- United States

- /

- Specialty Stores

- /

- NYSE:CVNA

Carvana (CVNA): Evaluating Valuation After Strong Q3 Earnings Growth and Investor Optimism

Reviewed by Simply Wall St

Carvana (CVNA) delivered a strong earnings report for the third quarter, with sales, revenue, and net income all rising sharply compared to last year. The results have caught the attention of investors.

See our latest analysis for Carvana.

Momentum is building for Carvana, with the stock up 63.8% year-to-date and total shareholder return of 32.5% over the past year. This reflects growing optimism after strong results and the new Stanford Athletics partnership. Over the longer term, the company's three-year total return of more than 3,100% underscores its status as one of the auto retail sector's most remarkable turnaround stories.

If this kind of comeback has you thinking about other fast movers, now's the perfect opportunity to broaden your scope and discover fast growing stocks with high insider ownership

But with the stock still trading below analyst price targets and the company’s streak of strong growth, investors may wonder if there is more upside, or if future gains are already reflected in the current price.

Most Popular Narrative: 22.9% Undervalued

Carvana's most popular narrative assigns a fair value of $423.90, well above the recent close of $326.88. This suggests the market is underestimating powerful long-term drivers that the consensus believes will propel future earnings.

"Ongoing advancements in Carvana's data-driven technology, including integration of AI for operational efficiency and customer-facing processes, enable continual process improvement, reducing per-unit costs and fueling net margin expansion. The company's scaled logistics and reconditioning infrastructure, bolstered by the integration of ADESA locations, is driving lower delivery and inbound transport costs; as utilization rises, these investments are expected to further enhance operating leverage, improving gross margins and profitability."

Want to know the bold forecasts that make this fair value possible? The narrative is built on a foundation of acceleration, one where record gains are not just possible but expected. There’s a high bar for revenue, margins, and profit growth, but the numbers behind that optimism are reserved for the curious. See what’s driving such a strong valuation call.

Result: Fair Value of $423.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising auto loan delinquencies and intensifying industry competition remain significant risks. These factors could disrupt Carvana’s strong momentum and market share gains.

Find out about the key risks to this Carvana narrative.

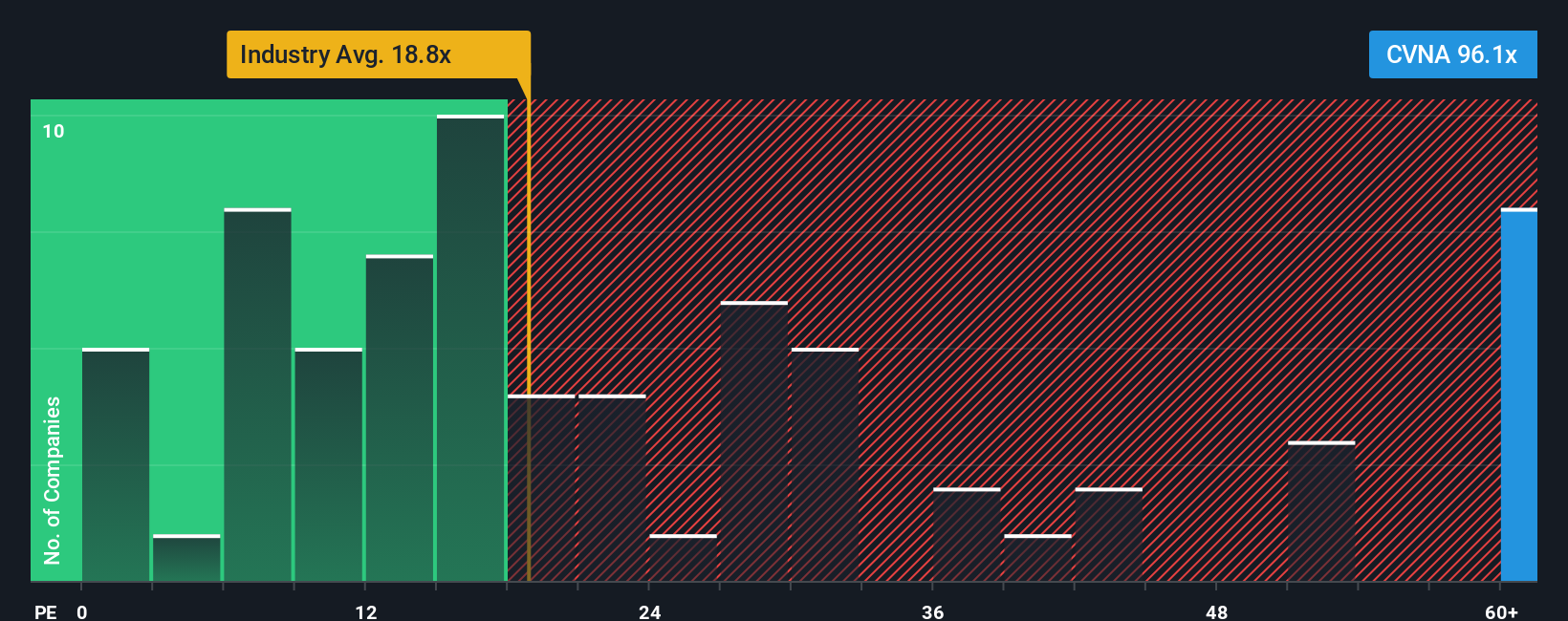

Another View: What Multiples Say About Carvana's Valuation

While the popular fair value narrative sees significant upside, a closer look at Carvana’s current price-to-earnings ratio of 73.5x tells a different story. This multiple is markedly higher than both the US Specialty Retail industry average of 18.3x and the peer group’s 19.4x. Even when compared to the estimated fair ratio of 37.7x, Carvana appears expensive by traditional standards. This suggests the market has already priced in aggressive future growth and raises the bar for what investors should expect.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Carvana Narrative

If you think the story goes deeper or want a fresh perspective based on your own research, it’s easy to craft a personalized view in just a few minutes. Do it your way

A great starting point for your Carvana research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Proven Investment Opportunities?

Take control of your portfolio and act now before other investors notice these rapidly emerging trends. Discover stocks worth your attention by considering these high-impact ideas:

- Supercharge your returns with these 872 undervalued stocks based on cash flows that are trading well below their intrinsic value and may offer future growth opportunities.

- Capture income potential by targeting these 15 dividend stocks with yields > 3% providing reliable yields above 3%, a useful consideration for building wealth and stability.

- Explore the AI trend and find tomorrow’s leaders using these 26 AI penny stocks positioned at the forefront of artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVNA

Carvana

Operates an e-commerce platform for buying and selling used cars in the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives