Dillard's (DDS) Is Up 9.6% After Announcing $30 Special Dividend and Reaffirming Regular Payout

Reviewed by Sasha Jovanovic

- On November 20, 2025, Dillard’s announced a special dividend of US$30.00 per share and reaffirmed its regular quarterly dividend, both payable to shareholders in early 2026.

- This substantial special dividend highlights Dillard’s current approach to rewarding shareholders through cash payouts in addition to ongoing distributions.

- We’ll explore how Dillard’s sizable special dividend sharpens its investment narrative around shareholder returns and capital allocation priorities.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Dillard's Investment Narrative?

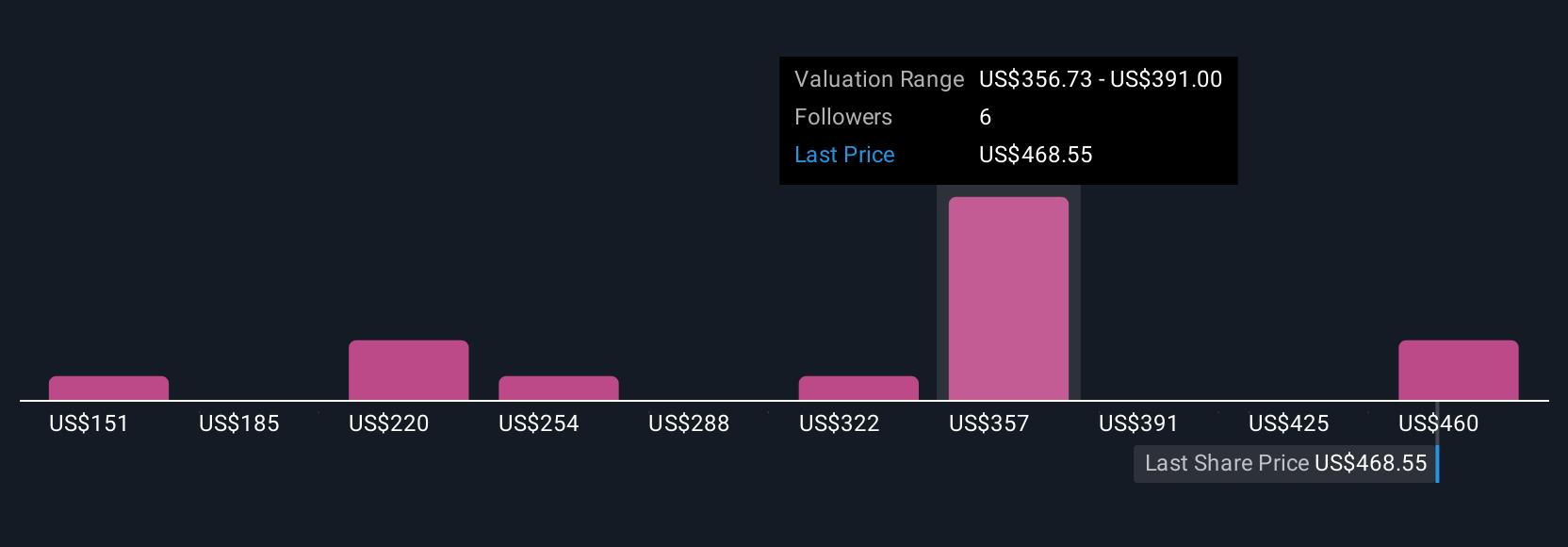

If you’re considering Dillard’s as a holding, the big-picture thesis hinges on its commitment to shareholder returns and prudent capital allocation, especially in an industry where growth is slow and the outlook for earnings is muted. The newly announced US$30.00 special dividend underscores management’s intention to directly return capital to shareholders, joining substantial buybacks and steady regular dividends as core components of the investment story. In the short term, this surprise cash payout could act as a catalyst for market attention and investor sentiment, but it may also shift focus from longer term strategic growth drivers to capital return, potentially reinforcing concerns over the company’s forecast decline in earnings and limited revenue growth. With analysts split between mixed long-term views and cautious ratings, this event might make the stock more attractive to income-focused investors, but the fundamental risks such as flat sales growth and industry pressures remain unchanged, and the equity’s valuation already trades at a premium to consensus fair value.

But behind the appealing special dividend, ongoing earnings decline is something investors should watch closely. Dillard's shares are on the way up, but they could be overextended by 26%. Uncover the fair value now.Exploring Other Perspectives

Explore 8 other fair value estimates on Dillard's - why the stock might be worth less than half the current price!

Build Your Own Dillard's Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dillard's research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dillard's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dillard's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DDS

Dillard's

Operates retail department stores in the southeastern, southwestern, and midwestern areas of the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.