- United States

- /

- Specialty Stores

- /

- NYSE:BOOT

Boot Barn (BOOT) Hits 500 Stores Milestone Can Expansion Pace Sustain Its Brand Strength?

Reviewed by Sasha Jovanovic

- Boot Barn Holdings, Inc. recently marked the grand opening of its 500th store, celebrating this achievement with new locations across the country and a return to its original Huntington Beach, CA storefront, first opened in 1978.

- This expansion underscores Boot Barn's successful nationwide growth strategy and ongoing consumer demand for western and work wear in 49 states.

- We'll explore how Boot Barn's milestone 500th store enhances its investment narrative and signals strength in expansion execution.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Boot Barn Holdings Investment Narrative Recap

Shareholders in Boot Barn Holdings tend to believe in the company's ongoing ability to expand its nationwide footprint and continually draw demand for western and work wear. The recent 500th store milestone signals positive momentum, but it does not materially reduce the risk that rapid store expansion could lead to overextension or weaker returns in new markets, Boot Barn's most significant short-term challenge remains balancing growth with sustained store productivity and profitability.

Among several updates, Boot Barn's announcement of plans to open 65 to 70 new stores in fiscal 2026 stands out as particularly relevant to the 500th store milestone. This growth plan is closely tied to both the company's current expansion narrative and the importance of ensuring new locations perform well enough to avoid negative impacts on margins and return on capital.

However, be aware that despite these successes, there remains a real risk if aggressive expansion leads to...

Read the full narrative on Boot Barn Holdings (it's free!)

Boot Barn Holdings’ narrative projects $2.8 billion in revenue and $264.7 million in earnings by 2028. This requires 12.5% yearly revenue growth and a $69.3 million earnings increase from $195.4 million today.

Uncover how Boot Barn Holdings' forecasts yield a $227.31 fair value, a 17% upside to its current price.

Exploring Other Perspectives

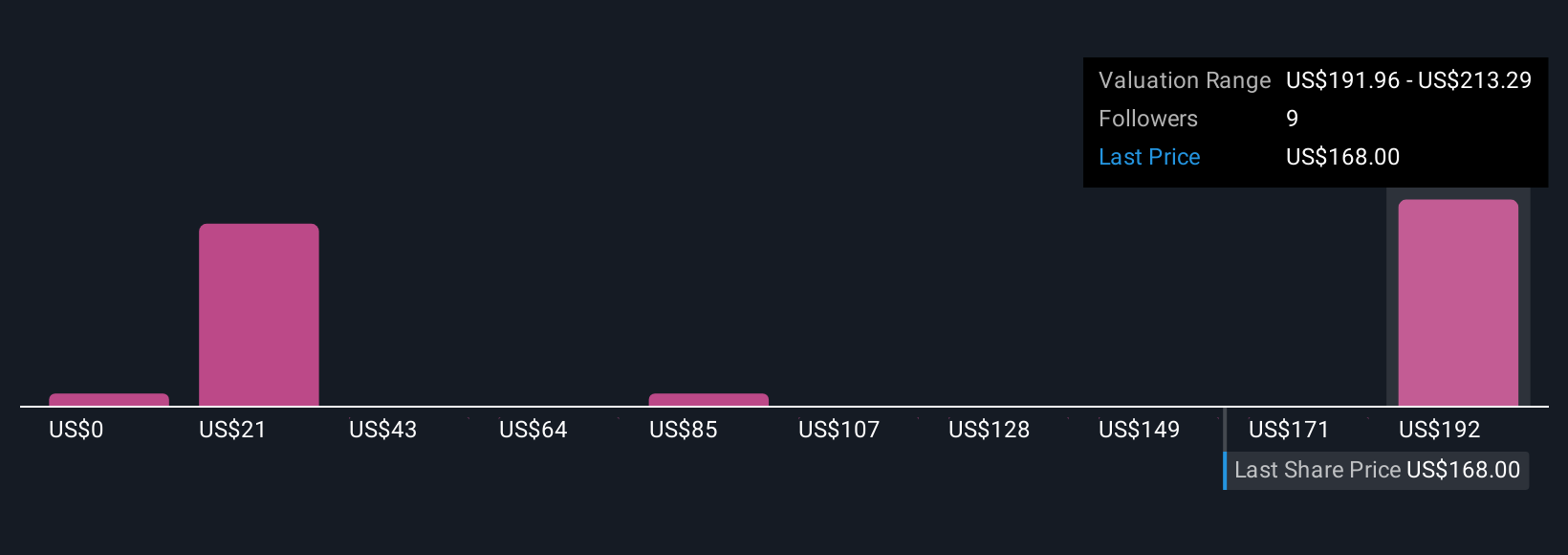

Fair value estimates from six Simply Wall St Community contributors range from US$22.73 to US$227.31 per share, reflecting vast differences in opinion. While some expect robust benefits from nationwide growth, others emphasize that overexpansion could pose long-term challenges for sustained profitability.

Explore 6 other fair value estimates on Boot Barn Holdings - why the stock might be worth as much as 17% more than the current price!

Build Your Own Boot Barn Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boot Barn Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Boot Barn Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boot Barn Holdings' overall financial health at a glance.

No Opportunity In Boot Barn Holdings?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boot Barn Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOOT

Boot Barn Holdings

Operates specialty retail stores in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026