- United States

- /

- Specialty Stores

- /

- NasdaqGS:TDUP

ThredUp (TDUP) Valuation in Focus After Recent Performance and Industry Shifts

Reviewed by Simply Wall St

ThredUp (TDUP) saw its shares edge higher recently as investors digested the company’s latest performance numbers along with industry trends. The movement follows a period of mixed returns for the online resale platform, raising questions about its future valuation.

See our latest analysis for ThredUp.

ThredUp’s share price has swung notably over the past year, yet its total shareholder return tells the bigger story: climbing a remarkable 1,489% in the past twelve months and 685% over three years. While short-term momentum has cooled a bit lately, the recent uptick shows that investors are still keen to catch any signs of sustainable growth or improving sentiment.

If you’re open to expanding your search, this could be the perfect moment to discover fast growing stocks with high insider ownership.

With impressive longer-term gains and recent volatility in play, the key question now is whether ThredUp’s current price reflects all future growth prospects or if there could be a genuine buying opportunity ahead.Most Popular Narrative: 32.4% Undervalued

With ThredUp's most popular analyst-backed narrative assigning a fair value of $13.00 against a last close at $8.79, the stage is set for a potentially outsized rerating if the narrative’s projections hold true. This gap shines a light on optimism for structural shifts and company-specific catalysts that could change the outlook.

The closure of the de minimis loophole and the introduction of new tariffs are making fast fashion and new apparel imports more expensive. This increases the relative value proposition and attractiveness of secondhand platforms like ThredUp, which should support further customer acquisition and drive strong revenue growth. Rising consumer awareness of sustainability and growing interest in circular fashion models continue to expand the addressable market for online resale, creating lasting demand tailwinds that are likely to boost volume growth and top-line revenue for ThredUp.

What’s fueling this confident outlook? The story hinges on a series of aggressive revenue assumptions, margin improvements that defy current losses, and a future profit benchmark that rivals the sector’s leaders. Intrigued by which levers analysts believe will be pulled to justify such a dramatic re-rating? Find out the surprising financial drivers behind this bold valuation forecast.

Result: Fair Value of $13.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising customer acquisition costs or weaker demand for secondhand apparel could quickly challenge even the most optimistic long-term forecasts for ThredUp.

Find out about the key risks to this ThredUp narrative.

Another View: Multiples Raise Red Flags

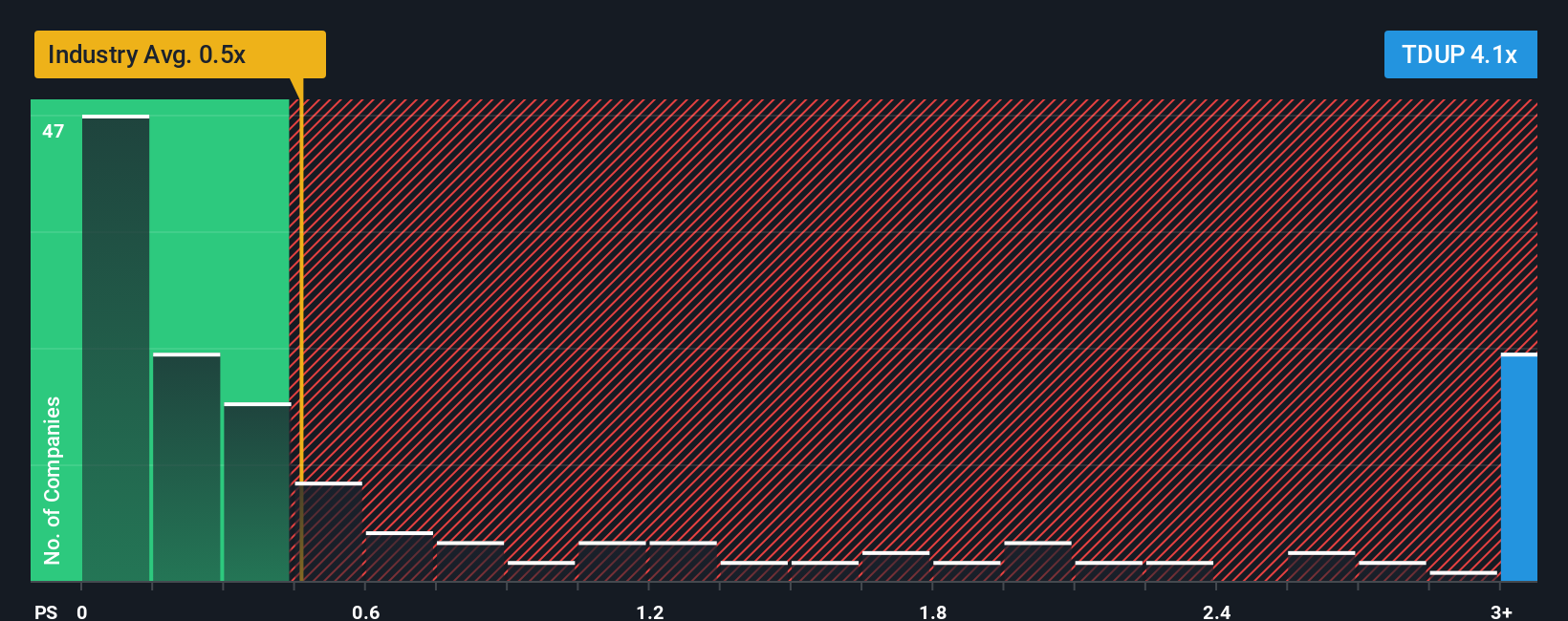

While analyst forecasts and long-term narratives present ThredUp as a growth winner, a review of valuation multiples presents a different perspective. The company trades at 3.9 times sales, which is much higher than its peer average of 1.2 and the industry average of just 0.4. Even compared to the fair ratio of 1.6, ThredUp appears expensive. This difference signals meaningful valuation risk if the company’s fundamentals do not dramatically improve. Could investors be paying too much for potential growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ThredUp Narrative

If you think there’s a different story behind ThredUp’s numbers or want to test your own assumptions, you can build a complete narrative in just a few minutes. Do it your way.

A great starting point for your ThredUp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unleash your next investment win by targeting opportunities others may overlook. Don’t miss the chance to get ahead with these unique stock selections:

- Grow your potential income by targeting companies rewarding investors with these 22 dividend stocks with yields > 3%, supported by attractive yields and resilient business models.

- Seize the edge in artificial intelligence by finding pioneers at the forefront. Start with these 26 AI penny stocks, which are driving innovations across industries.

- Capitalize on emerging tech with these 28 quantum computing stocks, positioned to transform everything from computing power to security infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ThredUp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TDUP

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives