- United States

- /

- Specialty Stores

- /

- NYSE:AZO

AutoZone (AZO): Exploring Valuation After Goldman Sachs Upgrade and Positive DIY Market Momentum

Reviewed by Simply Wall St

AutoZone (AZO) is drawing fresh attention after Goldman Sachs upgraded the stock, citing the company’s scale advantages and steady gains in the do-it-yourself segment. Recent management remarks provided additional insight into ongoing growth trends.

See our latest analysis for AutoZone.

AutoZone’s share price has climbed steadily in 2024, rising more than 21% year-to-date, with a 1-year total shareholder return of 24%. This momentum is catching investors’ eyes, especially as recent upgrades and market share gains have reinforced confidence in the company’s long-term growth story.

If AutoZone’s strong run has you considering what else is gaining traction, this could be the ideal moment to check out See the full list for free.

With shares at record highs and analysts divided, the key question now is whether AutoZone remains undervalued or if the stock’s strong momentum has already captured all those future growth prospects, potentially leaving little room for further upside.

Most Popular Narrative: 13.8% Undervalued

AutoZone’s most widely followed narrative places fair value at $4,579, which is over $600 above the recent closing price. This positioning reflects optimism about the company’s ability to overcome temporary margin pressures and realize long-term growth through expansion and operational efficiency.

The expansion of Mega-Hub locations, with an aim to open at least 19 more in the next two quarters, will enhance inventory availability and support both retail and Commercial growth, potentially improving sales and operating margins.

Curious why analysts ascribe such a premium? One bold strategy influences both top and bottom lines, but it hinges on a critical, quantifiable growth lever. What’s the standout variable driving this value? The answer may surprise you. See which financial forecast underpins this bullish projection.

Result: Fair Value of $4,579 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressures from inflation and tariffs, along with potential volatility in consumer demand, could quickly shift the outlook for AutoZone’s stock.

Find out about the key risks to this AutoZone narrative.

Another View: SWS DCF Model Tells a Different Story

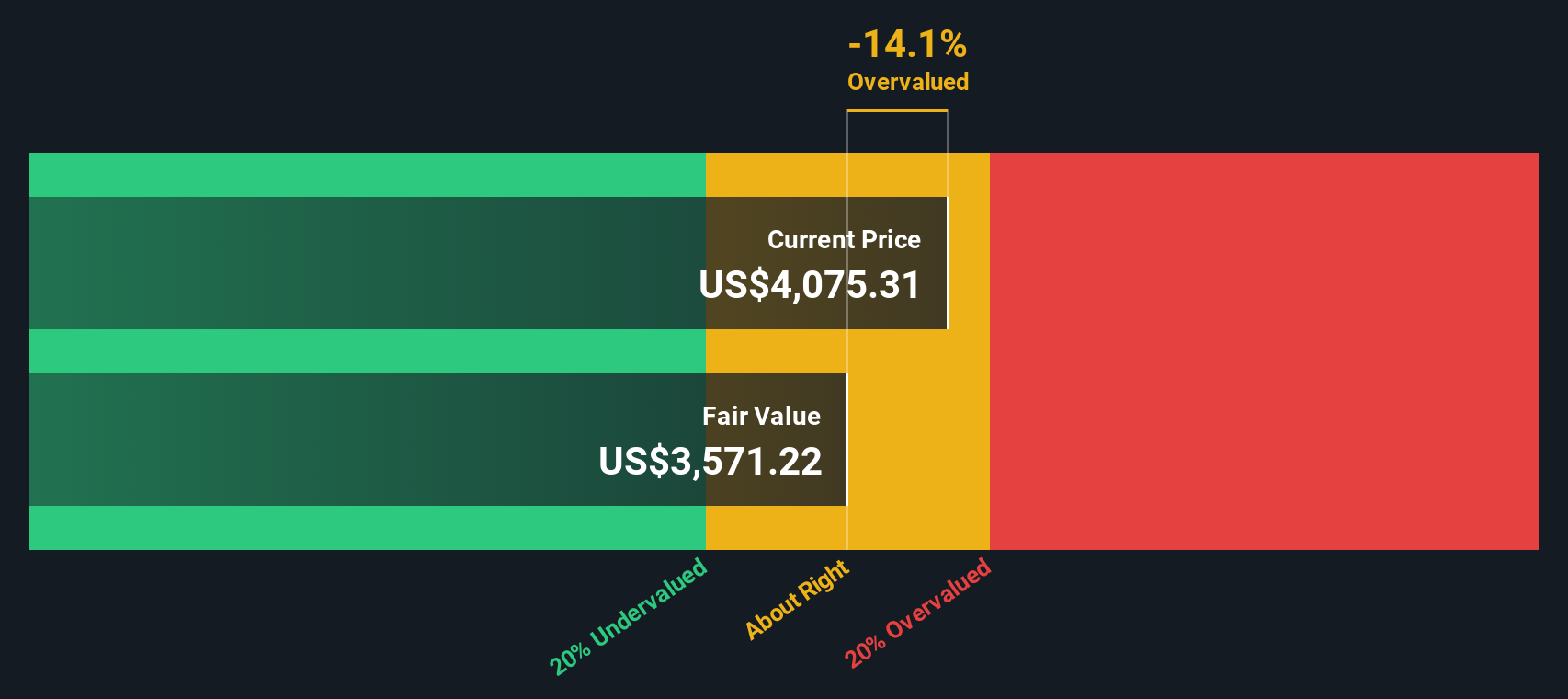

While analysts see AutoZone as undervalued, our SWS DCF model offers a contrasting perspective. It suggests the stock’s current price of $3,946.99 is above the estimated fair value of $3,281.03. This indicates AutoZone may be overvalued if projected future cash flows are weighed more heavily than earnings multiples. Which approach should investors trust when deciding whether to buy in or wait?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AutoZone for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 930 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AutoZone Narrative

If you have a different perspective or want to see how your analysis compares, you can spend just a few minutes reviewing the numbers yourself and form your own view. Do it your way

A great starting point for your AutoZone research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Great opportunities do not last forever. Be the investor who uncovers them first. Amplify your portfolio by acting now and tapping into these expertly curated stock ideas below.

- Enhance your returns by tapping into steady cash flow with these 14 dividend stocks with yields > 3% offering attractive yields above 3%.

- Capitalize on future growth by targeting these 25 AI penny stocks that are reshaping industries with artificial intelligence breakthroughs.

- Build your edge through deep value with these 930 undervalued stocks based on cash flows capturing stocks trading below their intrinsic worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AZO

AutoZone

Operates as a retailer and distributor of automotive replacement parts and accessories in the United States, Mexico, and Brazil.

Limited growth with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026