- United States

- /

- Specialty Stores

- /

- NasdaqGS:EVGO

Taking a Fresh Look at EVgo (EVGO) Valuation After Recent Share Price Weakness

Reviewed by Simply Wall St

EVgo (EVGO) has quietly stayed on investors’ radar as shares slipped about 10% over the past month and roughly 46% in the past year, despite solid double digit annual revenue and net income growth.

See our latest analysis for EVgo.

At around $3.41, EVgo’s 7 day share price return of 5.25% offers a brief bounce against a year to date share price return of negative 18.62% and a 1 year total shareholder return of negative 46.47%. This suggests fading momentum as investors reassess the pace and profitability of EV infrastructure growth.

If EVgo’s volatility has you thinking about portfolio balance, this could be a useful moment to explore auto manufacturers as a way to compare how traditional and newer players are positioned for the EV transition.

With EVgo still loss making but delivering strong revenue growth and trading at a steep discount to analyst targets, investors face a key question: is the market overlooking long term upside or already pricing in realistic growth?

Most Popular Narrative Narrative: 48% Undervalued

With EVgo last closing at 3.41 dollars against a narrative fair value of about 6.54 dollars, the story hinges on ambitious growth and margin lift.

The recently secured 225 million dollars plus commercial bank loan facility (expandable to 300 million dollars) and 1.25 billion dollars DOE loan provide EVgo with flexible, low cost, non dilutive capital, enabling accelerated network buildout and stall deployment, increased scale, and the ability to capture market share and operating efficiencies, all reinforcing EBITDA and earnings growth.

Curious how aggressive revenue compounding, a sharp margin turnaround, and a premium future earnings multiple can all coexist in one story? Unpack the full narrative to see which financial levers must fire in sync to justify that gap between today’s price and its projected fair value.

Result: Fair Value of $6.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained dependence on government incentives and intensifying fast charging competition could quickly pressure EVgo’s margins, stall its economics, and weaken long-term growth assumptions.

Find out about the key risks to this EVgo narrative.

Another Angle on Valuation

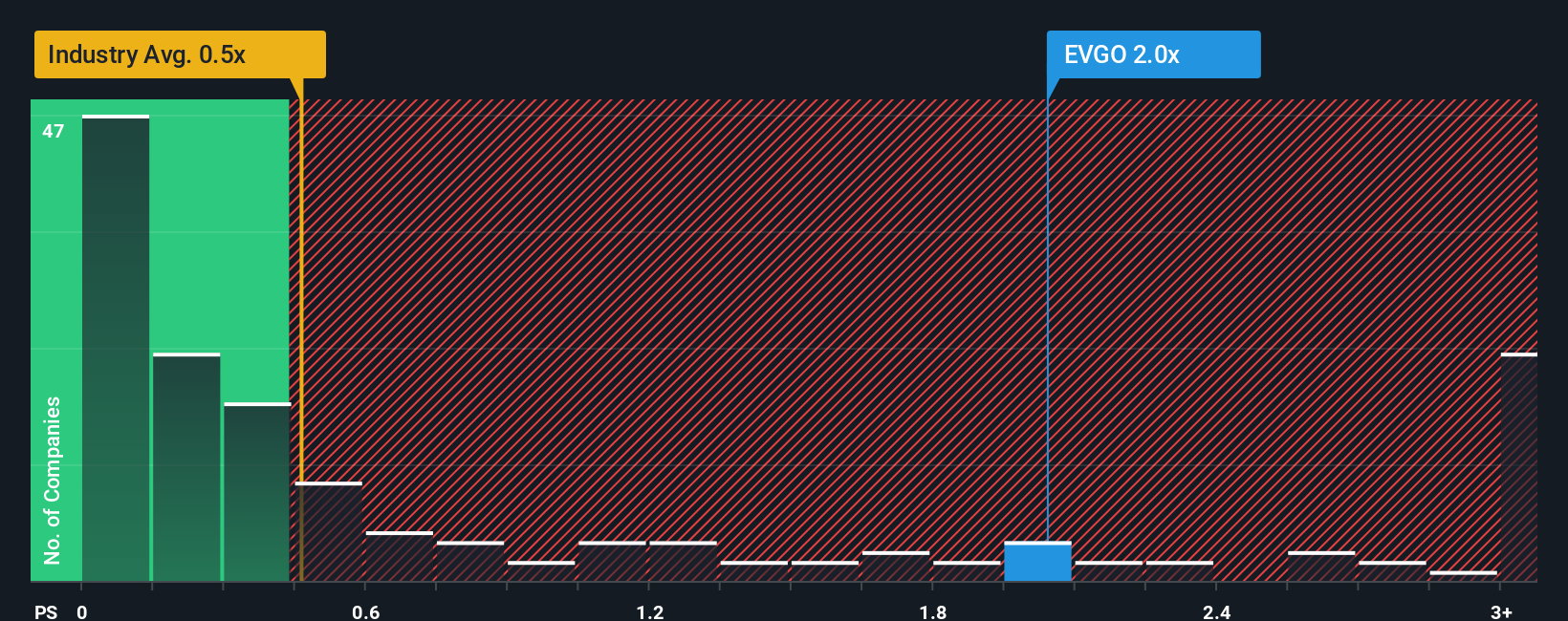

While the narrative fair value suggests EVgo is undervalued, the price to sales lens paints a tougher picture. At about 1.4 times sales, EVgo trades richer than both peers at 0.6 times and the US Specialty Retail sector at 0.5 times, and even above its 1.3 times fair ratio, hinting at limited margin for error if growth slips.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EVgo Narrative

If this view does not quite fit your own or you would rather dig into the numbers yourself, you can build a custom take in just a few minutes, Do it your way.

A great starting point for your EVgo research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single stock. Use the Simply Wall St Screener now to pinpoint your next opportunity before the crowd moves on.

- Capture early stage potential by scanning these 3574 penny stocks with strong financials that pair modest share prices with surprisingly robust financial foundations.

- Ride structural growth by targeting these 30 healthcare AI stocks that blend medical innovation with intelligent software to reshape patient outcomes and margins.

- Secure a steadier income stream by reviewing these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s cash returns while markets stay unpredictable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EVgo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EVGO

EVgo

Owns and operates a direct current fast charging network for electric vehicles in the United States.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026