- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:BZUN

Revenues Working Against Baozun Inc.'s (NASDAQ:BZUN) Share Price Following 28% Dive

Baozun Inc. (NASDAQ:BZUN) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

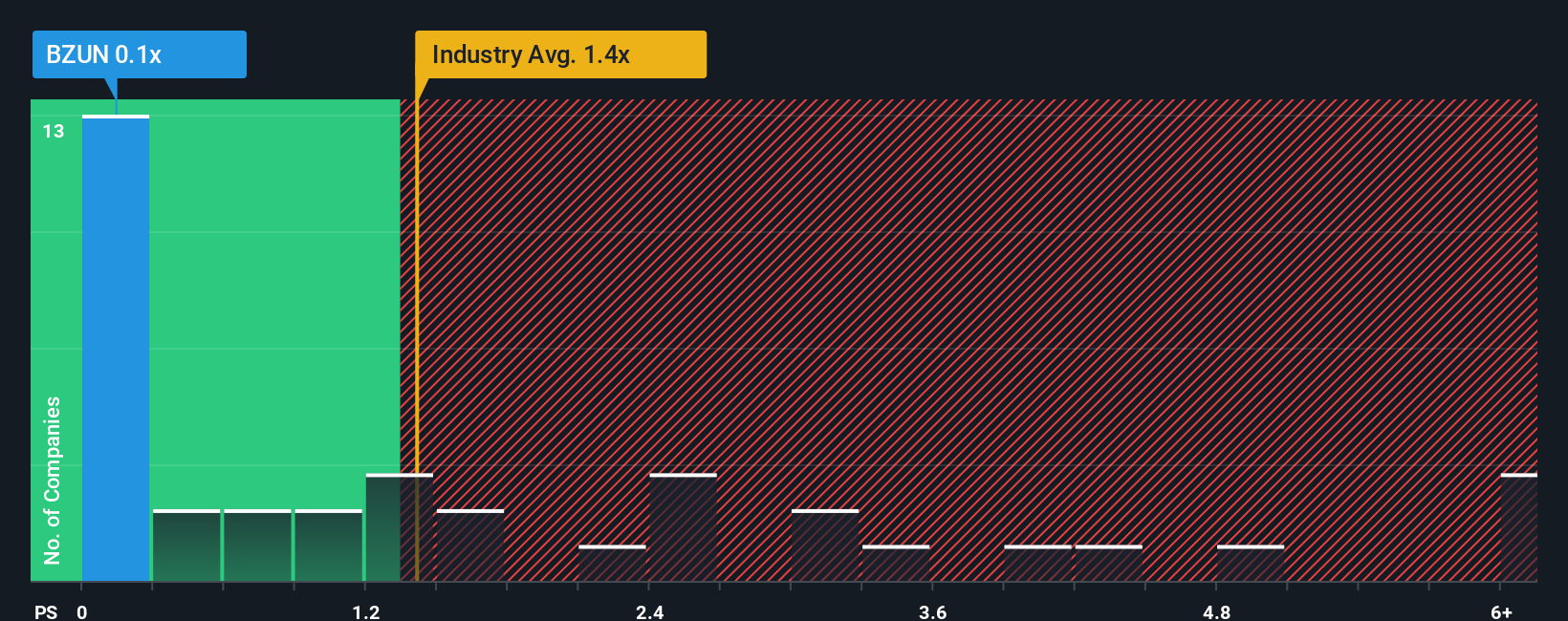

Following the heavy fall in price, Baozun may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Multiline Retail industry in the United States have P/S ratios greater than 1.4x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Baozun

How Has Baozun Performed Recently?

Recent times haven't been great for Baozun as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Baozun's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Baozun would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.7%. Revenue has also lifted 5.3% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 4.4% per annum during the coming three years according to the seven analysts following the company. That's shaping up to be materially lower than the 11% per annum growth forecast for the broader industry.

In light of this, it's understandable that Baozun's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Baozun's P/S Mean For Investors?

Baozun's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Baozun's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Baozun with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Baozun's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Baozun might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BZUN

Baozun

Through its subsidiaries, engages in the provision of end-to-end e-commerce solutions in the People's Republic of China.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives