- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:EBAY

eBay (NasdaqGS:EBAY) Announces Dividend Hike US$0.29 Share Buyback Completion And Earnings Guidance

Reviewed by Simply Wall St

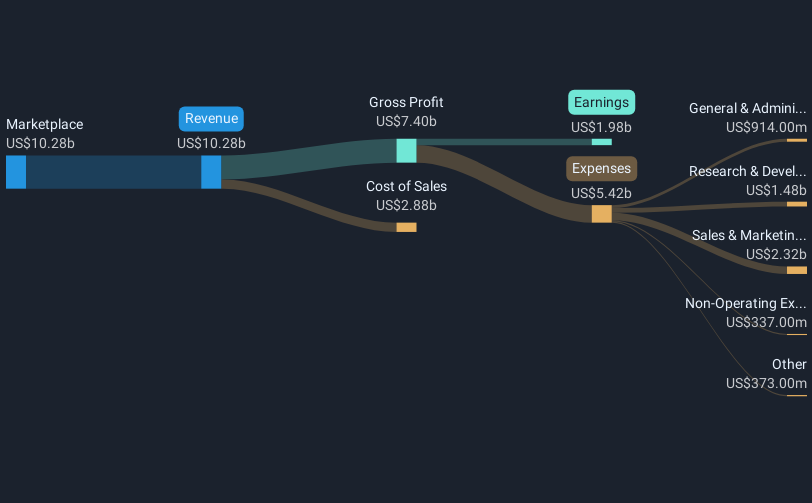

eBay (NasdaqGS:EBAY) experienced a 7.5% price increase over the last quarter, reflecting its strategic efforts and market responses. Notable occurrences included an increase in its cash dividend to $0.29 per share, alongside the repurchase of 14 million shares, signaling strong shareholder returns through dividends and buybacks. Despite a mixed earnings announcement showing a decline in net income but stable earnings per share, the company's forecast for steady revenue aligns with its recent positive share price performance. The tech-heavy Nasdaq Composite declined by 0.6% amid mixed U.S. stock index movements and market uncertainties over tariffs and economic health. However, eBay's boost contrasts with a broader market decline of 3.6% in the same period, highlighting its resilience against fluctuating investor sentiment. This blend of positive corporate financial maneuvers and relative outperformance within the uncertain tech sector has supported eBay's recent stock trajectory.

Unlock comprehensive insights into our analysis of eBay stock here.

Over the last five years, eBay's total returns to shareholders, including dividends, achieved a significant 94.95% increase. This performance reflects a combination of shareholder-friendly initiatives and financial executions. For instance, commencing from early 2022, eBay embarked on substantial share buybacks, completing over 113 million repurchased shares for a total of US$5.70 billion. These buybacks have consistently supported the stock's valuation. Moreover, eBay's commitment to returning capital was underscored by consistent dividend declarations, reflecting an ongoing emphasis on shareholder returns.

Despite some challenges, such as a 25.3% decline in earnings growth over the past year, the company has remained a good value with its Price-To-Earnings Ratio of 16.3x, compared to the peer average. Additionally, eBay's recent market performance has outpaced both the US Multiline Retail industry and the broader market, surpassing their growth by significant margins over the past year, showcasing its ability to maintain resilience in a fluctuating environment.

- Discover whether eBay is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Explore the potential challenges for eBay in our thorough risk analysis report.

- Is eBay part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EBAY

eBay

Operates marketplace platforms that connect buyers and sellers in the United States, the United Kingdom, China, Germany, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives