- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Does Amazon’s AI Rollout Signal Further Gains for Investors in 2025?

Reviewed by Bailey Pemberton

- Ever find yourself wondering if Amazon.com still offers long-term value or if most of the upside is already reflected in the price? Let's break down the factors that actually drive what this stock is worth.

- Amazon shares have delivered a solid 13.0% jump in the past month and are up 17.4% over the past year, showing both near-term momentum and resilience in a changing market.

- News about Amazon rolling out new AI-powered features across its retail and cloud businesses has fueled optimism, adding to the buzz around the company’s ability to innovate. Rising regulatory scrutiny has also kept risk in the spotlight for investors, providing important context for recent price moves.

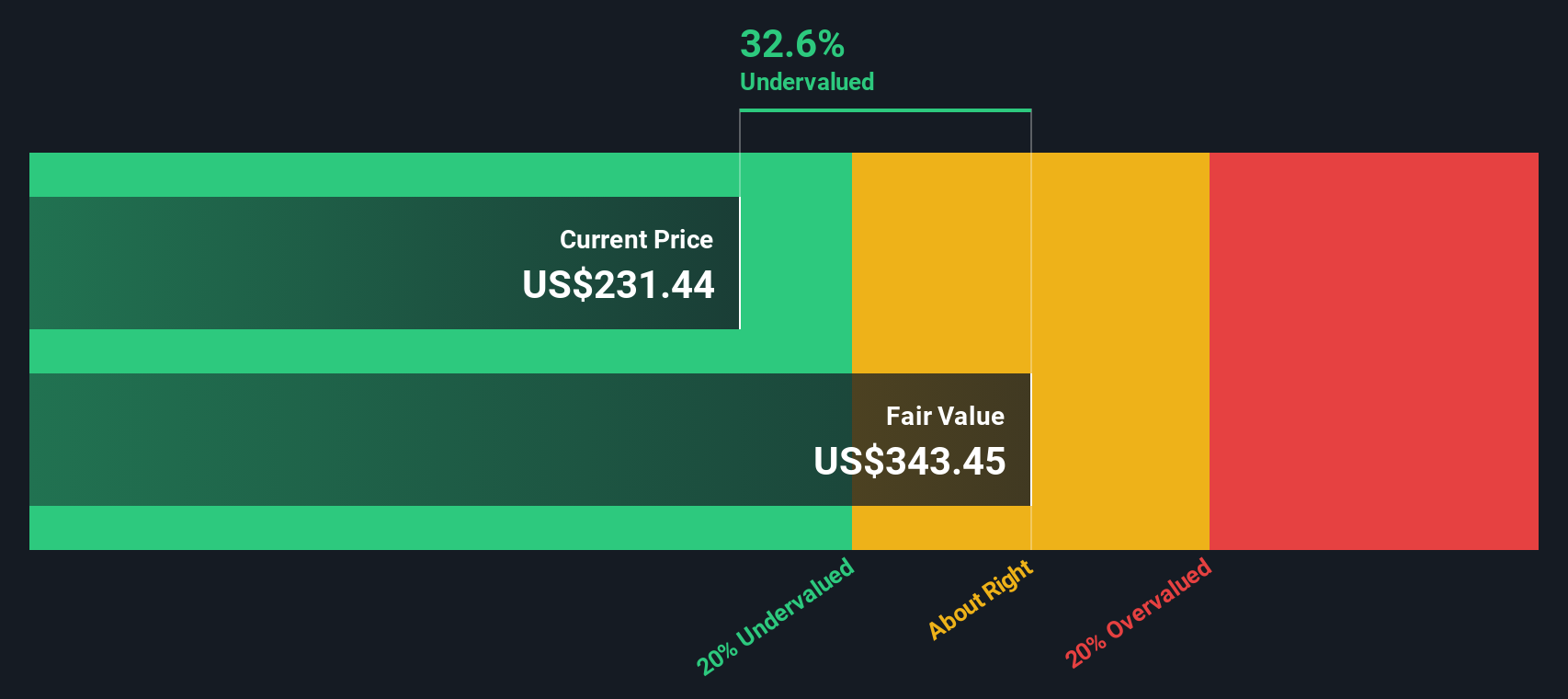

- On valuation, Amazon scores a 3 out of 6 on our undervaluation checks, placing it in the middle of the pack. Next, we will look at what different valuation methods say about Amazon’s current price and why there might be an even smarter way to make sense of it all by the end of this article.

Find out why Amazon.com's 17.4% return over the last year is lagging behind its peers.

Approach 1: Amazon.com Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to the present. This approach aims to capture Amazon.com’s underlying earning power over time, providing an independent check on the current market price.

Amazon.com’s latest reported Free Cash Flow stands at $40.0 Billion, a robust figure reflecting its worldwide scale. Analysts expect strong growth in the years ahead, projecting Free Cash Flow to reach approximately $139.4 Billion by 2029. While forecasts from analysts typically stop at five years, further projections such as those to 2029 and beyond are extrapolated based on recent trends and expert estimates. These projections help build a long-term picture of the company's cash-generating power in dollars ($).

Based on this DCF analysis, the intrinsic value of Amazon.com’s shares is calculated to be $294.69. Compared with the current price, this represents a 17.1% discount, signaling the stock is undervalued on this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amazon.com is undervalued by 17.1%. Track this in your watchlist or portfolio, or discover 874 more undervalued stocks based on cash flows.

Approach 2: Amazon.com Price vs Earnings

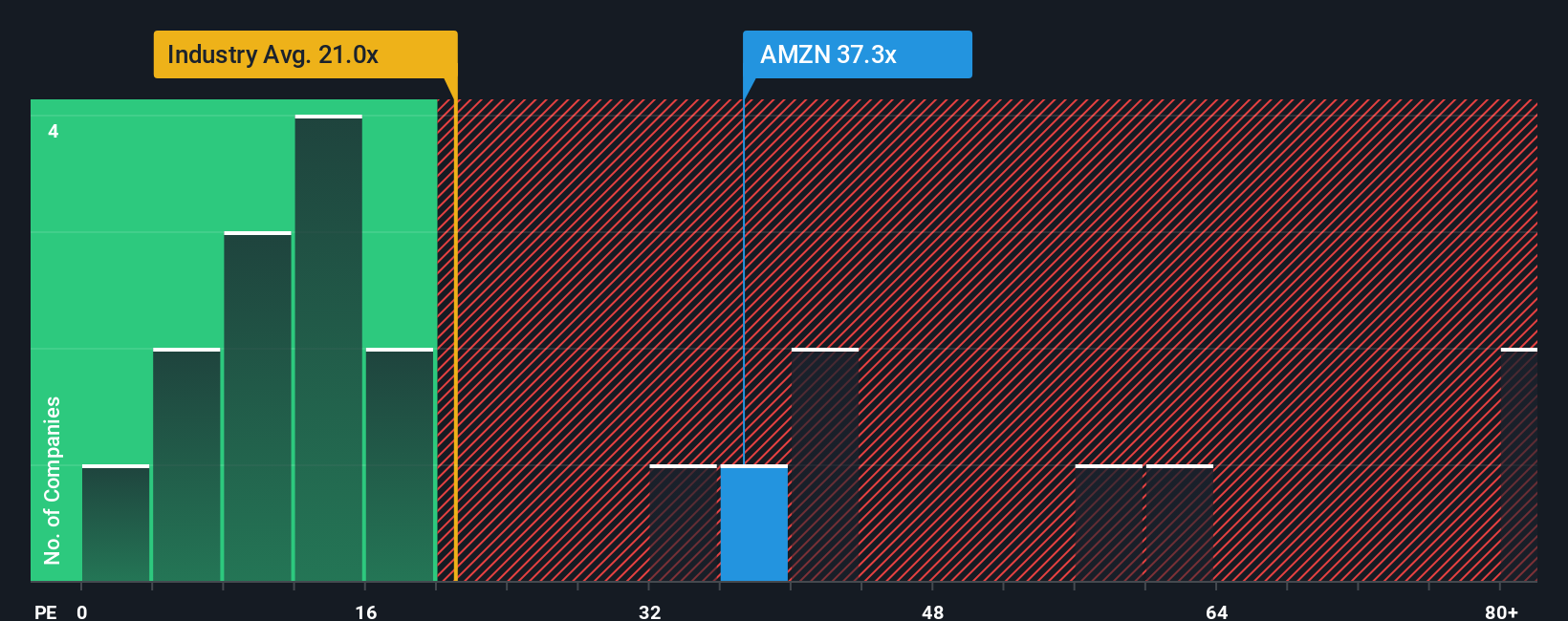

The Price-to-Earnings (PE) ratio is a popular valuation tool for profitable companies like Amazon.com because it directly connects the current share price to the company’s earnings power. It helps investors gauge whether the stock is trading at a reasonable level relative to the profits it generates.

What qualifies as a “fair” PE often depends on a company’s growth outlook and risk profile. Higher expected earnings growth can justify a higher PE, as investors anticipate bigger future profits. Conversely, companies facing greater risks or slower growth typically command lower PE ratios.

Amazon.com’s current PE ratio stands at 34.2x. This is not only above the Multiline Retail industry average of 19.9x, but also a bit below the average for its closest listed peers, which sits at 39.4x. While these benchmarks provide useful context, they do not fully capture Amazon’s unique mix of high growth potential, global scale, and risk factors.

That is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio factors in Amazon’s earnings growth, profit margins, industry conditions, market capitalization and risk, aiming to estimate what a reasonable PE ratio for Amazon should actually be, regardless of where peers or the industry average currently sit. For Amazon.com, the Fair Ratio is calculated at 36.8x.

With the current PE ratio just slightly below the Fair Ratio (by less than 0.10), this suggests Amazon shares are trading roughly in line with their fair value based on current earnings and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Amazon.com Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a dynamic and user-friendly approach that shows you not just what a company is worth, but why, and lets you see how others are thinking.

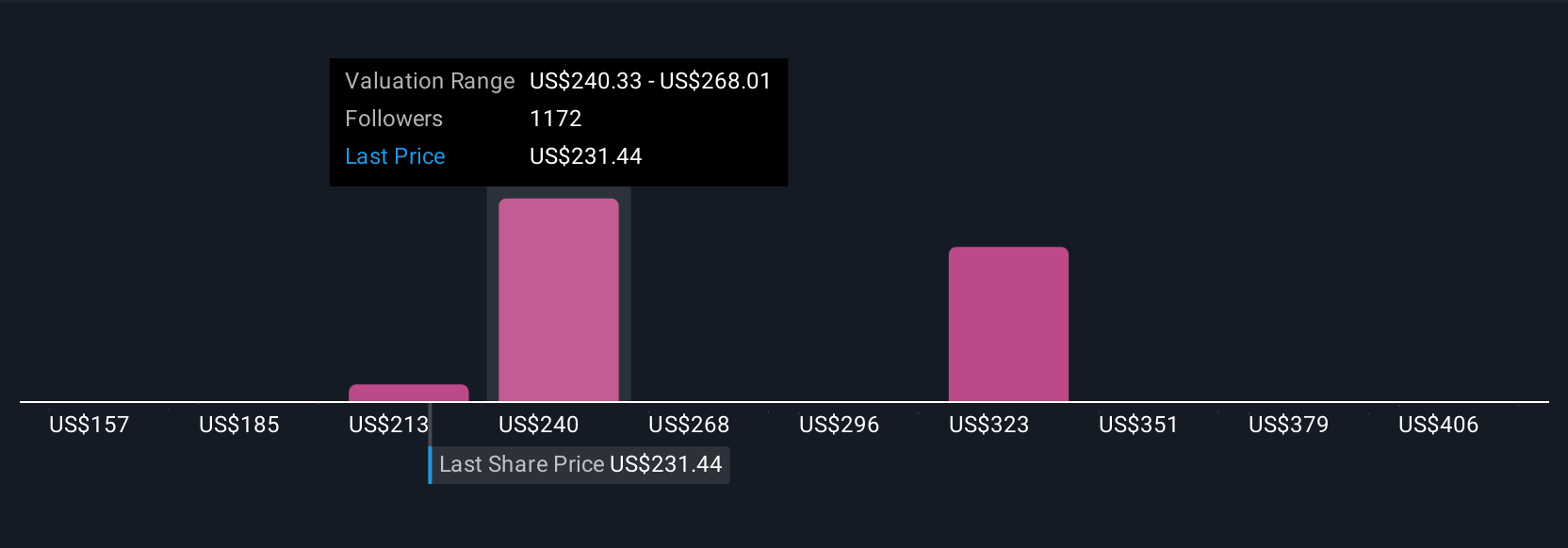

A Narrative is simply your story about a company: your perspective on its future growth, profit margins, and business drivers, all connected to your own estimate of fair value. Rather than relying just on traditional financial ratios, Narratives link Amazon.com’s long-term business story with a financial forecast, so you can see how your expectations and assumptions map to a value per share.

This isn’t just for the pros; Narratives are easy to use and are available on Simply Wall St’s Community page, where millions of investors share, compare, and refine their perspectives in real time. Narratives help you know when to buy or sell by comparing your Fair Value to the current Price, making your investment decisions more informed and personal.

What’s more, Narratives update automatically as new earnings, news, or market data arrives, so your viewpoint stays relevant. For example, some investors forecast Amazon’s fair value as high as $287.57 per share, betting on strong AWS and retail growth, while the most cautious project $151.21 per share, highlighting risks from competition and market saturation, showing there is always more than one story behind the numbers.

For Amazon.com, however, we'll make it really easy for you with previews of two leading Amazon.com Narratives: 🐂 Amazon.com Bull CaseFair Value: $287.57

Current Price is 15.0% below Fair Value (Undervalued)

Revenue Growth Rate: 11.3%

- AWS’s leadership in cloud and AI, alongside global Prime ecosystem growth and advanced logistics, is expected to drive high-margin, sustained profit expansion.

- Strong international expansion and automation create structural cost efficiencies and margin gains, while diverse business lines support recurring revenue growth.

- Risks include elevated regulatory scrutiny, supply chain pressures, and the need for continued investment in AI and infrastructure. Analysts remain positive on future earnings and valuation prospects.

Fair Value: $222.55

Current Price is 9.8% above Fair Value (Overvalued)

Revenue Growth Rate: 15.2%

- Amazon’s real earnings power is masked by ongoing reinvestment, but future cash flows hinge on relentless focus on AWS, advertising, and third-party sellers.

- Profit expansion relies on optimizing core businesses, but near-term cash flows and profitability will remain suppressed due to aggressive global investment.

- Major risks are regulatory pressures and the potential for a prolonged recession, both of which could dampen growth and profitability despite a strong business model.

Do you think there's more to the story for Amazon.com? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives