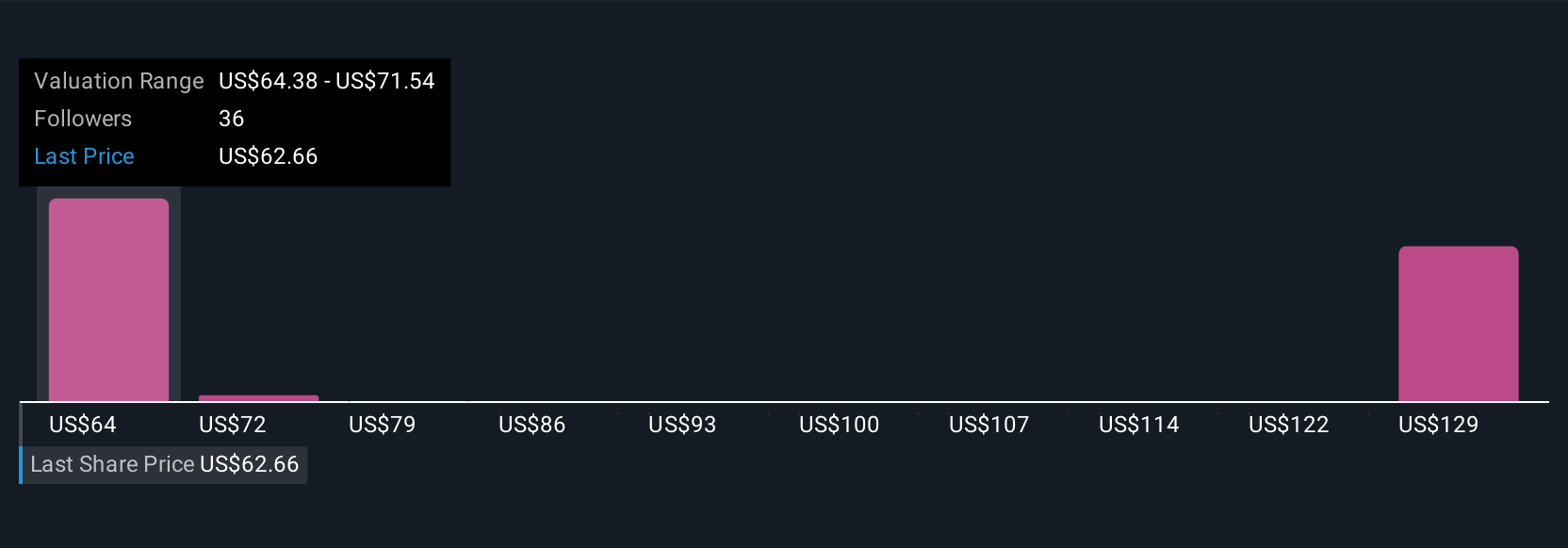

Upgrade Your Decision Making: Choose your Etsy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative goes beyond the numbers, allowing you to give your own story or perspective about Etsy’s future by combining your assumptions about revenue, earnings, growth catalysts, and risks into a tailored forecast that produces your personal view of fair value.

On Simply Wall St’s Community page, millions of investors build and share easy-to-understand Narratives that link what’s happening with the business to financial forecasts and a real-time fair value. This enables you to confidently decide if, when, and why to buy or sell. Unlike static ratios, Narratives are updated automatically as new news or results arrive, ensuring your investment logic always reflects the latest facts.

For example, some investors believe Etsy’s investments in AI and mobile engagement will boost retention and margins, leading them to set higher future earnings and a fair value as high as $86. On the other hand, more cautious investors focus on declining buyer engagement or margin pressures and assign a fair value closer to $48. This makes it easy to see how different expectations create different price targets and lets you track which Narrative aligns with your own view, so your decisions are always grounded in both story and data.

Do you think there's more to the story for Etsy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Etsy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETSY

Etsy

Operates two-sided online marketplaces that connect buyers and sellers worldwide.

Moderate risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives