- United States

- /

- Specialty Stores

- /

- NYSE:BOOT

Boot Barn (BOOT): Evaluating Valuation as Store Footprint Hits 500 and Expansion Plans Accelerate

Reviewed by Simply Wall St

Boot Barn Holdings (BOOT) just celebrated the opening of its 500th store, returning to its roots in Huntington Beach, California, while adding new locations nationwide. This milestone highlights the company’s expanding presence and steady execution of its growth plans.

See our latest analysis for Boot Barn Holdings.

Boot Barn’s recent grand opening celebrations have come as its share price continues to impress, with a year-to-date share price return of nearly 28% and a one-year total shareholder return of over 33%. The momentum behind both its store network and stock performance suggests investors are responding positively to the company’s accelerating footprint and growth strategy.

If expanding retailers pique your interest, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares trading near record highs and the business reporting robust double-digit growth, the real question for investors now is whether Boot Barn remains undervalued or if the market has already priced in future expansion and profitability. Investors may be considering if there is still an opportunity, or if the best chance has already passed.

Most Popular Narrative: 14.2% Undervalued

With Boot Barn Holdings closing at $195.12, the most popular narrative assigns a fair value of $227.31. This signals analysts see more upside potential based on the company’s growth and earnings trajectory.

Robust store expansion into underpenetrated markets, particularly in population-growing regions, is driving higher-than-expected new store performance, strong customer acquisition, and increased sales productivity. This expansion provides an ongoing tailwind for revenue and positions Boot Barn to benefit from broader demographic shifts, supporting long-term top-line growth.

Want to know the metrics that power this bullish projection? The analysts’ math hinges on aggressive future growth, ambitious profit margins, and a premium earnings multiple rarely seen outside top-tier growth stories. Think you can guess which big numbers justify this valuation? Click through and discover what’s behind the optimism. There’s more to the narrative than meets the eye.

Result: Fair Value of $227.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should note that aggressive expansion or sudden shifts in consumer demand could challenge Boot Barn’s impressive growth story going forward.

Find out about the key risks to this Boot Barn Holdings narrative.

Another View: Market Multiples Tell a Different Story

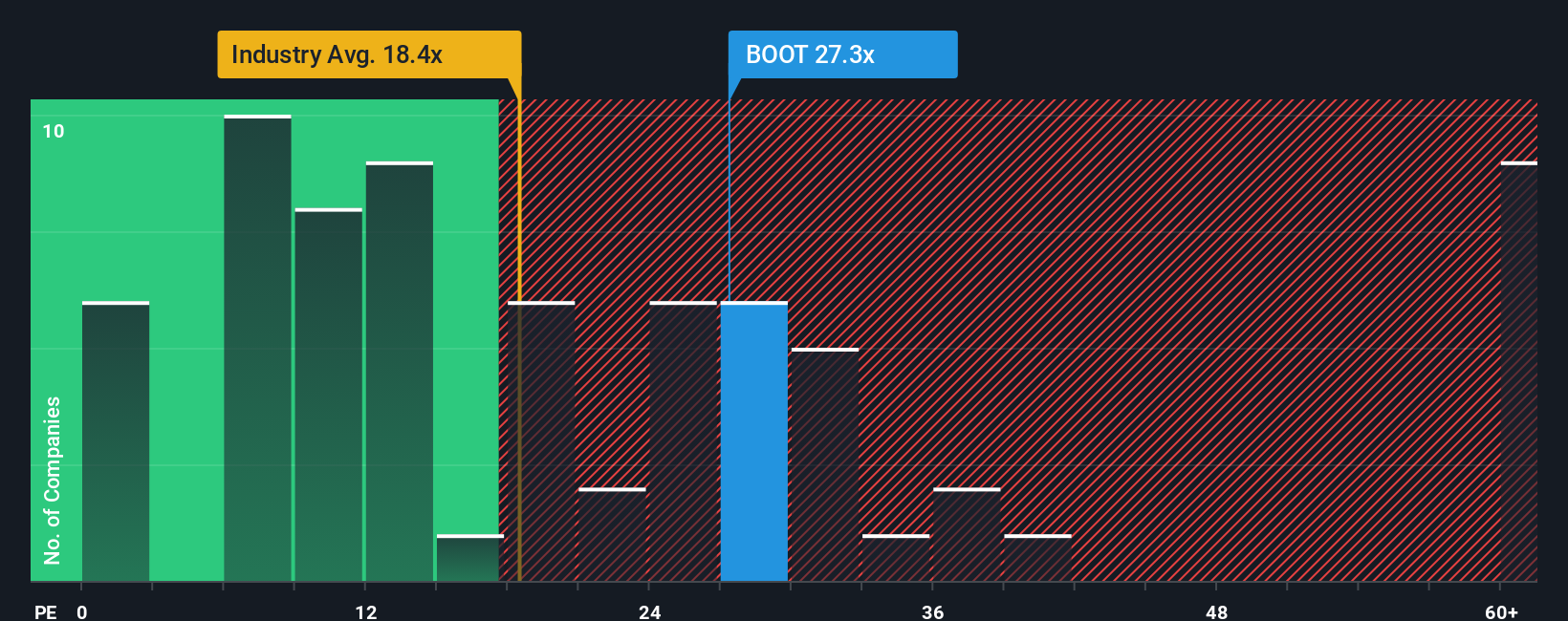

Looking at Boot Barn’s current price-to-earnings ratio of 28.6x, there is a sharp contrast with both the Specialty Retail industry average of 18x and the peer average of 13.5x. Even when compared to a fair ratio of 18.4x, Boot Barn appears richly valued, raising questions about its risk for a potential pullback.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boot Barn Holdings Narrative

If you have your own perspective or want to dig deeper into the numbers, you can put together your own narrative in just a few minutes. Do it your way

A great starting point for your Boot Barn Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Actionable Investment Ideas?

Unlock fresh opportunities and give your portfolio an edge. Don't let the best ideas pass you by. Check out these handpicked strategies and expand your horizons:

- Tap into the fast-growing world of artificial intelligence by reviewing these 25 AI penny stocks, which is packed with companies driving innovation in this booming sector.

- See which stocks are poised for long-term strength and real cash flow with our curated list of these 927 undervalued stocks based on cash flows.

- Maximize your income potential and peace of mind by targeting companies offering reliable payouts in these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boot Barn Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOOT

Boot Barn Holdings

Operates specialty retail stores in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026