- United States

- /

- Office REITs

- /

- NYSE:VNO

Will JPMorgan’s Upgrade of Vornado (VNO) Shift Perceptions About NYC Office Market Resilience?

Reviewed by Sasha Jovanovic

- Vornado Realty Trust recently participated in the International Security Conference & Exposition at New York's Jacob Javits Center, with Vice President of Information Technology Nick Stello representing the company. Following this and recent company developments, JPMorgan analysts upgraded the stock to Neutral, citing strong business fundamentals despite broader concerns about the New York City office market.

- The analyst upgrade highlights how improved sentiment around Vornado’s fundamentals may outweigh political and job market uncertainties for investors.

- We'll explore how the recent JPMorgan analyst upgrade, driven by confidence in Vornado's underlying fundamentals, shapes its investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Vornado Realty Trust Investment Narrative Recap

For someone to be a shareholder in Vornado Realty Trust today, they typically need to believe that demand for premium office space in Manhattan will drive long-term revenue and earnings growth, offsetting near-term headwinds. The JPMorgan upgrade to Neutral, following the recent industry conference appearance, reflects improved sentiment, but does not materially change the most important short-term catalyst, leasing momentum in top-tier trophy assets, or the biggest risk, which remains sensitivity to political and job market uncertainties in New York City.

Of the company’s recent announcements, the acquisition and planned redevelopment of 623 Fifth Avenue stands out. With this 75 percent vacant property, Vornado is leaning into its core strength, transforming high-potential, well-located assets, which could support the ongoing catalyst of rising occupancy and premium rents if successful.

However, in contrast, investors should be aware that even strong property fundamentals can’t fully insulate results from a softer office job market...

Read the full narrative on Vornado Realty Trust (it's free!)

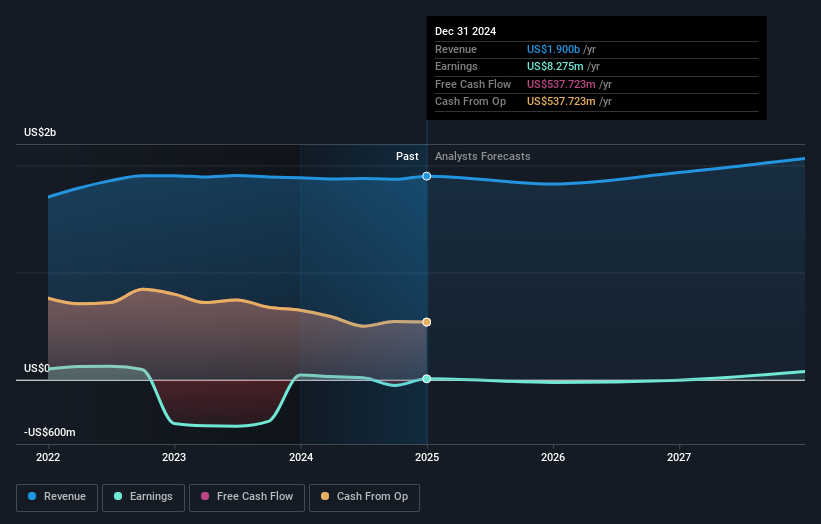

Vornado Realty Trust's outlook anticipates $2.1 billion in revenue and $21.9 million in earnings by 2028. This is based on a projected annual revenue growth rate of 3.0%, but a substantial decrease in earnings of $790.8 million from the current $812.7 million.

Uncover how Vornado Realty Trust's forecasts yield a $39.80 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Private investors in the Simply Wall St Community estimate Vornado’s fair value between US$39.80 and US$45.03 across two analyses. While some expect rising occupancy and premium rents, others highlight that sensitivity to New York’s job market can impact this outlook, reminding you to consider several viewpoints before making up your mind.

Explore 2 other fair value estimates on Vornado Realty Trust - why the stock might be worth just $39.80!

Build Your Own Vornado Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vornado Realty Trust research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Vornado Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vornado Realty Trust's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VNO

Vornado Realty Trust

Vornado Realty Trust (“Vornado”) is a fully-integrated real estate investment trust (“REIT”) and conducts its business through, and substantially all of its interests in properties are held by, Vornado Realty L.P.

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success