- United States

- /

- Specialty Stores

- /

- NasdaqGS:WOOF

Petco Health and Wellness Company, Inc. (NASDAQ:WOOF) Shares May Have Slumped 26% But Getting In Cheap Is Still Unlikely

Petco Health and Wellness Company, Inc. (NASDAQ:WOOF) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 28% share price drop.

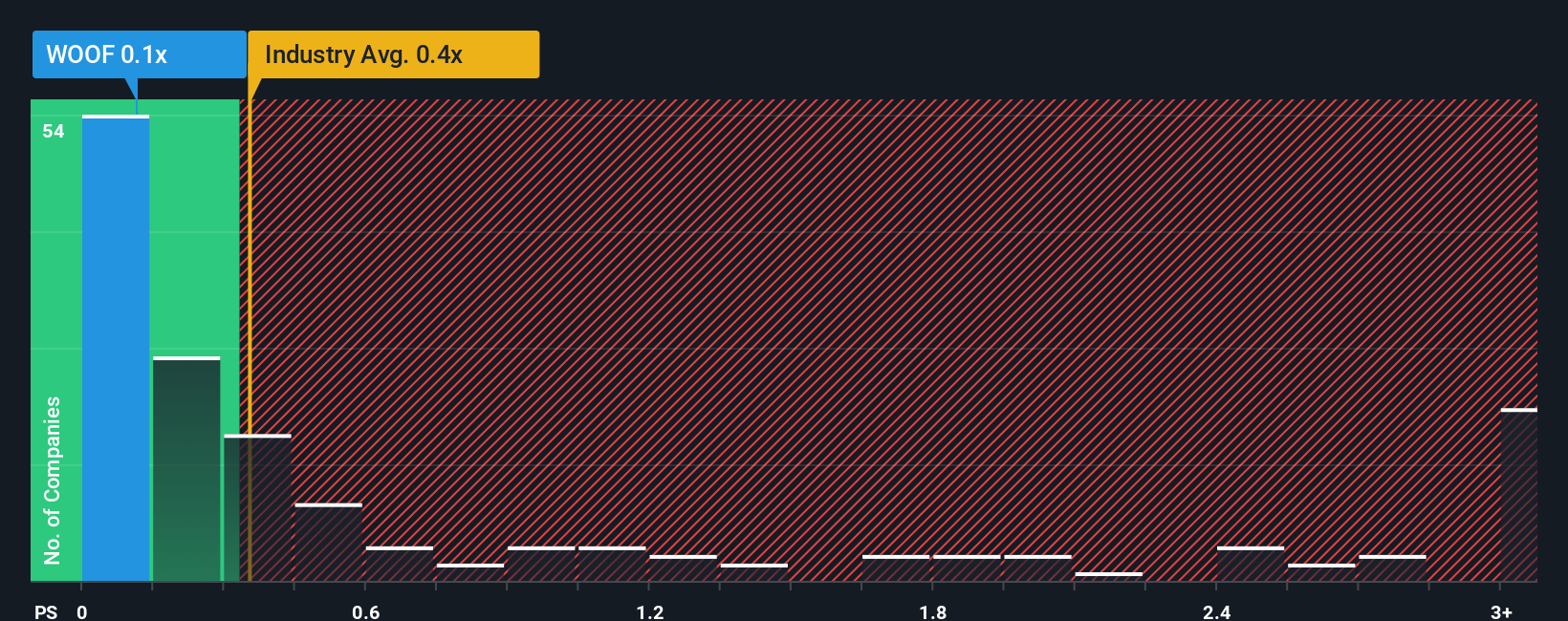

Even after such a large drop in price, there still wouldn't be many who think Petco Health and Wellness Company's price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S in the United States' Specialty Retail industry is similar at about 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Petco Health and Wellness Company

How Has Petco Health and Wellness Company Performed Recently?

While the industry has experienced revenue growth lately, Petco Health and Wellness Company's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Petco Health and Wellness Company's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Petco Health and Wellness Company's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 2.4% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to climb by 0.6% per year during the coming three years according to the twelve analysts following the company. With the industry predicted to deliver 6.0% growth per annum, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Petco Health and Wellness Company's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Following Petco Health and Wellness Company's share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

When you consider that Petco Health and Wellness Company's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

It is also worth noting that we have found 1 warning sign for Petco Health and Wellness Company that you need to take into consideration.

If you're unsure about the strength of Petco Health and Wellness Company's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:WOOF

Petco Health and Wellness Company

Operates as a health and wellness company, focuses on enhancing the lives of pets, pet parents, and its Petco partners in the United States, Mexico, and Puerto Rico.

Fair value with moderate growth potential.

Market Insights

Community Narratives