- United States

- /

- Hotel and Resort REITs

- /

- NYSE:XHR

Xenia Hotels & Resorts (XHR): One-Off Gain Drives 133% Earnings Growth, Clouds Profit Narrative

Reviewed by Simply Wall St

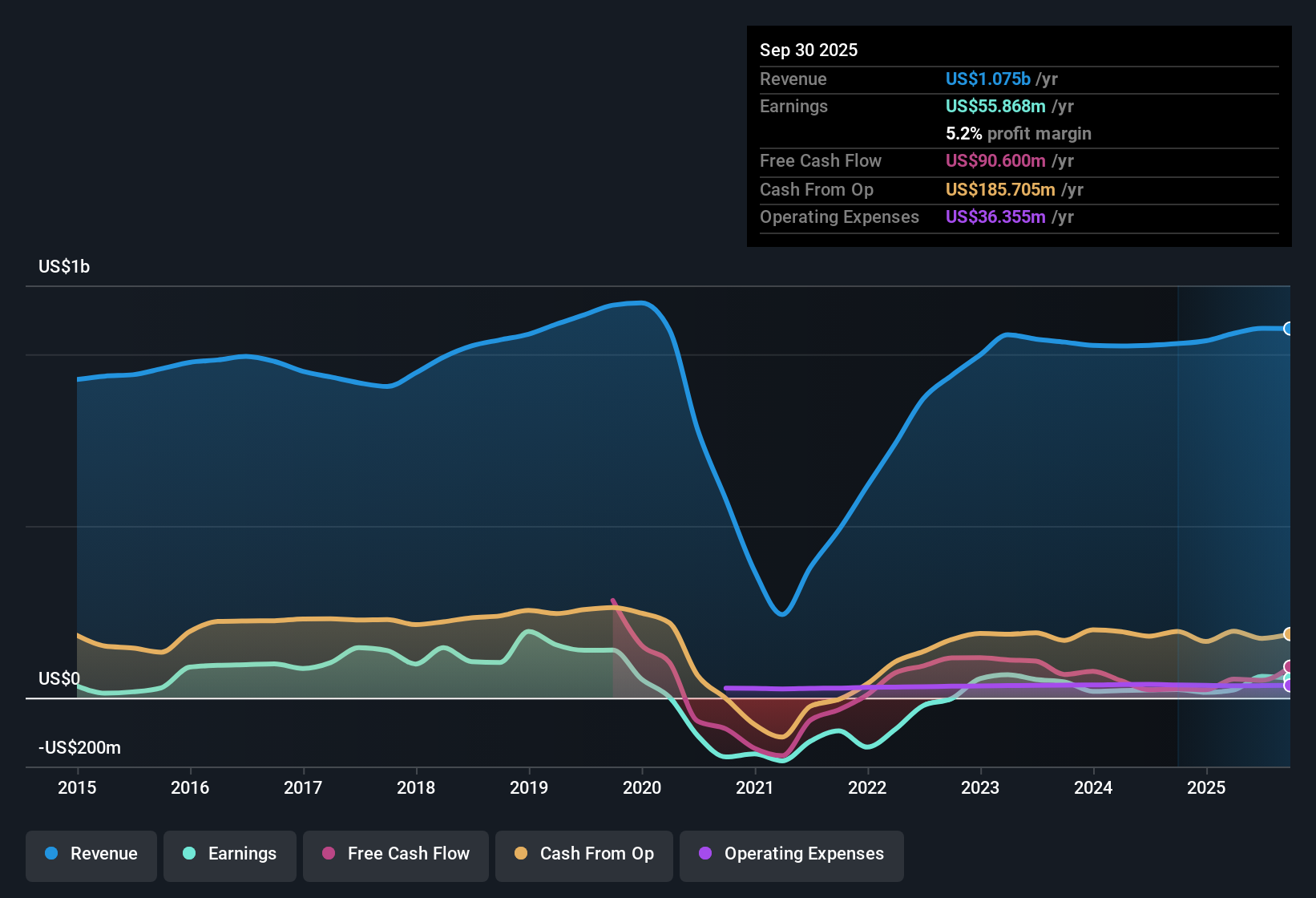

Xenia Hotels & Resorts (XHR) delivered standout earnings growth of 133% over the past year, significantly outpacing its five-year average of 68.2% per year. Net profit margin reached 5.2%, up from 2.3% a year ago, as the company transitioned to sustained profitability. The recent numbers, however, are boosted by a one-off $39.2 million gain, making it essential to look beyond the headline figures.

See our full analysis for Xenia Hotels & Resorts.The next section will put these results in context by comparing the numbers against the most widely discussed investor narratives. This will help identify which perspectives hold up and which may be due for a rethink.

See what the community is saying about Xenia Hotels & Resorts

One-Off Gain Drives Headline Profit

- The recent $39.2 million nonrecurring gain heavily influenced Xenia’s reported profit, temporarily boosting net profit margin to 5.2% from 2.3% a year ago.

- Analysts' consensus view acknowledges that while continued upgrades to group amenities and focus on luxury markets do build pricing power, current outperformance hinges significantly on this one-off gain rather than on recurring operational improvements.

- Consensus narrative flags management’s own admission that recent strong group revenues may not repeat, making future profit sustainability more questionable.

- This reliance on nonrecurring income creates tension with bullish arguments about the company’s margin durability, especially as leisure demand is already showing signs of softening.

- For a deeper look at whether these gains mark a lasting shift for Xenia, see the full consensus narrative for detailed context. 📊 Read the full Xenia Hotels & Resorts Consensus Narrative.

Margin Forecasts Reverse Despite Discipline

- Analysts expect profit margins to shrink from 5.8% today to just 0.4% over the next three years, even though selective buybacks and reduced capital expenditures are designed to support shareholder returns.

- According to the consensus narrative, while Xenia's efforts to improve asset quality and scale buybacks support returns in the near term, fast-rising labor costs and slower revenue growth risk overwhelming these positives.

- Cost inflation, especially wage increases in high-cost markets, directly threaten EBITDA and net margins even as revenue grows modestly at an annual rate of 2.8%.

- The consensus view cautions that margins are now highly vulnerable to even small shifts in demand or expenses, especially as competitive pressures mount from short-term rentals.

Valuation: At a Peer Discount, Still Near Fair Estimates

- The current share price of $12.30 sits below the allowed analyst price target of $15.00 and is also less than the calculated DCF fair value of $27.38. The company’s price-to-earnings ratio of 21x is above the global Hotel and Resort REITs average of 16.5x but still under the peer median of 23.7x.

- Analysts' consensus view points out this discount reflects caution about future earnings declines. Analysts foresee a 61.9% annualized decrease in earnings over the next three years.

- What stands out is that despite this negative outlook, the share price remains below both fair value and most analyst target ranges, suggesting some market skepticism even as valuation screens as reasonable compared to peers.

- Consensus narrative suggests that unless long-term catalysts or stronger profit trends emerge, investors may continue to value Xenia more conservatively than models or peer comparisons alone might justify.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Xenia Hotels & Resorts on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you interpret the results another way? Take just a few minutes to craft your viewpoint and share your take. Do it your way

A great starting point for your Xenia Hotels & Resorts research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite disciplined buybacks, Xenia faces shrinking profit margins and consensus forecasts of prolonged earnings weakness as costs rise faster than revenues.

If resilient earnings and steadier revenue trends appeal to you, check out stable growth stocks screener (2102 results) for companies delivering reliable financial performance no matter the cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XHR

Xenia Hotels & Resorts

A self-advised and self-administered REIT that invests in uniquely positioned luxury and upper upscale hotels and resorts with a focus on the top 25 lodging markets as well as key leisure destinations in the United States.

Proven track record with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success