- United States

- /

- Specialty Stores

- /

- NasdaqGS:ORLY

O'Reilly Automotive (ORLY): Valuation Check After Earnings Beat, Higher Guidance and Fresh Bullish Analyst Coverage

Reviewed by Simply Wall St

O'Reilly Automotive (ORLY) just picked up fresh bullish coverage after posting a quarter of better than expected revenue and earnings growth, and even nudging its full year guidance higher.

See our latest analysis for O'Reilly Automotive.

Even with the upbeat quarter and a wave of fresh bullish research, the stock has been choppy recently, with a 30 day share price return of 4.16%, a robust year to date share price return of 24.89%, and a 5 year total shareholder return of 231.15%. This suggests longer term momentum is still very much intact.

If O'Reilly's steady comp growth has you thinking about what else is working in autos, it might be worth exploring auto manufacturers as potential next ideas.

With analysts clustered around upbeat price targets and the shares already delivering hefty multiyear gains, investors now face a key question: Is O'Reilly still mispriced to the upside, or is the market fully discounting its future growth?

Most Popular Narrative: 10.1% Undervalued

With O'Reilly Automotive last closing at $98.89 against a narrative fair value of $110, the current setup leans toward a modest undervaluation story.

The company's commitment to store expansion, with the opening of 38 net new stores across the U.S. and Mexico in the first quarter, supports long term revenue growth potential by increasing market presence and customer reach.

Curious how steady, mid single digit growth can still justify such a rich future earnings multiple, even above the broader retail pack? The narrative leans on rising margins, shrinking share count, and a premium valuation normally reserved for fast growing compounders. Want to see the exact assumptions behind that confidence and how they stack up year by year? Read on to unpack the full playbook.

Result: Fair Value of $110 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could be knocked off course by weaker consumer demand or unexpected tariff and wage pressures that squeeze margins harder than expected.

Find out about the key risks to this O'Reilly Automotive narrative.

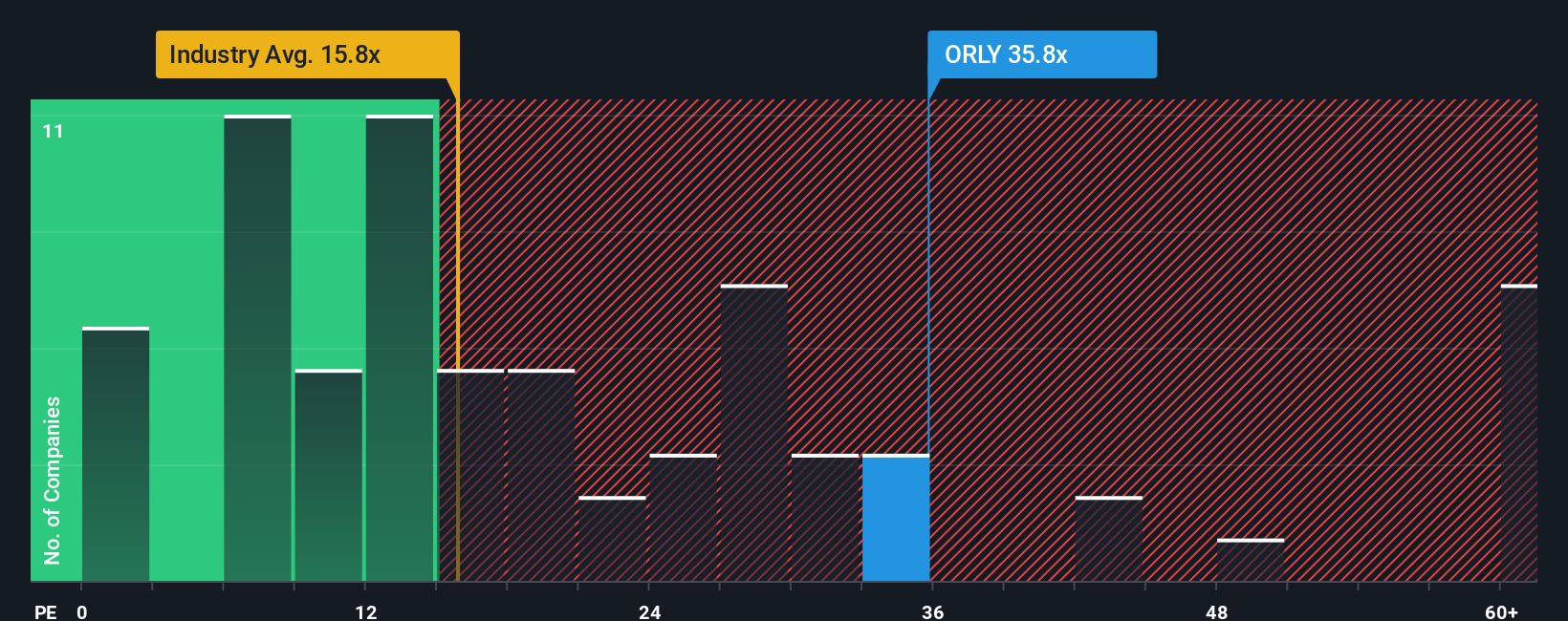

Another View: Rich on Earnings Multiples

While the narrative fair value points to a 10.1% upside, the earnings multiple view is much harsher. At a 33.6x price to earnings ratio, O'Reilly trades well above its 19.9x fair ratio and the 18.4x industry average. This suggests investors are paying a steep premium that could easily unwind if growth underdelivers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own O'Reilly Automotive Narrative

If you see things differently or want to stress test the numbers yourself, you can spin up a custom thesis in minutes: Do it your way.

A great starting point for your O'Reilly Automotive research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before this window of opportunity closes, use the Simply Wall St Screener to uncover fresh ideas that match your strategy and keep your portfolio working harder.

- Capture potential mispricings by targeting companies trading below their estimated cash flow value with these 911 undervalued stocks based on cash flows, tailored to long term investors.

- Ride breakthrough innovation by backing businesses at the heart of advanced computation and next generation processing power through these 28 quantum computing stocks.

- Strengthen your passive income stream by zeroing in on companies offering attractive, sustainable yields with these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ORLY

O'Reilly Automotive

Operates as a retailer and supplier of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States, Puerto Rico, Mexico, and Canada.

Low risk with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026