- United States

- /

- Specialty Stores

- /

- NYSE:ANF

Is Abercrombie & Fitch Still Attractive After a 38% Surge and DCF Fair Value Signal?

Reviewed by Bailey Pemberton

- If you are wondering whether Abercrombie & Fitch at around $100 a share is still a smart buy or already priced for perfection, you are not alone. That is exactly what we are going to unpack.

- The stock has jumped about 11% in the last week and 38% over the past month, even though it is still down roughly 35% over the last year. This mix hints at shifting market expectations and a reset in risk perception after a huge multi year run.

- Recent headlines have focused on Abercrombie & Fitch successfully leaning into a brand turnaround, expanding its online and international presence, and refreshing product lines that resonate more with its target demographic. Those narrative shifts help explain why investors have been quicker to buy the recent dip and could be rethinking what the business is worth today.

- On our checks, Abercrombie & Fitch scores a 4/6 valuation score, suggesting it looks undervalued on several yardsticks but not all. Next we will walk through those methods before exploring an even better way to judge what the market might be missing.

Find out why Abercrombie & Fitch's -35.4% return over the last year is lagging behind its peers.

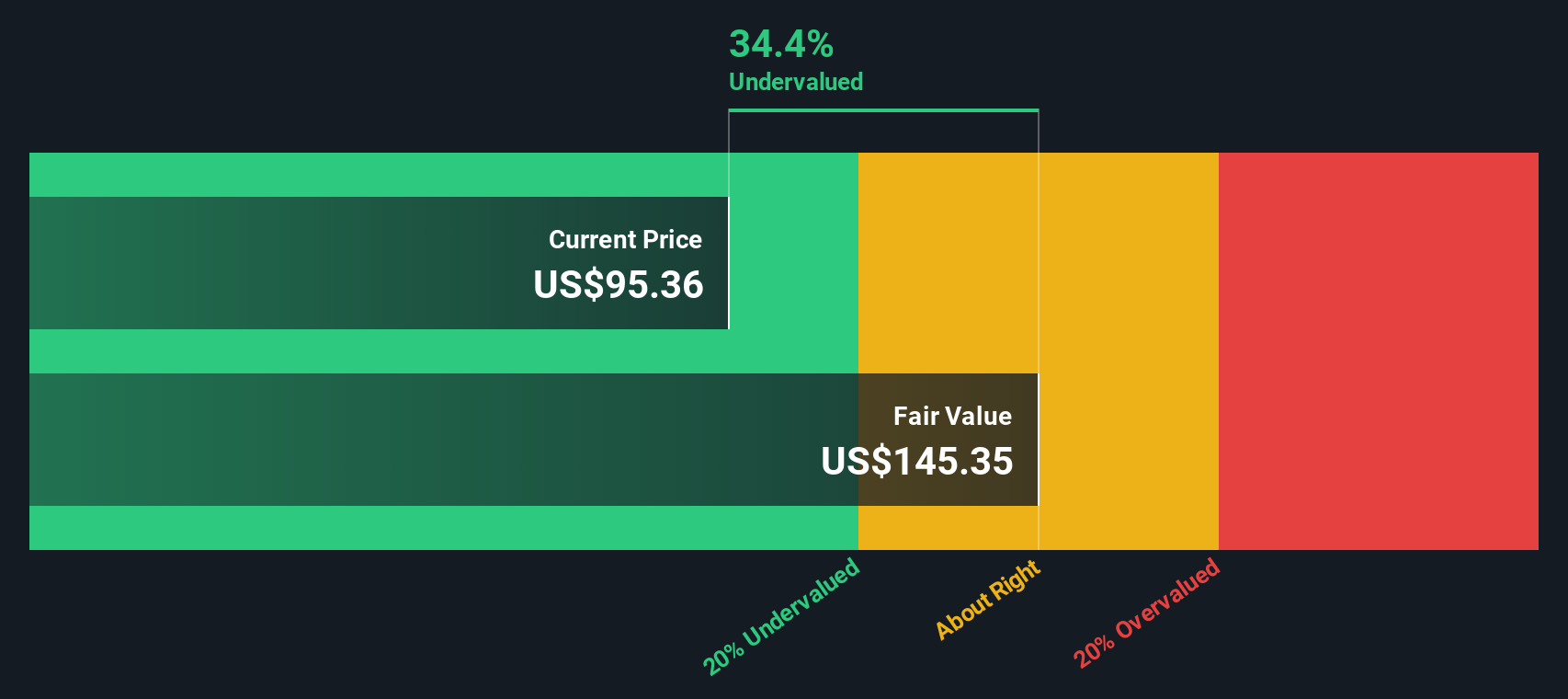

Approach 1: Abercrombie & Fitch Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by extrapolating its future cash flow projections and discounting them back to the present.

For Abercrombie & Fitch, the latest twelve month Free Cash Flow stands at about $410 million. Analysts expect cash flows to stay robust, with projections such as roughly $434 million in 2026 and $481 million in 2027, before moderating to about $329 million by 2028. Beyond these analyst years, Simply Wall St extends the forecast out to 2035 using a 2 stage Free Cash Flow to Equity approach, gradually tapering growth as the business matures.

When all those future cash flows are discounted back to today, the model arrives at an intrinsic value of around $102.39 per share. Compared with the current share price near $100, the stock screens as about 2.2% undervalued, which is a very small gap.

Result: ABOUT RIGHT

Abercrombie & Fitch is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

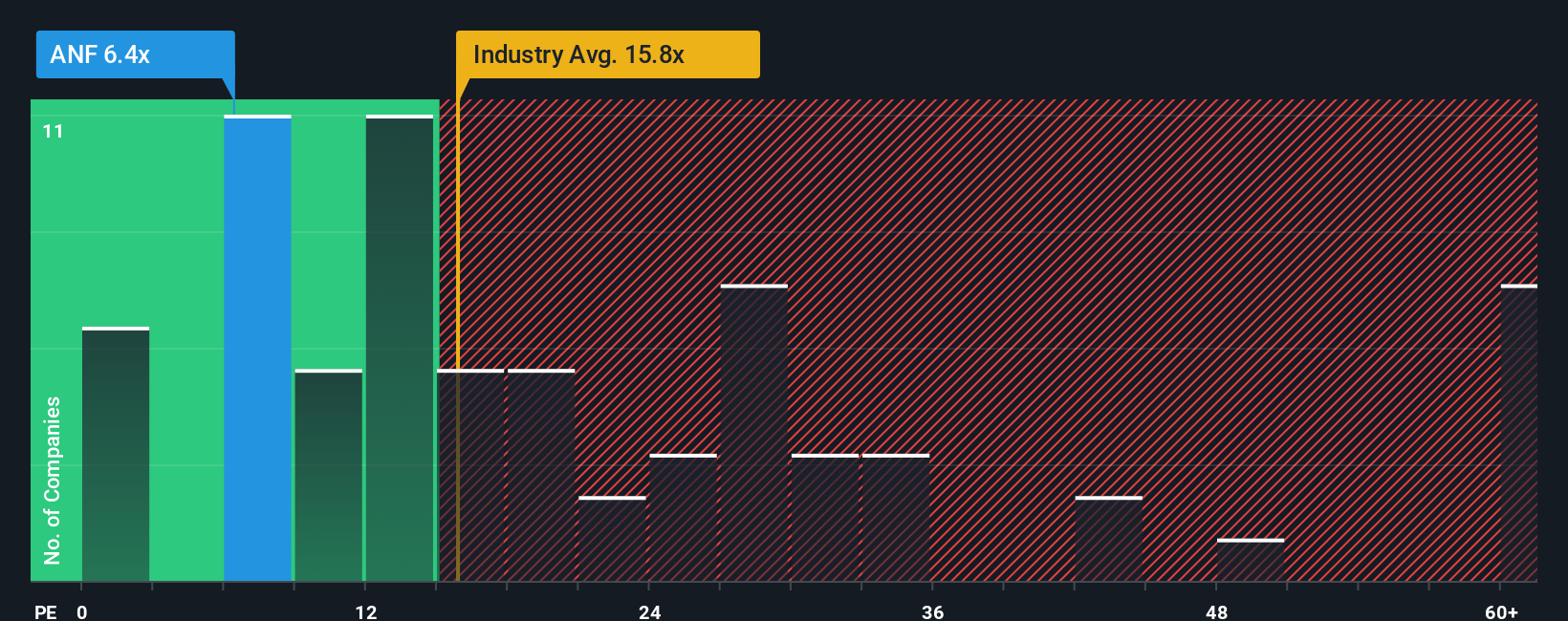

Approach 2: Abercrombie & Fitch Price vs Earnings

For profitable companies like Abercrombie & Fitch, the Price to Earnings ratio is a useful way to judge value because it directly relates what investors pay to the profits the business is already generating. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or higher risk should result in a lower, more cautious multiple.

Abercrombie & Fitch currently trades on roughly 9.0x earnings, which is well below both the Specialty Retail industry average of about 18.1x and a broader peer group closer to 20.7x. Simply Wall St also calculates a Fair Ratio of around 13.7x, which represents the PE you might expect based on Abercrombie & Fitch’s earnings growth profile, margins, size and risk characteristics.

This Fair Ratio is more tailored than a simple comparison with peers because it adjusts for the company’s own growth outlook, profitability, business quality and industry position rather than assuming all retailers deserve the same multiple. Comparing the current 9.0x PE to the 13.7x Fair Ratio suggests the shares trade at a notable discount to what those fundamentals might warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

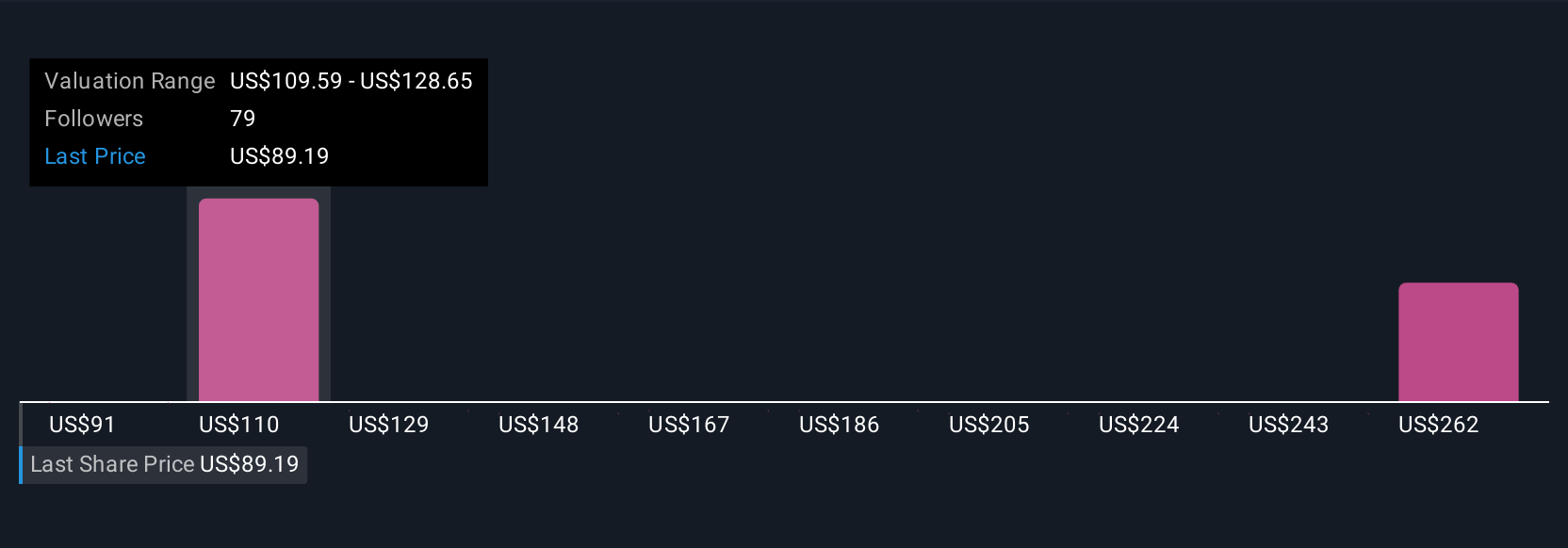

Upgrade Your Decision Making: Choose your Abercrombie & Fitch Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Abercrombie & Fitch’s future with concrete numbers. Narratives turn your story about its growth, margins and risks into a financial forecast, link that forecast to a fair value, and then compare that fair value with today’s price to help you decide whether to buy, hold or sell. All of this happens inside an easy to use tool on Simply Wall St’s Community page that millions of investors already use. Each Narrative automatically updates as new news or earnings arrive. For example, one investor might build a bullish Abercrombie & Fitch Narrative around accelerating international expansion, NFL partnerships and resilient margins that supports a fair value closer to the high end of current targets. Another might focus on tariffs, softer Europe demand and margin pressure and land nearer the low end. This gives you a clear, dynamic range of reasoned perspectives to benchmark your own decisions against.

Do you think there's more to the story for Abercrombie & Fitch? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANF

Abercrombie & Fitch

Through its subsidiaries, operates as an omnichannel retailer in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026