- United States

- /

- Specialty Stores

- /

- NasdaqGS:TSCO

Does Tractor Supply’s Expansion Signal a Fair Price After Recent Stock Fluctuations?

Reviewed by Bailey Pemberton

- Wondering if Tractor Supply stock is a bargain or just another story in the market? You are not alone, and we are about to dig into what truly drives its value.

- Shares have climbed by 2.4% year-to-date, even as they've slipped 1.4% in the past week and 0.8% over the last month. These moves hint at shifting sentiment around growth and risk.

- News this month has spotlighted Tractor Supply's ongoing expansion plans and rising input costs. This has fueled investor debate over long-term profitability. With analysts and business media citing its rural market strength alongside economic headwinds, context for those price moves is coming into focus.

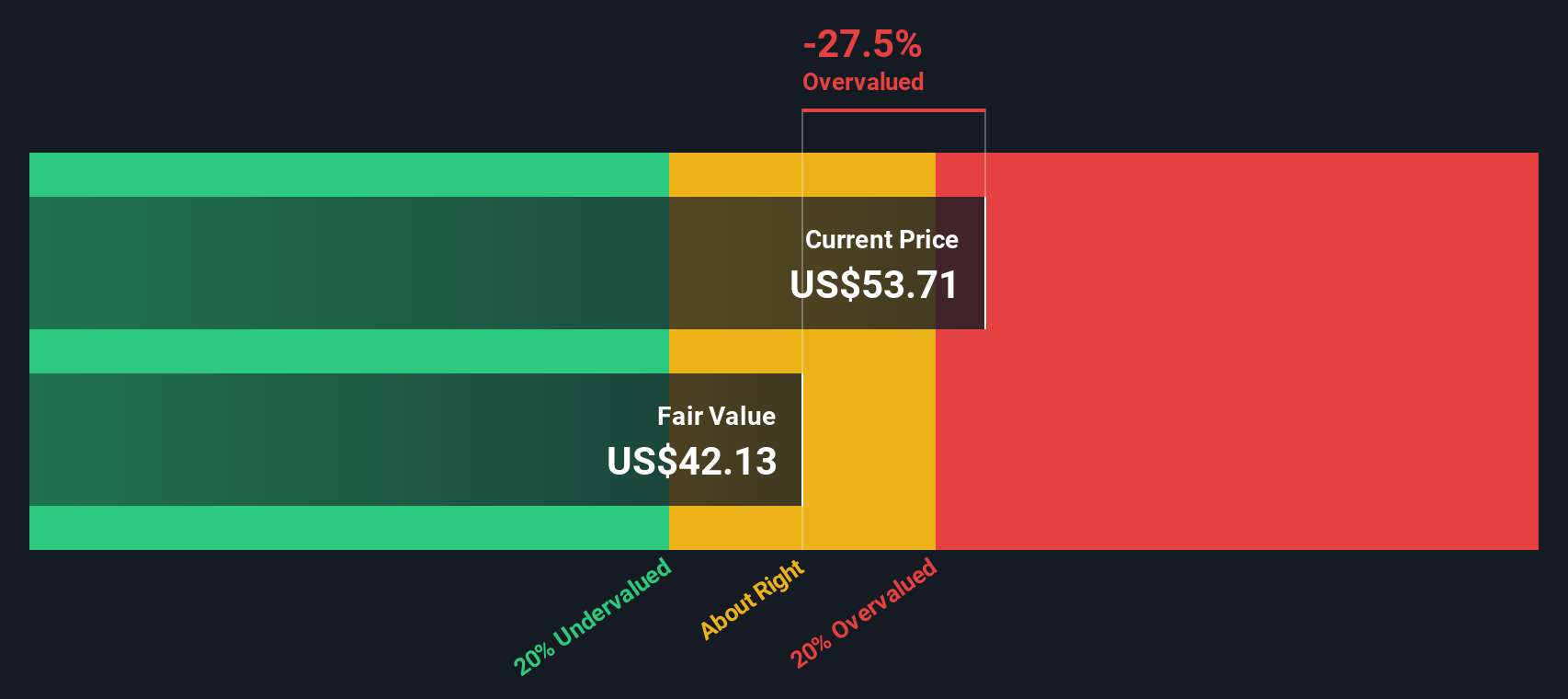

- According to our valuation checks, Tractor Supply scores just 1 out of 6 for being undervalued. This modest result raises questions about its current market price. Next, we will break down how those checks work and introduce an even more insightful approach to judging value so you can see the bigger picture.

Tractor Supply scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Tractor Supply Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's worth by projecting its future cash flows and then discounting them back to today's value, in order to account for the time value of money. For Tractor Supply, the latest reported Free Cash Flow stands at $976.96 Million. Analysts provide cash flow projections for the next several years, with free cash flow anticipated to reach approximately $1.13 Billion by the end of 2027. Beyond that, further cash flow estimates, reaching $1.55 Billion in 2035, are extrapolated using conservative annual growth rates.

All cash flows are denominated in USD. The specific DCF valuation for Tractor Supply relies on the "2 Stage Free Cash Flow to Equity" method, incorporating a blend of analyst forecasts and modest growth assumptions beyond the typical 5-year horizon.

Using this approach, the calculated intrinsic value for Tractor Supply is $39.00 per share. Compared to its current market price, this implies the stock is 37.6% overvalued. In practical terms, this means the current share price does not represent a bargain based on projected long-term cash flow returns.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tractor Supply may be overvalued by 37.6%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Tractor Supply Price vs Earnings (PE Ratio)

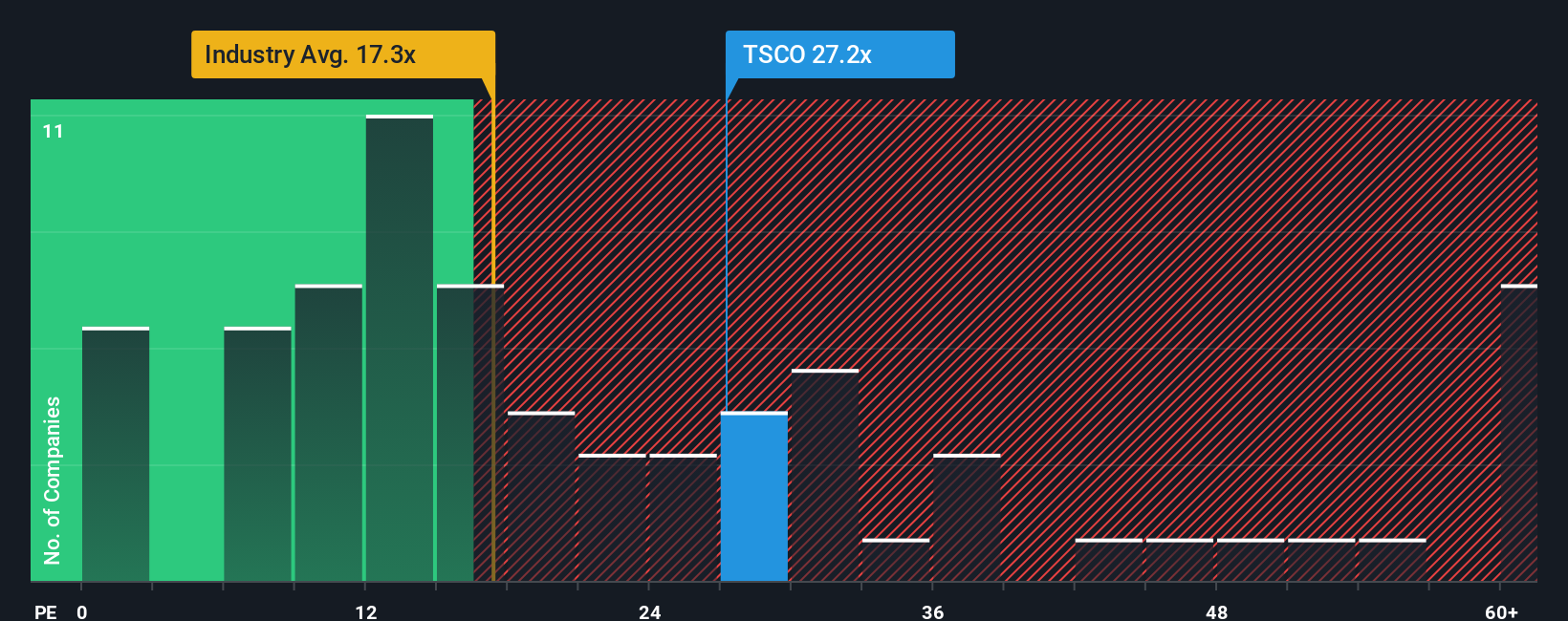

The Price-to-Earnings (PE) ratio is a widely used valuation metric when evaluating profitable companies like Tractor Supply. It helps investors judge how much they are paying for each dollar of a company's earnings, providing a quick check on whether a stock appears cheap or expensive relative to its profitability.

Growth expectations and perceived risks play a crucial role in determining what a “normal” PE should look like for a company. High future growth often justifies a higher PE, while increased risks or weaker margins can push it lower. For Tractor Supply, the current PE ratio stands at 25.7x. This is noticeably higher than the specialty retail industry average of 18.1x and the average among its peers at 41.2x.

Simply Wall St’s “Fair Ratio” offers deeper context and calculates a PE of 18.8x for Tractor Supply. Unlike a simple peer or industry comparison, the Fair Ratio reflects the company’s own earnings growth prospects, profit margins, size, and specific risks. This makes it a more tailored benchmark and therefore more meaningful for investors.

With these numbers considered side by side, Tractor Supply’s 25.7x PE is significantly above its Fair Ratio of 18.8x, suggesting the stock is overvalued relative to its fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tractor Supply Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are your opportunity to build a story behind the numbers, connecting your own view of a company’s direction, including assumptions about its future revenue, earnings, and margins, to an explicit fair value.

This approach enables you to tie a company’s story to a financial forecast and calculate a fair value based on what you believe is likely to unfold. Narratives are easy to create and use, and millions of investors already share and access them on Simply Wall St's Community page.

Narratives help investors decide when to buy or sell by making it simple to compare their own fair value to the current price. Because they update dynamically when new information, such as breaking news or company earnings, is released, your investment thesis is always current and relevant.

For example, some Tractor Supply investors are optimistic, forecasting strong earnings growth, higher margins, and a fair value above $70 per share. Others take a cautious stance, factoring in margin pressures and economic risk, setting fair value near $47. Narratives allow you to turn your personal view into an actionable investment framework.

Do you think there's more to the story for Tractor Supply? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tractor Supply might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSCO

Tractor Supply

Operates as a rural lifestyle retailer in the United States.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026