- United States

- /

- Specialized REITs

- /

- NYSE:WY

The Bull Case For Weyerhaeuser (WY) Could Change Following Its 2030 Investor Day Targets Reveal - Learn Why

Reviewed by Sasha Jovanovic

- Weyerhaeuser recently highlighted that its shares are trading below the implied value of its timberland portfolio, while housing demand and lumber prices remain soft, and it is preparing to hold an investor day to outline financial targets through 2030.

- The company is emphasizing the combination of its large timber asset base, climate-focused initiatives, and a dividend yield near 4% as potential sources of resilience through the lumber cycle.

- We’ll now examine how the upcoming investor day, with its long-term financial targets, could reshape Weyerhaeuser’s existing investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Weyerhaeuser Investment Narrative Recap

To own Weyerhaeuser, you need to believe its timberlands, climate-focused businesses and dividend can compensate for lumber and housing cyclicality. The recent update that shares trade below implied timberland value supports that thesis but does not change the near term reality that soft housing demand and lumber prices remain the key catalyst and risk, respectively, for the stock.

The upcoming investor day, where Weyerhaeuser plans to lay out financial targets through 2030, looks especially relevant here because it should clarify how management intends to balance timberland value, lumber cyclicality and newer climate initiatives while continuing to fund its roughly 4 percent dividend.

Yet even with a large timber base, investors should be aware that weaker lumber pricing could...

Read the full narrative on Weyerhaeuser (it's free!)

Weyerhaeuser's narrative projects $8.2 billion revenue and $990.3 million earnings by 2028. This requires 5.2% yearly revenue growth and a $711.3 million earnings increase from $279.0 million today.

Uncover how Weyerhaeuser's forecasts yield a $30.18 fair value, a 39% upside to its current price.

Exploring Other Perspectives

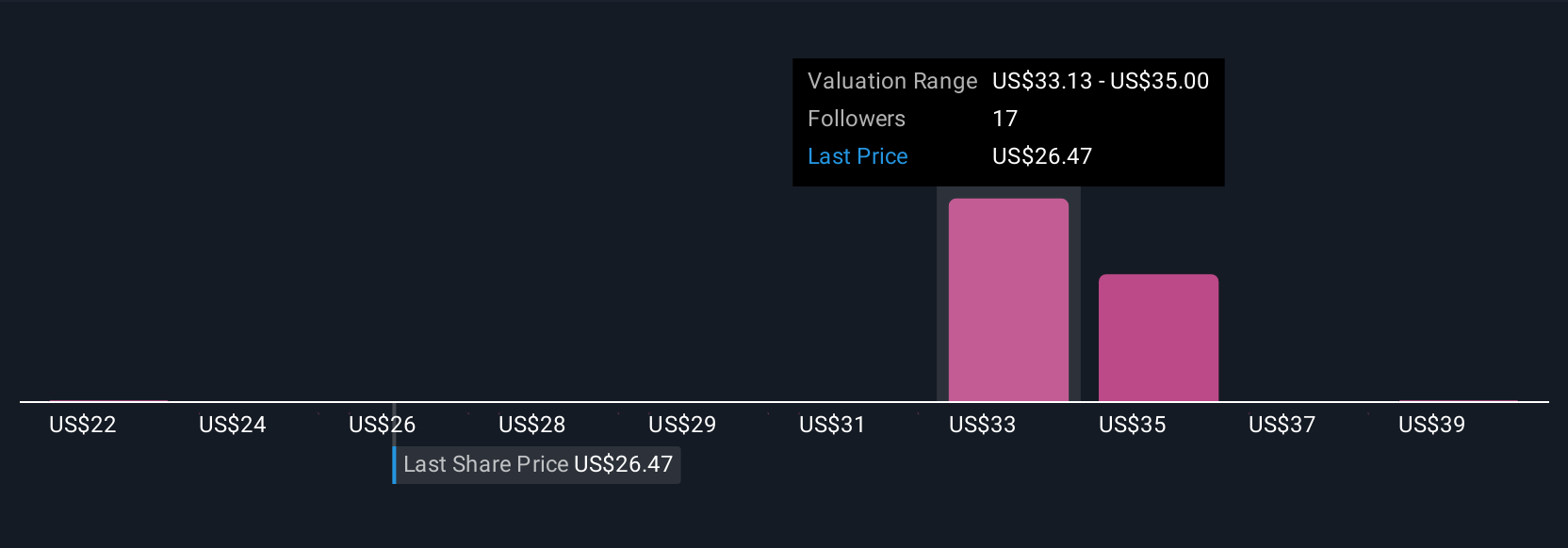

Four members of the Simply Wall St Community currently see Weyerhaeuser’s fair value between US$21.90 and US$40.61, reflecting very different expectations. When you set those views against today’s soft lumber demand risk, it underlines how much the company’s performance can hinge on housing and wood products pricing over time.

Explore 4 other fair value estimates on Weyerhaeuser - why the stock might be worth just $21.90!

Build Your Own Weyerhaeuser Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Weyerhaeuser research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Weyerhaeuser research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Weyerhaeuser's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weyerhaeuser might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WY

Weyerhaeuser

Weyerhaeuser Company, one of the world's largest private owners of timberlands, began operations in 1900 and today owns or controls approximately 10.4 million acres of timberlands in the U.S., as well as additional public timberlands managed under long-term licenses in Canada.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026