- United States

- /

- Specialty Stores

- /

- NYSE:DKS

Is There More Room for DICK'S Sporting Goods After New Store Format Launch?

Reviewed by Bailey Pemberton

- Curious if DICK'S Sporting Goods is a hidden value play or already fully priced in? You are not alone. Many investors are eyeing this stock to see if there's more upside to capture.

- The share price has delivered a spectacular run over the years, climbing 141.9% in three years and 377.2% over five, though it's down -3.0% this past month and slightly negative year-to-date at -1.8%.

- Recent headlines highlight DICK'S Sporting Goods leaning into innovation and expansion, with a new store format and partnerships making waves in the retail world. These moves have provided fresh optimism among analysts while adding a layer of intrigue to recent market volatility.

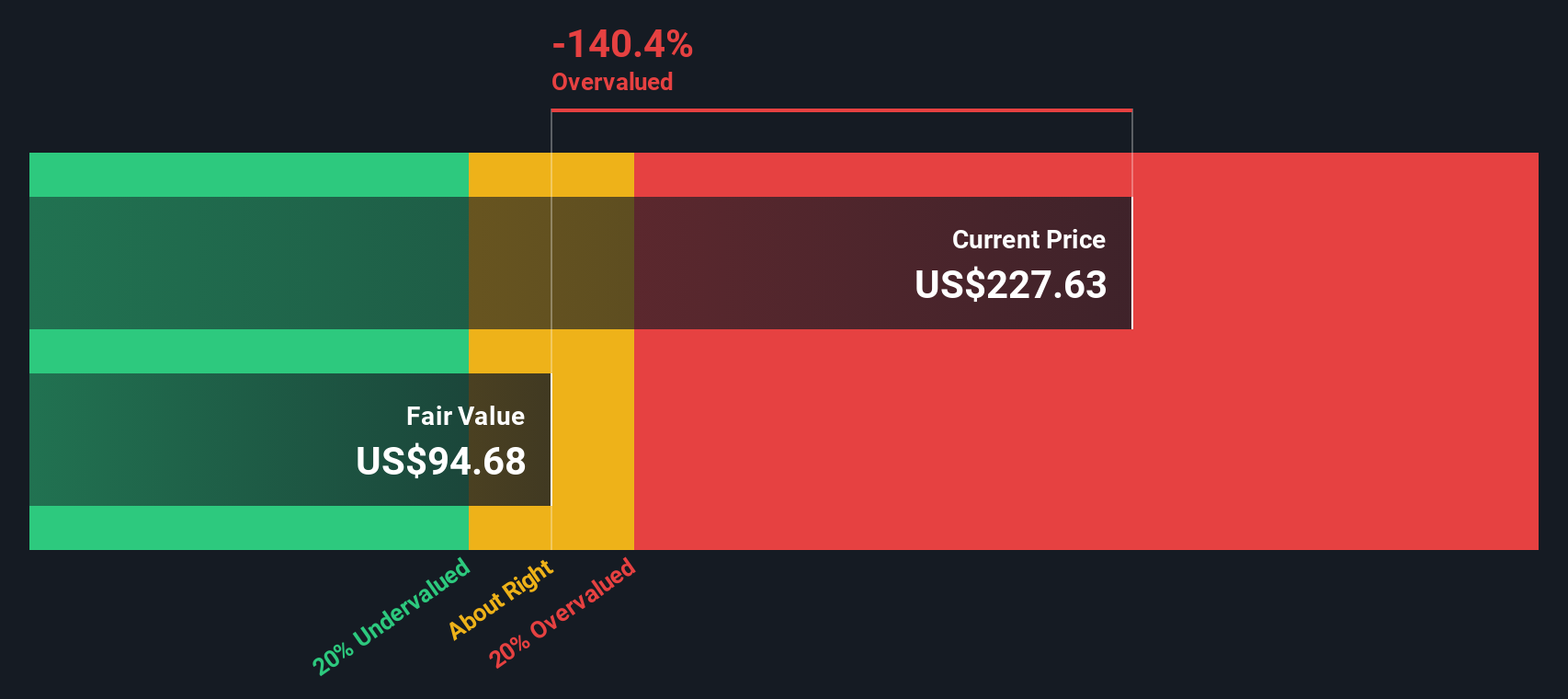

- The company currently scores a 5 out of 6 on our valuation checks, hinting at significant undervaluation in several key areas. Next, we'll break down exactly what these valuation approaches reveal, but stick around, as there is an even smarter way to interpret value that we'll explore at the end.

Approach 1: DICK'S Sporting Goods Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future cash flows and discounting them back to the present using a rate that reflects their riskiness. For DICK'S Sporting Goods, this approach leverages projections of how much cash the business will actually generate each year.

Currently, DICK'S Sporting Goods has a trailing twelve month Free Cash Flow of $689.8 Million. According to analysts, this figure is set to grow steadily, with projections showing Free Cash Flow rising to $1.95 Billion by 2030. The path to this figure includes near-term analyst estimates, such as $621.5 Million in 2027, while long-term projections beyond the next five years are extrapolated using industry models.

After accounting for all projected annual cash flows and discounting them back to today, the DCF model estimates that DICK'S Sporting Goods shares have an intrinsic value of $541.37. This suggests the stock is trading at a 58.8% discount to its calculated fair value, pointing to a substantial degree of undervaluation at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DICK'S Sporting Goods is undervalued by 58.8%. Track this in your watchlist or portfolio, or discover 882 more undervalued stocks based on cash flows.

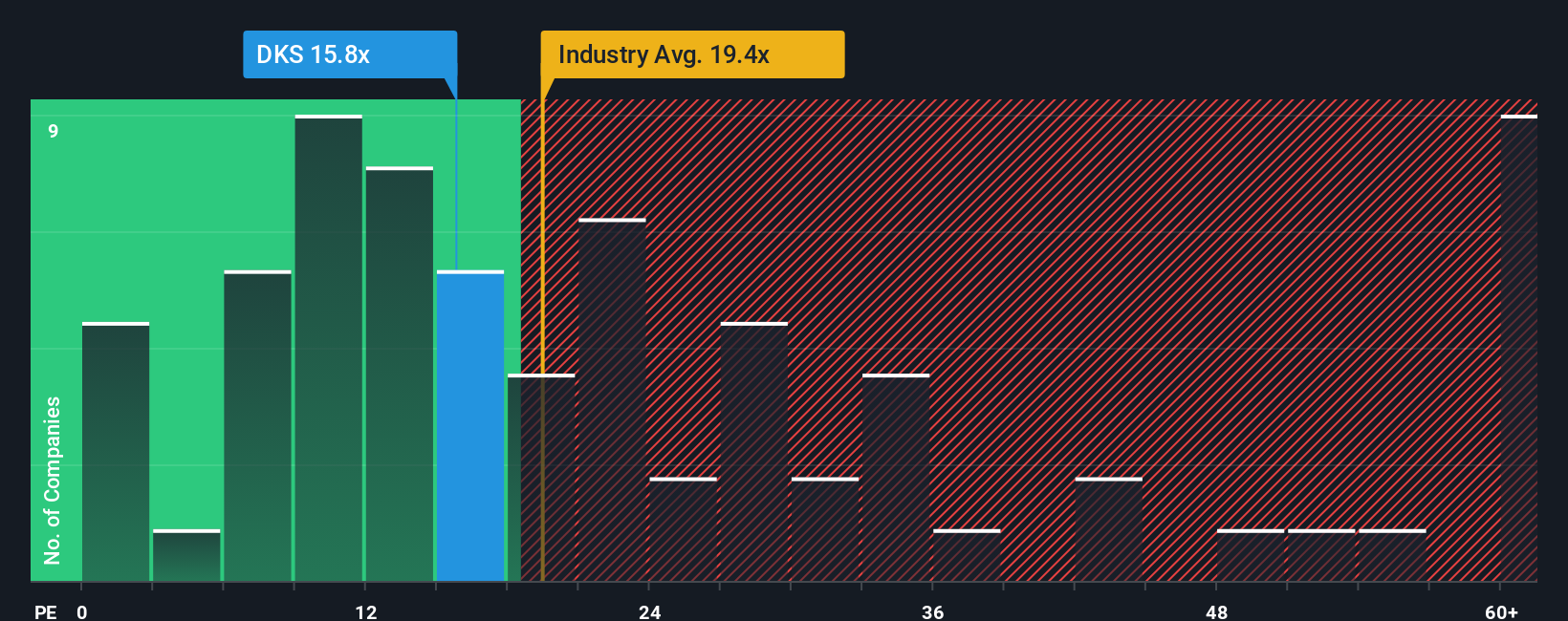

Approach 2: DICK'S Sporting Goods Price vs Earnings

The Price-to-Earnings (PE) ratio is a favored measure for valuing established, profitable companies such as DICK'S Sporting Goods, since it directly compares the price investors are willing to pay for each dollar of earnings. This makes it a useful shorthand for how highly the market rates the company's current and future profitability.

When assessing what constitutes a “normal” or “fair” PE ratio, it is important to consider the company’s expected earnings growth, profitability, and risk profile. A higher growth outlook or lower risk often justifies a premium PE ratio, while slower growth or elevated risk could warrant a discount.

Currently, DICK'S Sporting Goods trades at a PE ratio of 15.21x. This sits below both the Specialty Retail industry average of 17.84x and its peers’ average of 42.05x. This suggests that the stock commands a discount relative to the broader space.

However, Simple Wall St’s proprietary Fair Ratio for DICK'S Sporting Goods stands at 18.99x. This Fair Ratio is derived from a comprehensive model that incorporates the company’s earnings growth prospects, profit margins, industry trends, market capitalization, and risk factors. Unlike simple peer or industry comparisons, the Fair Ratio provides a nuanced benchmark that is more tailored to the company’s actual fundamentals and outlook.

Comparing the current PE ratio of 15.21x to the Fair Ratio of 18.99x, DICK'S Sporting Goods appears undervalued relative to where the multiple should be based on the company’s specific characteristics.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

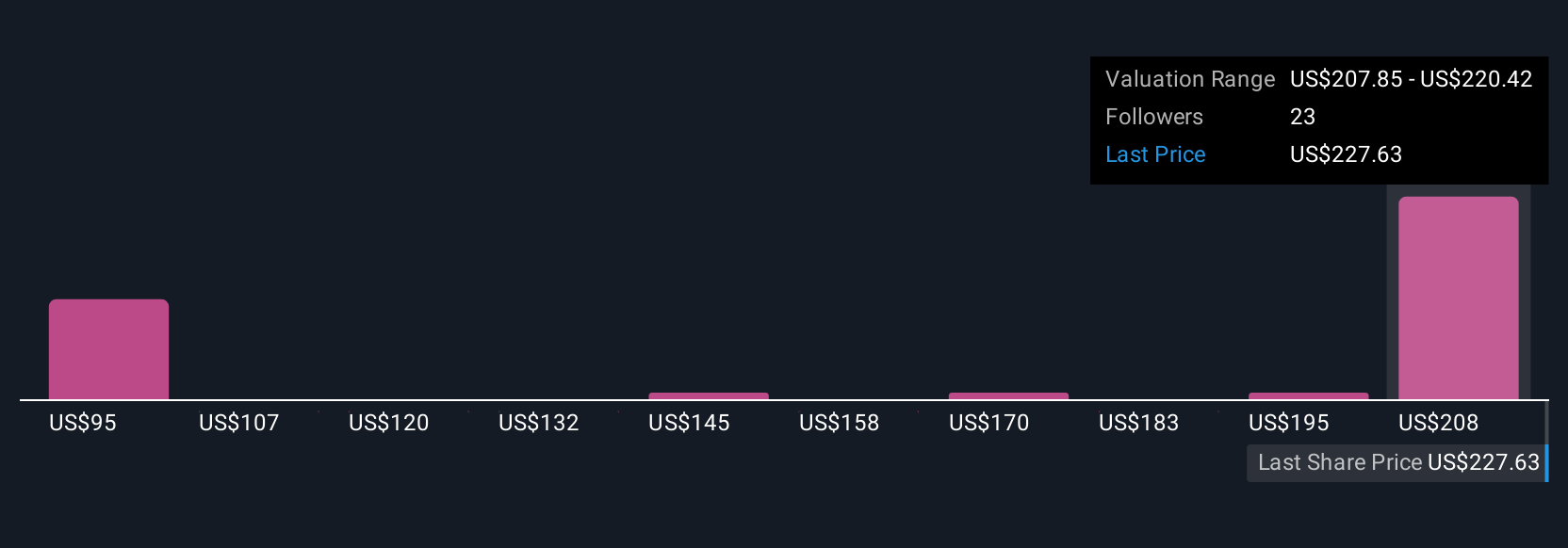

Upgrade Your Decision Making: Choose your DICK'S Sporting Goods Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives.

Narratives give you the chance to go beyond the numbers, letting you connect your personal view of DICK'S Sporting Goods—whether it will thrive or struggle—to a set of financial forecasts and a clear, data-driven fair value.

Think of a Narrative as your investment story brought to life. You outline what you believe about the company’s future, set your own assumptions for things like revenue growth or profit margins, and instantly see the fair value that flows from your expectations.

On Simply Wall St’s Community page (used by millions of investors), you can easily create, update, and browse Narratives for DICK'S or any company. This tool is widely accessible for investors of all experience levels.

Narratives help you decide whether to buy, hold, or sell by comparing your personalized fair value to the market price. They automatically refresh when new events such as earnings releases or big news change the outlook.

For example, some investors now see DICK'S Sporting Goods as worth as much as $280 per share, based on bets that health trends and digital innovation will drive strong growth, while others, concerned about execution risks, see value as low as $165 per share.

Do you think there's more to the story for DICK'S Sporting Goods? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DKS

DICK'S Sporting Goods

Operates as an omni-channel sporting goods retailer primarily in the United States.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives