- United States

- /

- Specialty Stores

- /

- NasdaqGS:REAL

Will RealReal's (REAL) Board Transition Refocus Its Investment Priorities and Long-Term Vision?

Reviewed by Sasha Jovanovic

- On November 17, 2025, The RealReal, Inc. announced that Gilbert L. (Chip) Baird III resigned from its Board of Directors following the sale of GreyLion Partners LP's shareholding in the company.

- This departure marks a significant transition in governance, as a key pre-IPO investor representative exits the board while continuing to consult for RealReal until mid-2026.

- We'll examine how the exit of a major investor's board representative could influence RealReal's long-term business priorities and investment outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

RealReal Investment Narrative Recap

To be a shareholder in The RealReal, an investor needs to believe in the long-term growth of authenticated luxury resale and the company's ability to drive profitable expansion despite ongoing losses. The recent resignation of a key pre-IPO investor representative from the board does not appear to materially change the most important short-term catalyst, the scaling of AI-driven operational efficiencies, or the primary risk, which remains pressure on margins from a declining take rate and shifting product mix. Of recent announcements, continued revenue growth, evidenced by raised FY 2025 guidance to US$687 million–US$690 million, directly ties into the principal catalyst: expanding demand for luxury resale supported by operational improvements. This strengthening top-line outlook reinforces management’s emphasis on profitable growth, though ongoing board changes underline the company's transition toward its next stage of development. In contrast, investors should be alert to potential margin volatility if high-value items continue to dilute take rates over coming quarters...

Read the full narrative on RealReal (it's free!)

RealReal's outlook anticipates $842.8 million in revenue and $40.0 million in earnings by 2028. This implies a 9.8% annual revenue growth rate and an $75.4 million increase in earnings from the current level of -$35.4 million.

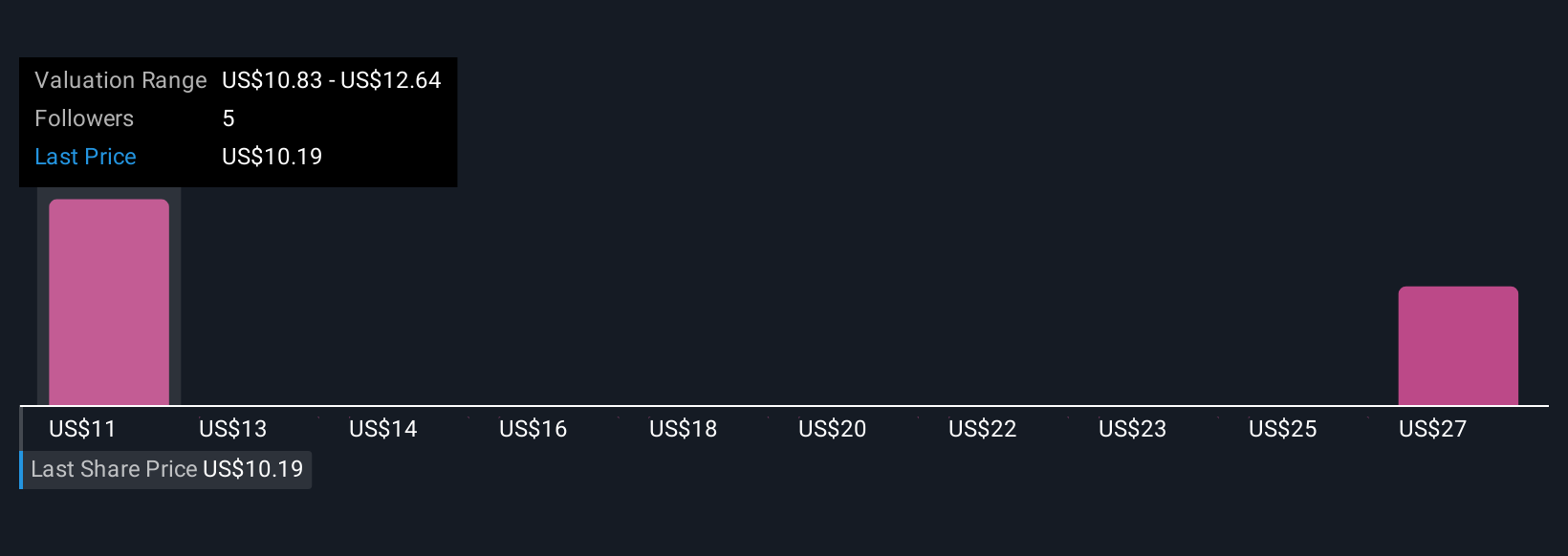

Uncover how RealReal's forecasts yield a $15.12 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Retail investor fair value estimates for The RealReal from the Simply Wall St Community span from US$4.65 to US$15.13, with two distinct perspectives included. While optimism surrounds ongoing revenue growth and operational initiatives, the range highlights how differing views on long-term profitability continue to shape outlooks for the stock's performance.

Explore 2 other fair value estimates on RealReal - why the stock might be worth less than half the current price!

Build Your Own RealReal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RealReal research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free RealReal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RealReal's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REAL

RealReal

Operates an online marketplace for resale luxury goods worldwide.

Slight risk with worrying balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026