- United States

- /

- Specialty Stores

- /

- NasdaqCM:NEGG

Newegg (NEGG): Examining Valuation Following New SHEIN Partnership and Expansion Into Tech Lifestyle Markets

Reviewed by Simply Wall St

Newegg Commerce (NEGG) just launched its own storefront on SHEIN’s U.S. site, featuring over 1,000 technology products curated for style-conscious gamers and tech enthusiasts. This partnership could help Newegg connect with new audiences and sales channels.

See our latest analysis for Newegg Commerce.

Newegg’s share price has soared nearly 100% in the last month alone, and is up an astonishing 935.7% year-to-date. This signals strong momentum as the company secures new partnerships and pivots toward the swiftly growing tech lifestyle market. While its 1-year total shareholder return of 563.9% is remarkable, the recent pace suggests investor optimism is rapidly building.

If a fresh sales channel like SHEIN caught your attention, it might be the perfect time to discover more standouts in tech. See the full list here: See the full list for free.

But with shares on an explosive run, the big question now is whether Newegg is still undervalued or if the market is already pricing in all the upside from its latest strategic moves and future growth potential.

Price-to-Sales of 1.4x: Is it justified?

Newegg Commerce is trading at a price-to-sales (P/S) ratio of 1.4x, which is significantly higher than both the US Specialty Retail industry average of 0.4x and the peer group average of 1.1x. As of the last close, the share price was $92.32, indicating that the market is willing to pay a substantial premium for every dollar of Newegg’s revenue.

The price-to-sales multiple reflects how much investors are paying for the company's sales rather than profits. This metric is especially relevant for retailers and e-commerce firms where earnings may be inconsistent or negative. A higher ratio can point to expectations of strong future growth or differentiated business momentum, but it can also be a red flag if not supported by fundamentals.

In Newegg’s case, its unprofitability and declining earnings indicate a disconnect between investor optimism and underlying financial performance. With a premium P/S relative to both the industry and its peers, the stock is priced for high expectations that may require significant future revenue growth to justify. The market could return to more typical sector levels if these expectations are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 1.4x (OVERVALUED)

However, losses continue and revenue growth remains unclear. Any disappointment on future results could quickly shift investor sentiment and momentum.

Find out about the key risks to this Newegg Commerce narrative.

Another View: What Does Our DCF Model Say?

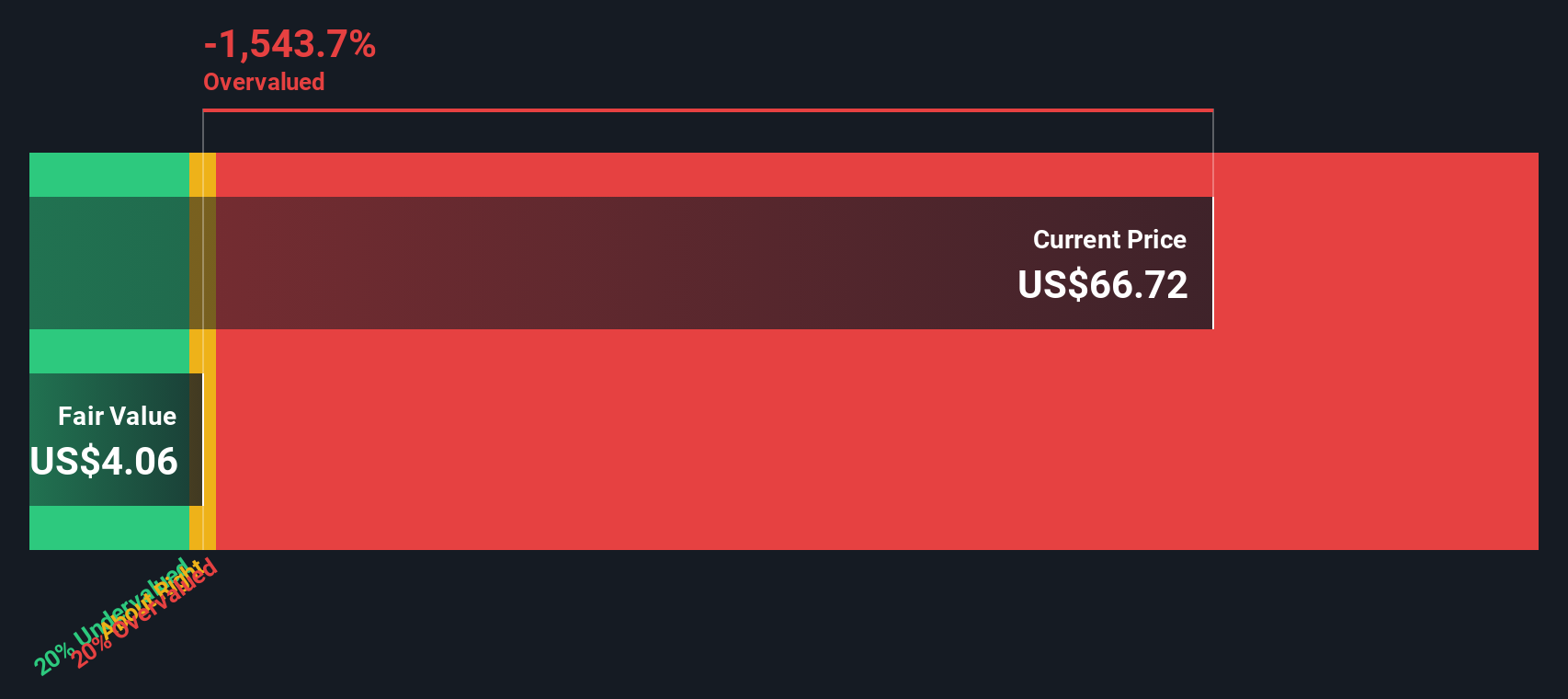

While the price-to-sales ratio puts Newegg squarely in the overvalued camp, our SWS DCF model offers an even starker contrast. Based on this approach, the shares look significantly overvalued at $92.32 compared to an estimated fair value of just $4.23. This gap raises questions about whether market enthusiasm can overcome the fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Newegg Commerce for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Newegg Commerce Narrative

If our take doesn’t match your own, or you want to dig into the numbers yourself, you can shape your own view in just a few minutes with Do it your way.

A great starting point for your Newegg Commerce research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors keep their edge by staying ahead of trends, and there’s a world of opportunity beyond Newegg. Don’t let the next winning idea pass you by. Seize it today with these handpicked lists.

- Unlock strong, reliable income potential by reviewing these 16 dividend stocks with yields > 3% offering attractive yields above 3%.

- Find tomorrow’s breakthrough technologies by scanning these 24 AI penny stocks that are powering the AI revolution.

- Boost your growth prospects with these 874 undervalued stocks based on cash flows trading at compelling prices based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newegg Commerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NEGG

Newegg Commerce

Operates as an electronics-focused e-retailer in the United States, Canada, and internationally.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives