- United States

- /

- Specialty Stores

- /

- NasdaqGS:ORLY

O'Reilly Automotive (ORLY): Assessing Valuation After Recent Share Price Strength

Reviewed by Simply Wall St

See our latest analysis for O'Reilly Automotive.

O'Reilly Automotive’s momentum over the past year is hard to ignore, with a 22.6% year-to-date share price return and an impressive 19.6% total shareholder return for the year. While the stock has dipped slightly over the past month, long-term holders have enjoyed robust gains, as seen in its 215% total return over five years. This signals both resilience and ongoing interest from investors.

If you're curious where other auto parts and vehicle-related companies are finding growth, now is a perfect time to see the full lineup with our auto manufacturers screener: See the full list for free.

But with shares trading near record highs and solid growth already in the books, the key question is whether O'Reilly Automotive still offers an attractive entry point, or if the current price already fully reflects its future prospects.

Most Popular Narrative: 11.8% Undervalued

With O'Reilly Automotive's estimated fair value pegged at $110.13 per share versus a last close of $97.09, narrative followers see plenty of room for further gains. Let's examine a key catalyst shaping this view.

The company's robust and improving supply chain is supporting top-tier parts coverage and faster delivery. This is strengthening its competitive position and market share potential.

What is fueling such optimism in O'Reilly's near-term future? The narrative's bold target hinges on tightly forecast profit growth, margin expansion, and a premium multiple that is uncommon in retail. Curious to find out exactly which projections drive that conviction? The full story reveals the unexpected metrics behind this substantial valuation gap.

Result: Fair Value of $110.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued trade uncertainties and unexpected shifts in consumer sentiment could still challenge O'Reilly Automotive’s positive growth outlook in the months ahead.

Find out about the key risks to this O'Reilly Automotive narrative.

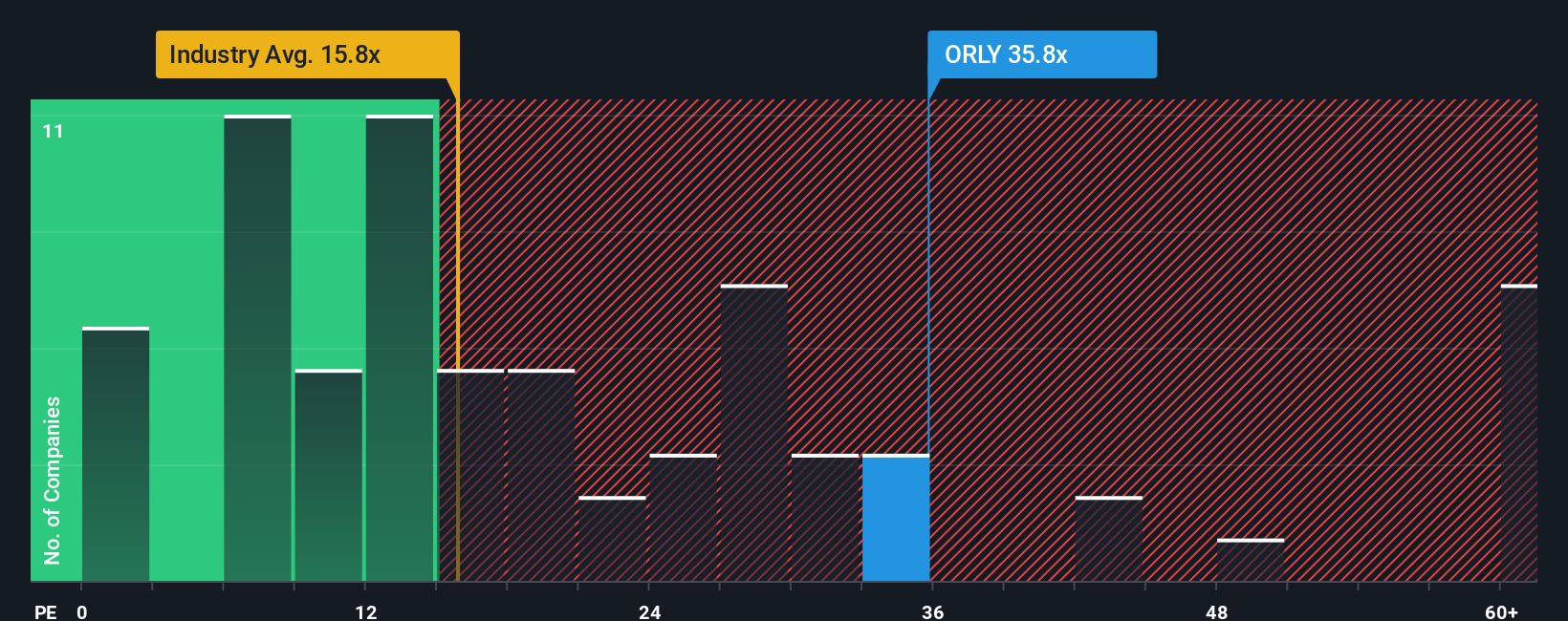

Another View: Multiples Tell a Cautionary Story

While some see O'Reilly as discounted to its fair value, a look at the market's favored pricing lens draws a different picture. The company’s price-to-earnings ratio sits well above both industry averages and the fair ratio, making it look quite pricey by comparison. Does this signal valuation risk ahead, or can O'Reilly outgrow these concerns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own O'Reilly Automotive Narrative

If you have your own perspective or want to dig deeper into the numbers and trends, you're free to piece together your own view in just minutes. Do it your way.

A great starting point for your O'Reilly Automotive research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Hundreds of unique stock opportunities await, tailored to your investing style and ambitions. Don’t let the market pass you by. Sharpen your edge with these top ideas today:

- Target steady income potential right now by reviewing these 16 dividend stocks with yields > 3% and see which companies are delivering attractive yields above 3%.

- Jump on the trends transforming healthcare by examining these 32 healthcare AI stocks with breakthroughs in AI-driven diagnostics and life sciences innovation.

- Capitalize on undervalued opportunities today by checking out these 874 undervalued stocks based on cash flows based on solid cash flow metrics and overlooked upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ORLY

O'Reilly Automotive

Operates as a retailer and supplier of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States, Puerto Rico, Mexico, and Canada.

Low risk with limited growth.

Similar Companies

Market Insights

Community Narratives