- United States

- /

- Specialty Stores

- /

- NYSE:ANF

Why Abercrombie & Fitch (ANF) Is Up 40.1% After Surpassing Q3 Forecasts and Raising Guidance

Reviewed by Sasha Jovanovic

- Earlier this week, Abercrombie & Fitch reported third-quarter earnings surpassing analyst expectations, with US$1.29 billion in sales as its Hollister brand continued to outperform, and the company raised its full-year net sales and profit guidance.

- An interesting highlight is the company's ongoing share repurchase program, completing buybacks totaling over US$351 million since March, alongside ambitious holiday promotions and new retail partnerships such as Abercrombie Kids at Macy’s and an NFL collection.

- We'll now explore how these stronger earnings and heightened sales outlook could reshape Abercrombie & Fitch's investment narrative this quarter.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Abercrombie & Fitch Investment Narrative Recap

To see value in Abercrombie & Fitch today, investors need confidence in its ability to sustain brand momentum and margin resilience despite sector volatility and lingering tariff headwinds. The recent quarterly results and raised guidance reinforce US$ sales and margin growth as the key short-term catalysts; however, persisting cost pressures from tariffs remain a material risk for operating performance over the coming year.

The most relevant announcement to these catalysts is the completion of US$351 million in share buybacks since March 2025, which could further enhance earnings per share and support shareholder value. Yet, these shareholder returns come at a time when international market softness and rising tariffs may still test the durability of the company’s performance.

But while recent momentum captures attention, investors should be aware that rising tariff costs and lagging margin mitigation strategies could still affect...

Read the full narrative on Abercrombie & Fitch (it's free!)

Abercrombie & Fitch's narrative projects $5.8 billion in revenue and $489.4 million in earnings by 2028. This requires 4.3% yearly revenue growth and a $51.6 million decrease in earnings from the current $541.0 million.

Uncover how Abercrombie & Fitch's forecasts yield a $100.89 fair value, a 3% upside to its current price.

Exploring Other Perspectives

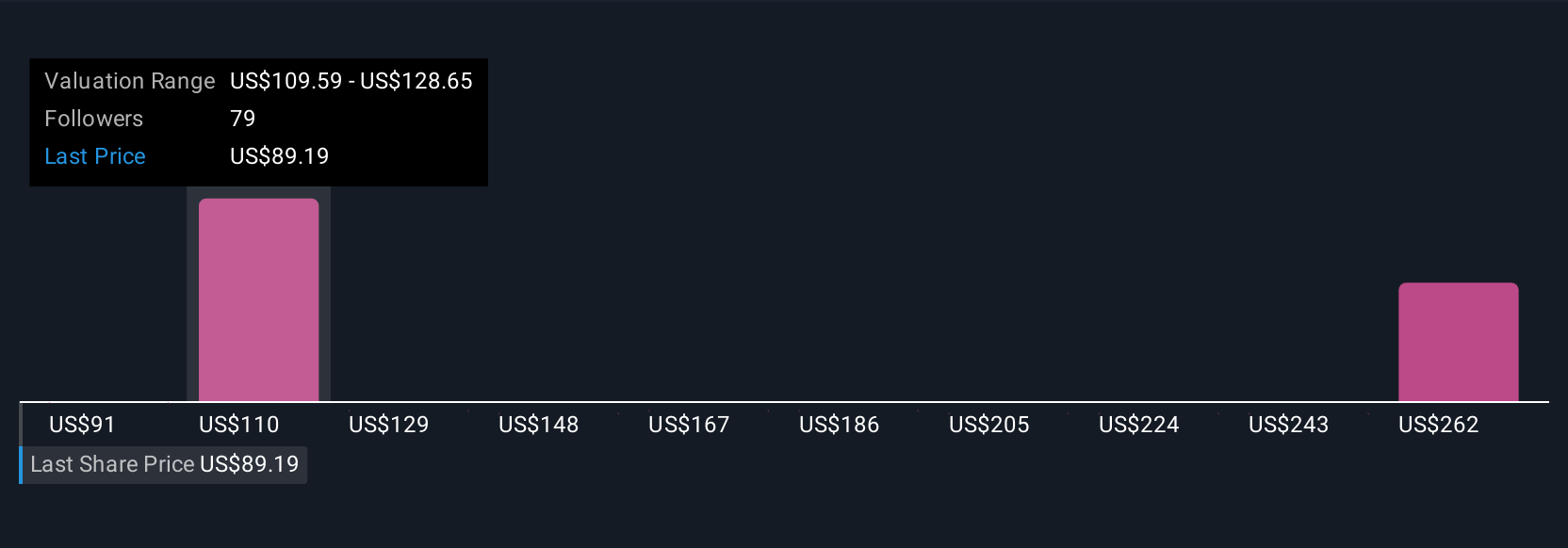

Thirteen members of the Simply Wall St Community set fair value estimates for Abercrombie & Fitch from US$84 to US$145.75 per share, highlighting a broad spread of outlooks. Against this backdrop, persistent tariff headwinds could challenge the company’s ability to maintain margins, underlining why performance expectations remain a point of debate among market participants.

Explore 13 other fair value estimates on Abercrombie & Fitch - why the stock might be worth 14% less than the current price!

Build Your Own Abercrombie & Fitch Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Abercrombie & Fitch research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Abercrombie & Fitch research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Abercrombie & Fitch's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANF

Abercrombie & Fitch

Through its subsidiaries, operates as an omnichannel retailer in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.