- United States

- /

- Specialty Stores

- /

- NasdaqGS:EVGO

A Closer Look at EVgo (EVGO) Valuation as Investors Weigh a Recent 19% Share Price Slide

Reviewed by Simply Wall St

EVgo (EVGO) shares have recently moved, catching investor attention during a challenging period for the EV charging sector. With the company’s stock down 19% over the past month, some are wondering what could shift momentum.

See our latest analysis for EVgo.

While EVgo’s recent 1-day share price gain of 0.58% hints at some stabilization, the bigger picture shows momentum has cooled, with a 30-day share price return of -19.4% and a disappointing 1-year total shareholder return of -36.3%. With sentiment still clearly cautious, long-term investors are watching closely for signals that risk perception is shifting back in EVgo’s favor.

If you’re curious to see how other auto sector stocks are navigating this market, now is a great time to discover See the full list for free.

With shares trading at a sharp discount to analyst price targets, but recent growth still lagging, the critical question now is whether EVgo’s current valuation is a bargain or if the market is already reflecting muted future prospects.

Most Popular Narrative: 45.7% Undervalued

According to the most widely followed narrative, EVgo's fair value estimate of $6.34 stands well above its latest close at $3.44, setting the stage for a debate on whether the stock is truly being overlooked or if risks are too great for a higher valuation.

EVgo has dramatically lowered its net CapEx per stall (down 28% versus initial 2025 projections) through a combination of improved contractor pricing, material sourcing, use of prefabricated skids, and by capturing more state grants and utility incentives. This has enabled higher projected returns on capital, improved net margins, and stronger long-term earnings growth.

Want to know what’s behind this aggressive upside? The narrative centers on surging revenue projections, margin expansion, and a profit turnaround the market might not expect. Intrigued by the bold financial assumptions and the math that leads to such a big gap between price and target? Dive deeper and see what’s driving these high hopes.

Result: Fair Value of $6.34 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, EVgo’s heavy reliance on government incentives and recent maintenance challenges could threaten its path to improved margins and long-term growth.

Find out about the key risks to this EVgo narrative.

Another View: Market Multiples Signal Caution

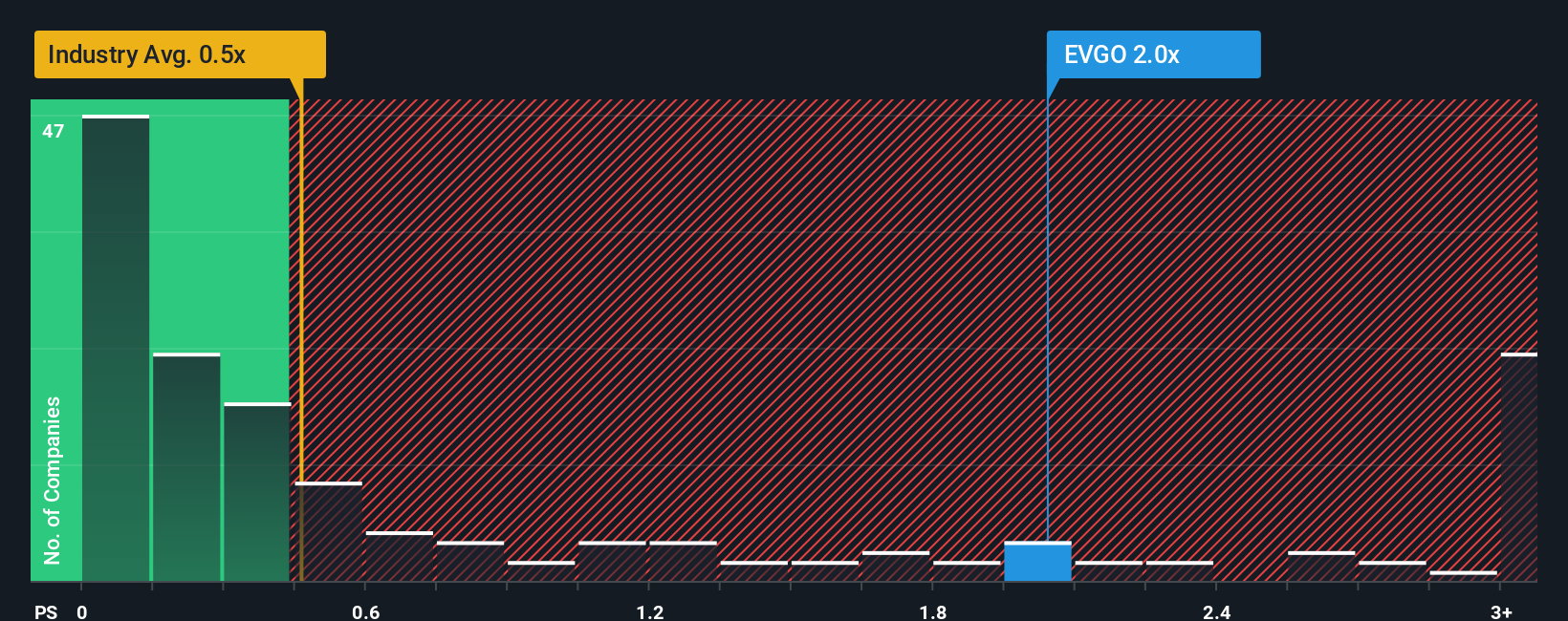

While the analyst narrative suggests EVgo is undervalued, market multiples tell a different story. EVgo trades at a price-to-sales ratio of 1.5x, which is higher than its peer average of 1.1x and the US Specialty Retail industry average of 0.4x. Even compared to its estimated fair ratio of 1.4x, EVgo looks slightly expensive. This raises questions about whether the market is factoring in higher risks or if investors are simply more skeptical than analysts. Which guide should investors trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EVgo Narrative

If the current narrative does not align with your perspective or you prefer to analyze the numbers yourself, crafting your own view is quick and simple. It takes less than three minutes – Do it your way.

A great starting point for your EVgo research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for More High-Potential Picks?

Take your investment strategy to the next level by tapping into other stock ideas. Don’t let opportunity slip by while trends are shifting fast.

- Spot value opportunities by targeting companies priced attractively with strong future cash flow using these 867 undervalued stocks based on cash flows.

- Capture tomorrow’s innovation by reviewing these 32 healthcare AI stocks, where breakthroughs in health technology and artificial intelligence converge.

- Power up your returns by seeking income from these 16 dividend stocks with yields > 3% offering robust yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EVgo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EVGO

EVgo

Owns and operates a direct current fast charging network for electric vehicles in the United States.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives