- United States

- /

- Specialty Stores

- /

- NYSE:AAP

Advance Auto Parts (AAP): Evaluating Valuation Following Raised Full-Year Sales Guidance and Q3 Results

Reviewed by Simply Wall St

Advance Auto Parts (AAP) raised its full-year net sales guidance along with its third quarter earnings, signaling greater confidence in the company's outlook. This move often attracts investor attention since it suggests improved business momentum.

See our latest analysis for Advance Auto Parts.

Alongside the raised sales outlook, Advance Auto Parts declared another quarterly dividend and announced a board-level retirement, keeping corporate news flow steady this quarter. As investor sentiment responded to these updates, the share price notched a 4.85% gain over the last week and reversed some of its recent downward trend. While year-to-date performance is positive and the one-year total shareholder return stands at an impressive 27.46%, long-term returns remain deeply negative, with a three-year total shareholder return of -64.91%. There are signs that momentum is tentatively building, though the bigger picture still demands caution.

If news like this makes you curious about what else is happening in the automotive space, now could be the perfect time to broaden your search and discover See the full list for free.

With shares rebounding and guidance ticking higher, the real question now is whether Advance Auto Parts is trading below its true value or if the market has already priced in any potential gains from future growth.

Most Popular Narrative: 4.1% Undervalued

With Advance Auto Parts closing at $51.02, the most widely followed narrative places fair value at $53.20, just above the last market price. This modest gap suggests that optimism about operational improvements is driving slightly higher expectations ahead of 2028.

"Advance Auto Parts is executing a 3-year strategic plan focused on improving profitability. Initiatives such as optimizing its asset base and divesting noncore operations are expected to deliver adjusted operating margins of approximately 7% by 2027, which could enhance net margins and earnings."

Want to know why market watchers think margins could surge, even as sales only crawl forward? This narrative hinges on bold cost cuts, margin gains, and a new outlook for sustainable earnings. Numbers the bulls are betting will drive a turnaround. Find out which future projections set the stage for this price target.

Result: Fair Value of $53.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, short-term store closure costs and weaker-than-expected early 2025 sales could still unsettle analyst expectations if these trends persist.

Find out about the key risks to this Advance Auto Parts narrative.

Another View: What If the Market Is Ahead of Itself?

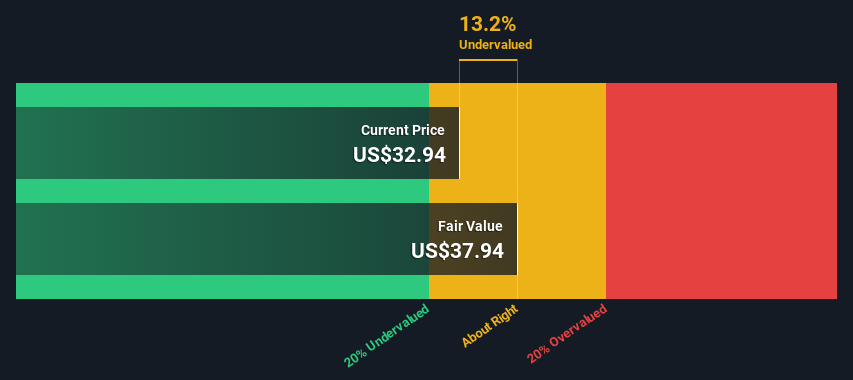

While analyst consensus points to a slight undervaluation, our DCF model comes to a starkly different conclusion. It indicates Advance Auto Parts shares could be significantly overvalued at current prices. When two methods disagree, it raises the question of which fundamentals will matter most in the months ahead.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Advance Auto Parts Narrative

If you see the story differently or want to dig through the numbers on your own terms, you can easily shape your own outlook in just a few minutes, your way. Do it your way

A great starting point for your Advance Auto Parts research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Now is the time to expand your investing universe. Miss out and you might overlook opportunities packed with growth, value, or breakthrough potential.

- Accelerate your search for overlooked bargains with the latest picks in these 865 undervalued stocks based on cash flows. This gives you a head start on value others might miss.

- Capture the yield advantage by exploring these 14 dividend stocks with yields > 3%, which consistently deliver strong returns for income-minded investors.

- Jump into the frontier of technology by reviewing these 25 AI penny stocks. These companies are leading advancements in artificial intelligence and reshaping whole industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AAP

Advance Auto Parts

Engages in the provision of automotive aftermarket parts in the United States and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives