- United States

- /

- Specialty Stores

- /

- NYSE:BBWI

Will BBWI’s New Leadership Mean a Shift in Brand Strategy or Business as Usual?

Reviewed by Sasha Jovanovic

- Bath & Body Works, Inc. recently declared a regular quarterly dividend of US$0.20 per share payable on December 5, 2025, to shareholders of record as of November 21, 2025, and announced the appointments of Maly Bernstein as Chief Commercial Officer and Samantha Charleston as Chief Human Resources Officer, both effective November 12, 2025.

- These significant leadership changes bring executives with considerable experience in brand evolution, omnichannel retail, and organizational transformation, potentially introducing new direction for the company at a critical stage of its business strategy.

- We'll examine how the addition of a new Chief Commercial Officer might alter Bath & Body Works' path toward long-term brand and digital growth.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Bath & Body Works Investment Narrative Recap

Owning Bath & Body Works stock hinges on believing the brand can reignite customer growth and achieve digital transformation, despite recent earnings and margin pressures. The fresh executive appointments, while positioning the company for potential change, do not immediately alter the urgent short-term need to attract new and younger consumers, or address persistent digital underperformance, both of which remain the central catalyst and risk right now. Among the announcements, the appointment of Maly Bernstein as Chief Commercial Officer is especially relevant, given her background in digital retail and omnichannel success, which aligns closely with the company’s ambition to reverse declines in the digital channel and broaden its consumer base. Yet, there are factors investors should be aware of that still cloud the outlook, particularly if...

Read the full narrative on Bath & Body Works (it's free!)

Bath & Body Works is projected to achieve $8.1 billion in revenue and $860.7 million in earnings by 2028. This outlook assumes annual revenue growth of 3.1% and an earnings increase of $132.7 million from the current $728.0 million.

Uncover how Bath & Body Works' forecasts yield a $37.77 fair value, a 72% upside to its current price.

Exploring Other Perspectives

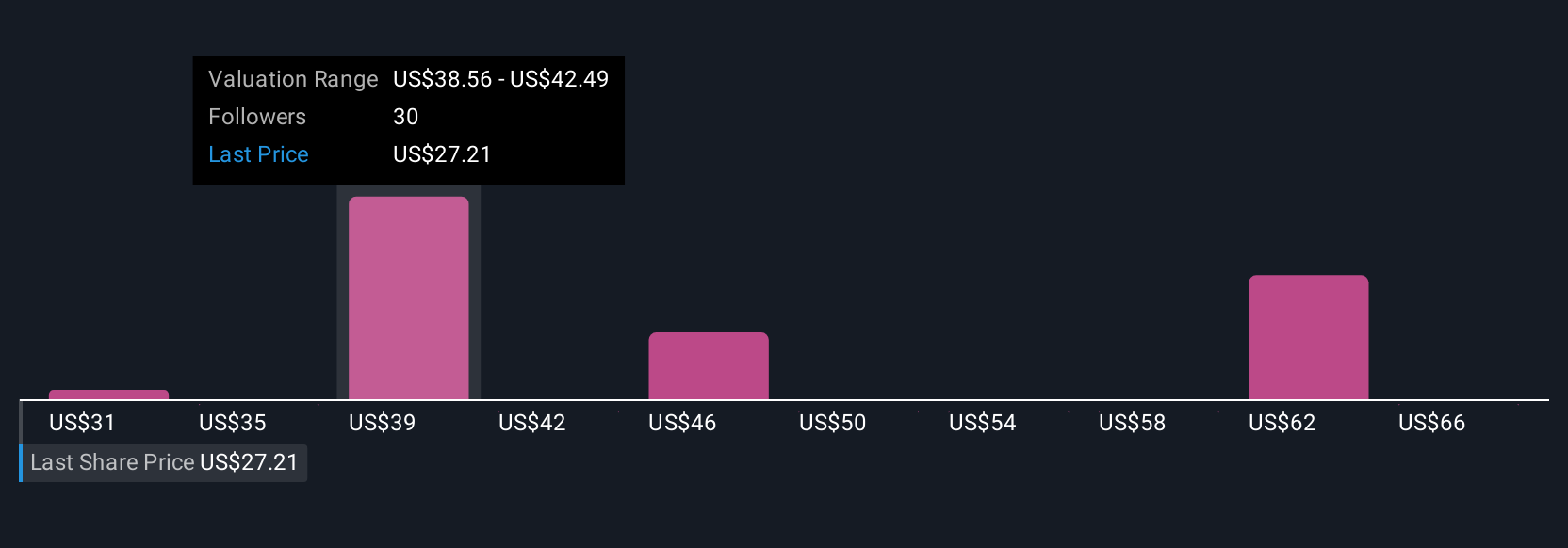

Simply Wall St Community members provided 9 fair value estimates on Bath & Body Works, ranging from US$30.70 to US$64.56 per share. While opinions span the full spectrum, sluggish new customer growth and digital challenges are prominent concerns for many, prompting varied outlooks on future performance.

Explore 9 other fair value estimates on Bath & Body Works - why the stock might be worth just $30.70!

Build Your Own Bath & Body Works Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bath & Body Works research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bath & Body Works research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bath & Body Works' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bath & Body Works might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBWI

Bath & Body Works

Operates as a specialty retailer of home fragrance, personal and body care, soaps, and sanitizer products.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives