- United States

- /

- Specialty Stores

- /

- NasdaqGS:UPBD

Can Upbound Group’s (UPBD) CFO Transition Offset Mixed Profit Trends in Its Evolving Strategy?

Reviewed by Sasha Jovanovic

- Upbound Group recently reported its third quarter 2025 earnings, revealing year-over-year growth in both sales and total revenue, but a decline in net income and earnings per share.

- Along with its results, the company announced Hal Khouri will become Chief Financial Officer effective November 10, 2025, bringing decades of financial leadership experience to oversee Upbound's financial operations and business strategy.

- We'll now explore how the incoming CFO, alongside mixed third quarter results, may shape Upbound Group's evolving investment outlook.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Upbound Group Investment Narrative Recap

To be a shareholder in Upbound Group, one needs to believe in the company's ability to grow its lease-to-own business and execute on new credit offerings, despite a challenging competitive environment and ongoing regulatory scrutiny. The recent announcement of a new CFO, Hal Khouri, is unlikely to materially alter the immediate catalyst, merchants and customer growth in Acima, and the biggest risk, which remains the risk of regulatory or legal setbacks impacting margins.

Among the recent developments, the appointment of Chief Growth Officer Rebecca Wooters stands out, with her oversight of marketing, data analytics, and customer experience expected to play an important role alongside the new CFO as Upbound focuses on driving merchant and technology-driven growth. This supports the main catalyst around expanding financial access and improving digital platforms while navigating short-term earnings pressure.

However, investors should be cautious, as contrasting with new leadership and growth initiatives, the ongoing legal challenges represent potential headwinds that investors should be aware of, especially if...

Read the full narrative on Upbound Group (it's free!)

Upbound Group's narrative projects $4.8 billion revenue and $278.5 million earnings by 2028. This requires 3.9% yearly revenue growth and a $197.3 million earnings increase from $81.2 million today.

Uncover how Upbound Group's forecasts yield a $32.38 fair value, a 63% upside to its current price.

Exploring Other Perspectives

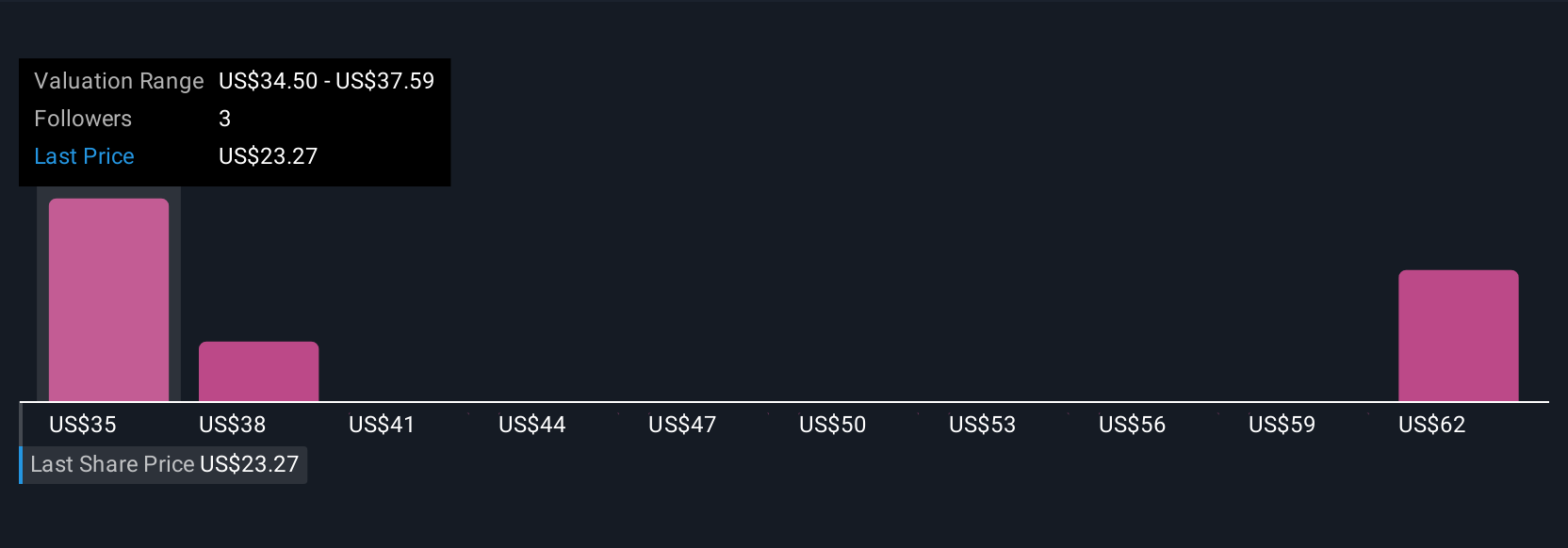

Four fair value estimates from the Simply Wall St Community range from US$31.38 up to US$59.77 per share. While there is clear divergence in these retail investor forecasts, keep in mind that legal challenges such as the lawsuit involving Acima could create additional uncertainty for future performance, so it pays to consider a variety of viewpoints before forming your own opinion.

Explore 4 other fair value estimates on Upbound Group - why the stock might be worth over 3x more than the current price!

Build Your Own Upbound Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Upbound Group research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Upbound Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Upbound Group's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPBD

Upbound Group

Upbound Group, Inc. leases household durable goods to customers on a lease-to-own basis in the United States, Puerto Rico, and Mexico.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives