- United States

- /

- Specialized REITs

- /

- NYSE:WY

The Bull Case For Weyerhaeuser (WY) Could Change Following Q3 Profit Surge Amid Mixed Nine-Month Results

Reviewed by Sasha Jovanovic

- Weyerhaeuser Company recently reported third quarter 2025 earnings, posting net income of US$80 million and basic earnings per share of US$0.11, both rising compared to the same period last year.

- While quarterly net income saw substantial improvement year-on-year, total net income for the nine-month period decreased from the previous year, indicating mixed performance across reporting periods.

- We'll explore how Weyerhaeuser's significant third quarter profit growth influences outlooks for its longer-term earnings trajectory.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Weyerhaeuser Investment Narrative Recap

If you're considering Weyerhaeuser as an investment, it helps to believe in the company's potential for stable long-term growth through its timberland and wood products businesses, while being mindful of sensitivity to housing market cycles and global trade trends. The significant jump in third quarter net income is encouraging, but it does not substantially offset the ongoing short-term risk posed by softer lumber demand and pricing, still the most critical factor for the business. At this stage, the recent results do not materially alter the near-term outlook for either growth catalysts or prevailing risks.

Of the company's recent announcements, the declared quarterly dividend of US$0.21 per share stands out as most relevant to the latest earnings report. It reflects Weyerhaeuser's ongoing commitment to shareholder returns, even amid profitability variability, and serves as a signal of confidence. This decision ties directly to the short-term catalyst of rebuilding earnings momentum, which could support more consistent future distributions as earnings stabilize.

However, it's important to remember, in contrast to the positive quarter, investors should be aware that recent volatility in demand and average realizations for wood products could...

Read the full narrative on Weyerhaeuser (it's free!)

Weyerhaeuser's outlook forecasts $8.2 billion in revenue and $990.3 million in earnings by 2028. This scenario assumes a 5.2% annual revenue growth rate and a $711.3 million increase in earnings from the current $279.0 million.

Uncover how Weyerhaeuser's forecasts yield a $31.75 fair value, a 35% upside to its current price.

Exploring Other Perspectives

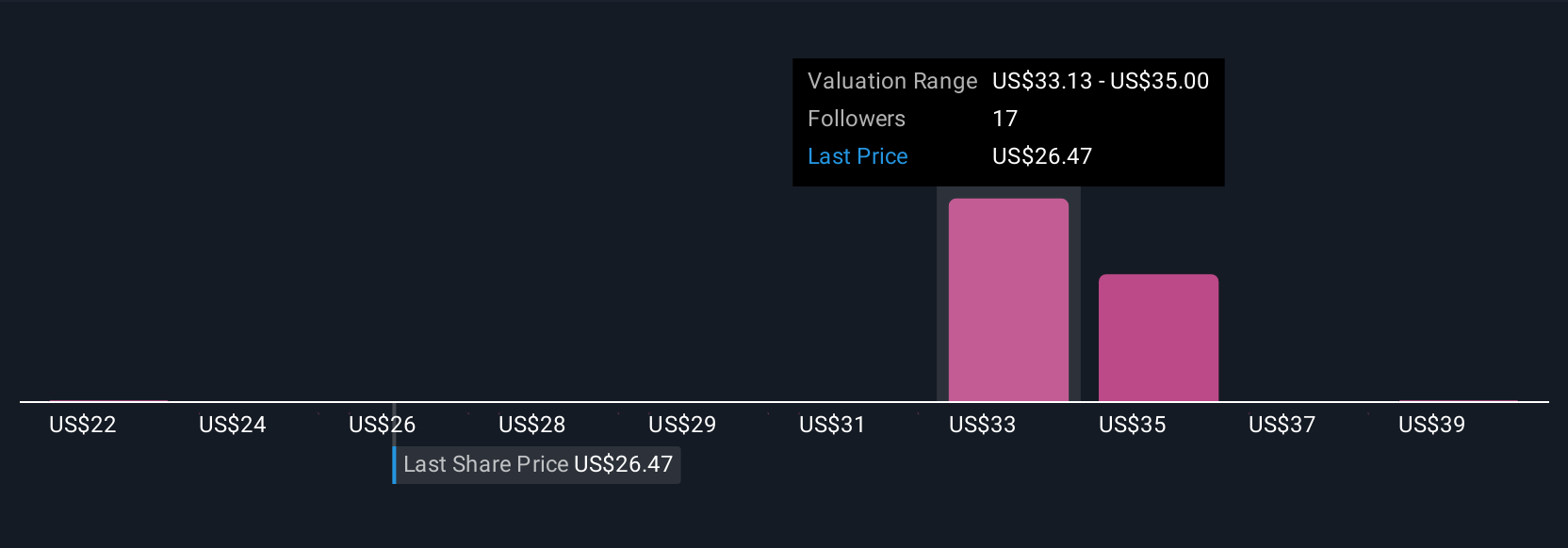

Four fair value estimates from the Simply Wall St Community range from US$21.90 to US$40.61, revealing a broad spectrum of investor outlooks. While some focus on future growth potential, others remain mindful of near-term risks like persistent softness in lumber demand, offering diverse insights for those weighing Weyerhaeuser's prospects.

Explore 4 other fair value estimates on Weyerhaeuser - why the stock might be worth as much as 73% more than the current price!

Build Your Own Weyerhaeuser Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Weyerhaeuser research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Weyerhaeuser research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Weyerhaeuser's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weyerhaeuser might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WY

Weyerhaeuser

Weyerhaeuser Company, one of the world's largest private owners of timberlands, began operations in 1900 and today owns or controls approximately 10.4 million acres of timberlands in the U.S., as well as additional public timberlands managed under long-term licenses in Canada.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives