- United States

- /

- Health Care REITs

- /

- NYSE:VTR

What Ventas (VTR)'s Raised 2025 Guidance and Senior Housing Expansion Mean For Shareholders

Reviewed by Sasha Jovanovic

- Ventas reported third-quarter 2025 results with normalized FFO per share of 88 cents, beating estimates and marking a 10% year-over-year increase, and raised its 2025 guidance for both FFO and investment volume in its senior housing segment to US$2.5 billion.

- Several major analysts reiterated positive views on Ventas, and the company’s expansion in senior housing investments comes as short interest remains lower than industry peers, indicating analyst and market confidence in its business strategy.

- We’ll look at how raised guidance and analyst optimism could influence Ventas’s investment narrative amid sustained demand for senior housing.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Ventas Investment Narrative Recap

The main reason investors own Ventas is the expectation that aging demographics and steady demand for senior housing will drive earnings and margin growth, supported by disciplined acquisitions and operating improvements. The recent announcement of an executive retirement in outpatient medical and research is not expected to materially affect the company's near-term performance or change the key catalyst: ongoing expansion in senior housing investments, nor does it significantly alter integration or operator performance risks.

Of the recent company updates, Ventas’s raised 2025 investment volume guidance in the senior housing portfolio to US$2.5 billion stands out. This move ties directly to the investment narrative discussed above, as effective execution and integration of these acquisitions are vital to unlocking the leverage from increasing demand, a catalyst closely monitored by investors for its impact on earnings growth and future distributions. In contrast, one area investors should be aware of is…

Read the full narrative on Ventas (it's free!)

Ventas' narrative projects $6.9 billion revenue and $443.6 million earnings by 2028. This requires 9.3% yearly revenue growth and a $252.4 million earnings increase from $191.2 million currently.

Uncover how Ventas' forecasts yield a $82.95 fair value, a 3% upside to its current price.

Exploring Other Perspectives

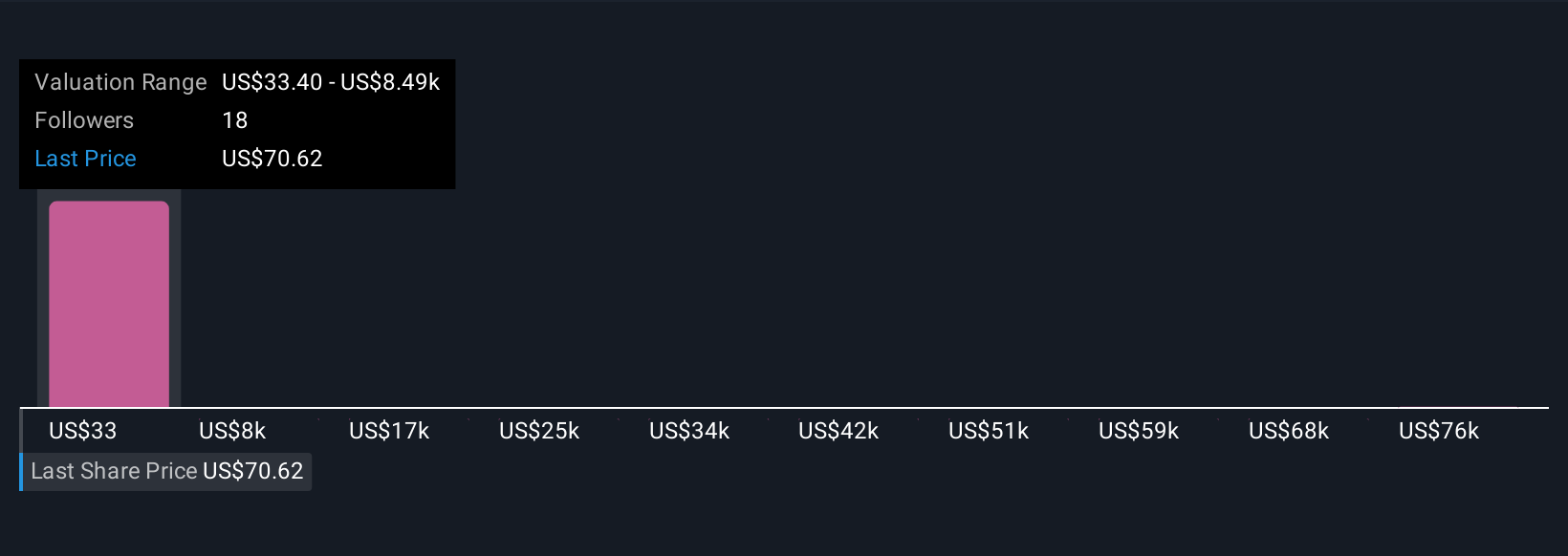

Simply Wall St Community members offered five fair value estimates for Ventas, ranging from US$33 to over US$84,000. As growth through acquisitions continues to be a catalyst, these differing views reflect broader questions about how effectively new investments will translate into results, encouraging you to explore different viewpoints and expectations.

Explore 5 other fair value estimates on Ventas - why the stock might be a potential multi-bagger!

Build Your Own Ventas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ventas research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ventas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ventas' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VTR

Ventas

Ventas, Inc. (NYSE: VTR) is a leading S&P 500 real estate investment trust enabling exceptional environments that benefit a large and growing aging population.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.