- United States

- /

- Retail Distributors

- /

- NasdaqCM:INEO

INNEOVA Holdings Limited (NASDAQ:INEO) Stock's 27% Dive Might Signal An Opportunity But It Requires Some Scrutiny

INNEOVA Holdings Limited (NASDAQ:INEO) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 79% share price decline.

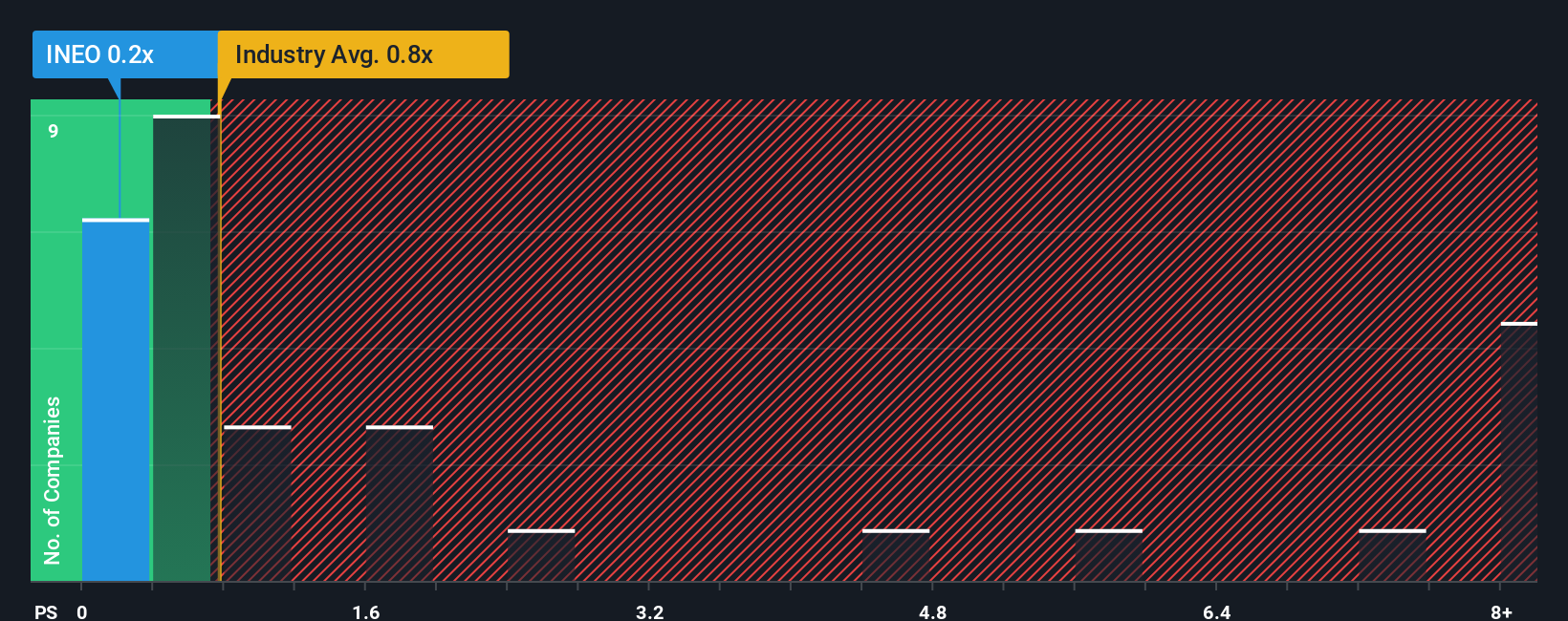

After such a large drop in price, INNEOVA Holdings' price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Retail Distributors industry in the United States, where around half of the companies have P/S ratios above 0.8x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for INNEOVA Holdings

What Does INNEOVA Holdings' P/S Mean For Shareholders?

Revenue has risen firmly for INNEOVA Holdings recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for INNEOVA Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For INNEOVA Holdings?

There's an inherent assumption that a company should underperform the industry for P/S ratios like INNEOVA Holdings' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.5% last year. This was backed up an excellent period prior to see revenue up by 33% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 3.4% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that INNEOVA Holdings is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does INNEOVA Holdings' P/S Mean For Investors?

INNEOVA Holdings' recently weak share price has pulled its P/S back below other Retail Distributors companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We're very surprised to see INNEOVA Holdings currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Before you take the next step, you should know about the 5 warning signs for INNEOVA Holdings (3 are significant!) that we have uncovered.

If these risks are making you reconsider your opinion on INNEOVA Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:INEO

INNEOVA Holdings

Through its subsidiaries, distributes and sells automotive and industrial spare parts in Singapore, the Middle East, and internationally.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives