- United States

- /

- Health Care REITs

- /

- NYSE:VTR

Ventas (VTR): Evaluating Valuation After a 39% Year-to-Date Rally

Reviewed by Simply Wall St

See our latest analysis for Ventas.

Ventas has built serious momentum this year, with its share price climbing nearly 39% year-to-date, and even notching a 19% gain over the past three months alone. With a 31.9% total shareholder return over the last year and almost doubling investors' money over three and five-year horizons, it is clear the market is responding positively, whether to renewed growth prospects or a shift in how risks are being perceived.

If you’re thinking about your next move, this is a great time to broaden your investing outlook and discover fast growing stocks with high insider ownership

With shares surging and fundamentals improving, investors are left to consider whether Ventas remains undervalued based on its outlook, or if the current price already reflects all the expected future growth. Is there still room to buy in, or has the market gotten ahead of itself?

Most Popular Narrative: 3% Undervalued

Ventas's widely followed fair value estimate now sits at $82.95, a touch above the current share price of $80.39. This small margin has caught the attention of the market and is setting the tone for a deeper examination of what is fueling this number.

Ongoing active portfolio management, such as converting underperforming triple-net assets to SHOP, strategic acquisitions focused on high-performing newer assets in strong-demographic markets, and expanding relationships with best-in-class operators, creates a runway for outsized top-line revenue and FFO per share growth.

Curious how these ambitious strategies might push profits higher? Behind the narrative’s fair value is a bold vision of accelerated growth and a future profit multiple that might surprise you. Want to see the exact quantitative shifts driving this target? Uncover how changing assumptions and bullish forecasts shape the outlook for Ventas.

Result: Fair Value of $82.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor cost pressures and reliance on acquisitions could undermine margin expansion and temper Ventas's otherwise promising growth outlook.

Find out about the key risks to this Ventas narrative.

Another View: Looking Through a Different Lens

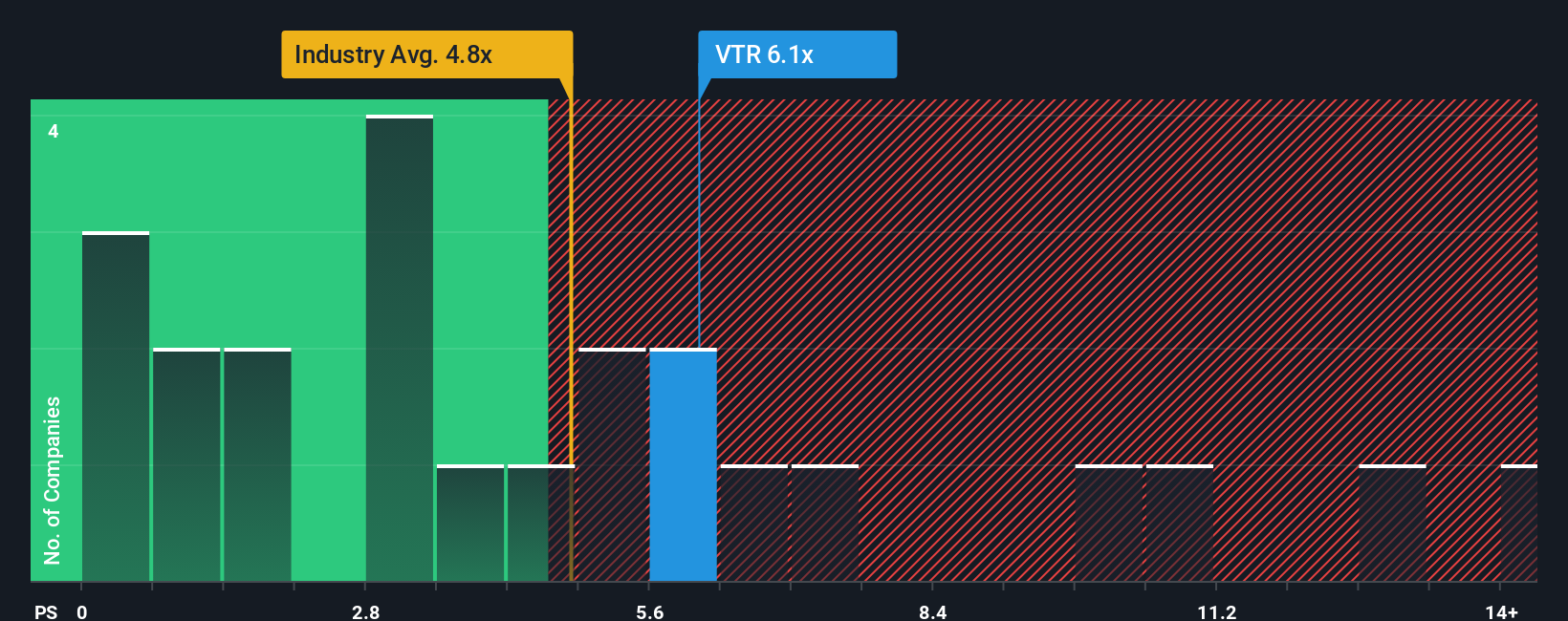

While the market is focused on Ventas being slightly undervalued versus its fair value, a look at the common price-to-sales ratio tells a different story. Ventas trades at 6.8x sales, which is higher than the industry average of 4.9x and above its fair ratio of 5.9x. This premium suggests investors are already baking in a lot of optimism, increasing valuation risk even as the growth narrative remains strong. Could further gains be limited if the market shifts back toward fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ventas Narrative

If you see things differently or want to investigate the numbers yourself, you can craft your own view in just a few short minutes, so Do it your way

A great starting point for your Ventas research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Staying ahead means always searching for stand-out opportunities. Don’t miss your chance to take the next step and grow your portfolio with smart, data-driven moves.

- Seize the momentum in artificial intelligence by reviewing these 25 AI penny stocks, which are fueling tomorrow’s breakthroughs across industries.

- Secure income-focused potential and tap into consistent yield with these 14 dividend stocks with yields > 3%, which meet rigorous financial strength criteria.

- Spot undervalued gems that may be positioned for rebound by checking out these 929 undervalued stocks based on cash flows, offering attractive upside based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VTR

Ventas

Ventas, Inc. (NYSE: VTR) is a leading S&P 500 real estate investment trust enabling exceptional environments that benefit a large and growing aging population.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026