- United States

- /

- Specialty Stores

- /

- NYSE:CHWY

Chewy (CHWY): Evaluating Valuation in Light of Recent Momentum and Shifting Market Sentiment

Reviewed by Simply Wall St

Chewy (CHWY) shares moved higher today as the company’s stock responded to recent trading momentum and investor interest. This shift comes as the broader market weighs Chewy’s growth trends and profitability in relation to longer-term performance.

See our latest analysis for Chewy.

After some impressive momentum late last year, Chewy's recent 1-month share price return of -14.78% shows sentiment has cooled, even as the stock boasts a strong 12-month total shareholder return of 27.81%. The contrast between short-term price swings and its healthy full-year performance suggests that investors are reassessing both growth potential and risk in response to changing market dynamics.

If you're watching these shifts and want to spot other emerging stories, now is a perfect time to explore fast growing stocks with high insider ownership.

The real question for investors now is whether Chewy shares are trading at a discount given recent declines, or if the market has already factored in all expected growth and there is little room for upside from current levels.

Most Popular Narrative: 24.2% Undervalued

Chewy’s most closely-watched narrative sets fair value much higher than its last close, suggesting there is significant upside potential if expectations are realized.

Chewy’s strategic expansions, such as opening new Chewy Vet Care Clinics, are expected to further penetrate the $25 billion vet services market. This is likely to increase revenue and active customer engagement in 2025 and beyond.

Curious what is really powering this bullish target? The full narrative reveals bold growth bets and surprisingly ambitious profit assumptions that underpin Chewy’s current valuation case. See how future margins and expansion plans drive this estimate. Click in for the key numbers analysts are banking on.

Result: Fair Value of $45.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on Autoship for revenue and only modest customer growth could pose hurdles for Chewy’s promising long-term narrative.

Find out about the key risks to this Chewy narrative.

Another View: Multiples Tell a Different Story

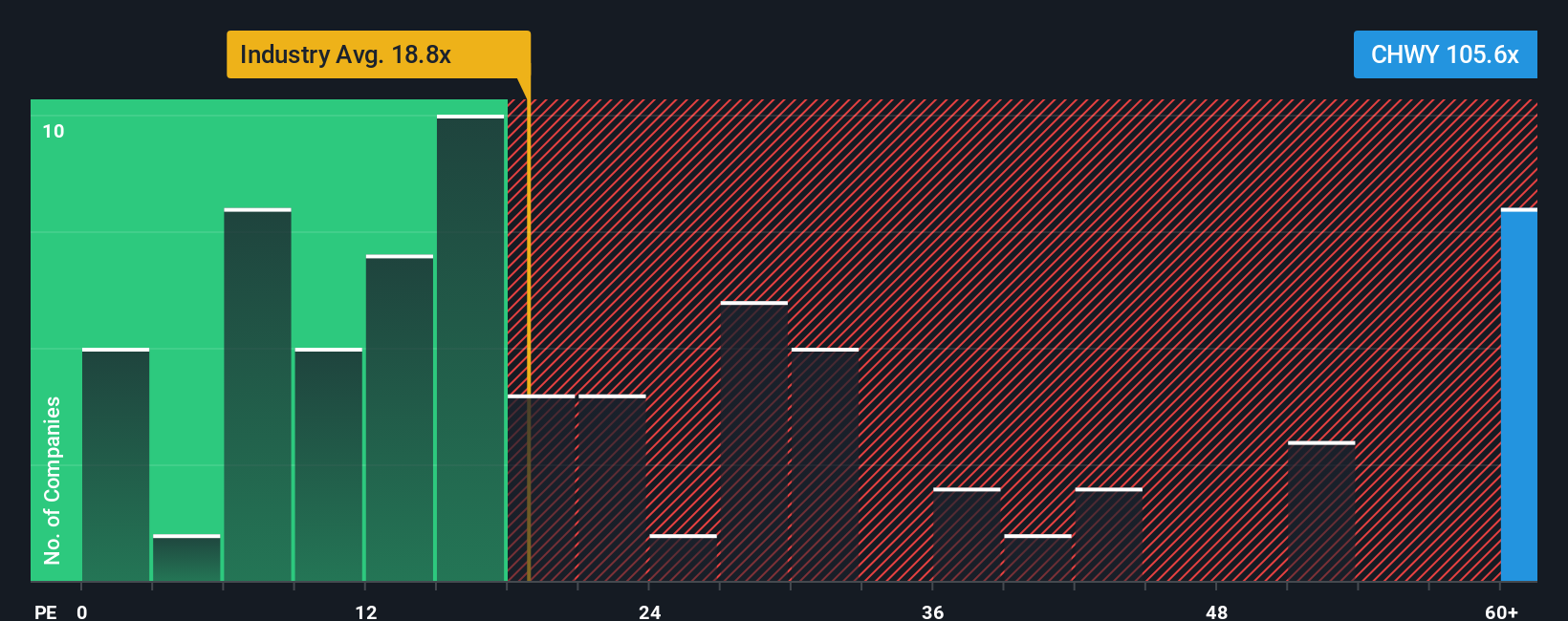

Looking at Chewy through the lens of its price-to-earnings ratio gives a starkly different conclusion. The company trades at a lofty 94.6 times earnings, which is far above the US Specialty Retail industry average of 16.5 and its peer average of 22.9. Even the fair ratio model suggests a ratio of just 28.8 could be justified. This kind of gap signals investors may be banking on sustained rapid growth, but also opens the door to greater risk if growth expectations fall short. Can such a premium really be sustained?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chewy Narrative

If these perspectives don't line up with your own, or you'd rather dig through the numbers yourself, you can shape your own view in just minutes. Do it your way.

A great starting point for your Chewy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize the chance to get ahead of upcoming market trends. Expand your watchlist beyond Chewy with three unique stock themes just waiting for you. Make every search count and never let a compelling opportunity pass you by.

- Tap into the booming AI revolution with these 26 AI penny stocks and see which companies could transform industries through machine learning and automation.

- Unlock serious income potential by starting with these 24 dividend stocks with yields > 3% offering attractive yields well above the market average.

- Uncover untapped future leaders as you check out these 831 undervalued stocks based on cash flows with stocks trading below their fair value based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHWY

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives