- United States

- /

- Specialty Stores

- /

- NYSE:BBWI

Is Bath & Body Works’ (BBWI) Candle Day Discount Strategy Quietly Reshaping Its Margin Narrative?

Reviewed by Sasha Jovanovic

- Bath & Body Works’ 14th Annual Candle Day event ran from December 4–7, 2025, offering its three-wick candles at about US$10, the lowest price of the year across more than 180 scents, including limited-edition and new fragrances, both online and in stores.

- This concentrated promotional push, featuring exclusive drops and a wide assortment of seasonal favorites, highlights how Bath & Body Works uses event-based discounting to deepen customer engagement and boost holiday-period sales.

- We’ll now examine how this high-traffic, deeply discounted Candle Day promotion fits into Bath & Body Works’ investment narrative around promotions and margins.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Bath & Body Works Investment Narrative Recap

To own Bath & Body Works, you need to believe the brand can convert intense event traffic into profitable, repeat spending while stabilizing earnings after a weak year. Candle Day’s deep discounts and high volume may lift holiday sales, but the impact on the key near term issue of margin pressure from tariffs, promotions and rising SG&A looks limited rather than transformational in the short run.

The most relevant recent announcement is management’s November guidance cut, with 2025 sales now expected to decline slightly and EPS guided below 2024 levels. Against that backdrop, a heavily promoted Candle Day underscores the core tension in the story: using aggressive events to support demand while trying to protect gross margin and earnings.

Yet behind the excitement of Candle Day, investors should be aware of the risk that Bath & Body Works’ heavy reliance on promotions and seasonal events...

Read the full narrative on Bath & Body Works (it's free!)

Bath & Body Works' narrative projects $8.1 billion revenue and $860.7 million earnings by 2028.

Uncover how Bath & Body Works' forecasts yield a $23.82 fair value, a 27% upside to its current price.

Exploring Other Perspectives

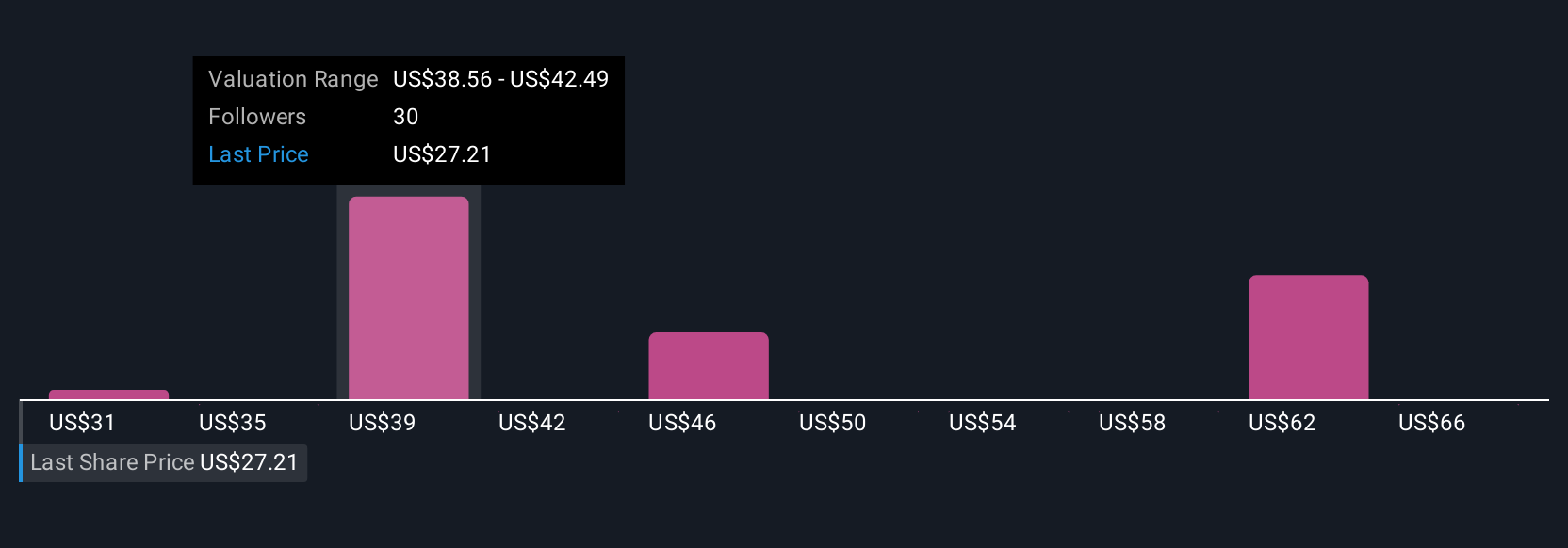

Ten members of the Simply Wall St Community value Bath & Body Works between US$23.82 and US$64.56, underlining how far opinions can stretch. When you set those views against guidance that now points to lower sales and earnings in 2025, it becomes even more important to understand how promotional intensity and cost pressures could shape the path back to more stable performance.

Explore 10 other fair value estimates on Bath & Body Works - why the stock might be worth over 3x more than the current price!

Build Your Own Bath & Body Works Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bath & Body Works research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bath & Body Works research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bath & Body Works' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bath & Body Works might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBWI

Bath & Body Works

Operates as a specialty retailer of home fragrance, personal and body care, soaps, and sanitizer products.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026