- United States

- /

- Specialized REITs

- /

- NYSE:VICI

Is VICI Properties' (VICI) Rising Income Signaling Long-Term Strength in Gaming Real Estate Demand?

Reviewed by Sasha Jovanovic

- VICI Properties Inc. recently reported third quarter 2025 results, posting revenue of US$1.01 billion and net income of US$762.04 million, both up from the prior year.

- Steady growth in revenue and net income highlights solid demand across VICI's gaming and hospitality real estate portfolio, underpinning its recurring income streams.

- We'll explore how this continued revenue and earnings growth impacts the company's investment narrative, particularly as it relates to portfolio demand.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

VICI Properties Investment Narrative Recap

To be a VICI Properties shareholder, you need to believe in sustained demand for experiential real estate and the resilience of triple-net leases in the face of economic shifts. The latest earnings update reaffirms stable top-line and bottom-line growth, but this news has not fundamentally shifted the short-term catalyst, continued revenue and income growth from existing properties, nor the largest current risk: tenant concentration, especially among key gaming operators.

Of recent announcements, VICI's October lease agreement with Clairvest Group for MGM Northfield Park stands out. This arrangement, with annual rent escalations, reinforces the company’s focus on recurring income and asset-backed growth. It supports the catalyst of expanding stable revenue streams through new partnerships, though investor focus remains on tenant diversification and ongoing lease performance.

By contrast, investors should also be aware of the risks that come from relying on a small group of major tenants for much of VICI's income, such as what might happen if...

Read the full narrative on VICI Properties (it's free!)

VICI Properties is projected to reach $4.3 billion in revenue and $2.8 billion in earnings by 2028. This outlook assumes a 3.4% annual growth in revenue and earnings remaining flat compared to current levels of $2.8 billion.

Uncover how VICI Properties' forecasts yield a $36.91 fair value, a 25% upside to its current price.

Exploring Other Perspectives

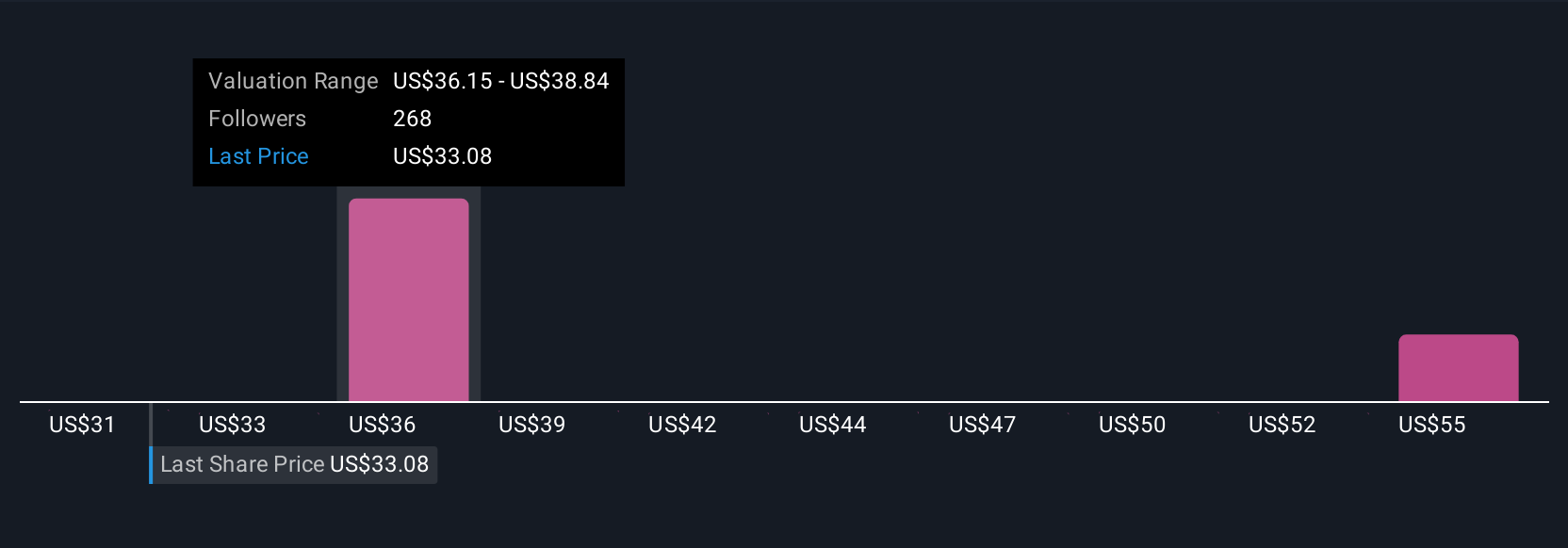

Simply Wall St Community members have shared 10 fair value estimates for VICI Properties ranging from US$30.78 to US$56.49 per share. These diverse outlooks reflect different views on the company’s revenue growth and the importance of stable rent escalators, so you can compare several interesting interpretations side by side.

Explore 10 other fair value estimates on VICI Properties - why the stock might be worth as much as 91% more than the current price!

Build Your Own VICI Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VICI Properties research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free VICI Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VICI Properties' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VICI

VICI Properties

An S&P 500 experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality, wellness, entertainment and leisure destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip.

Very undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives